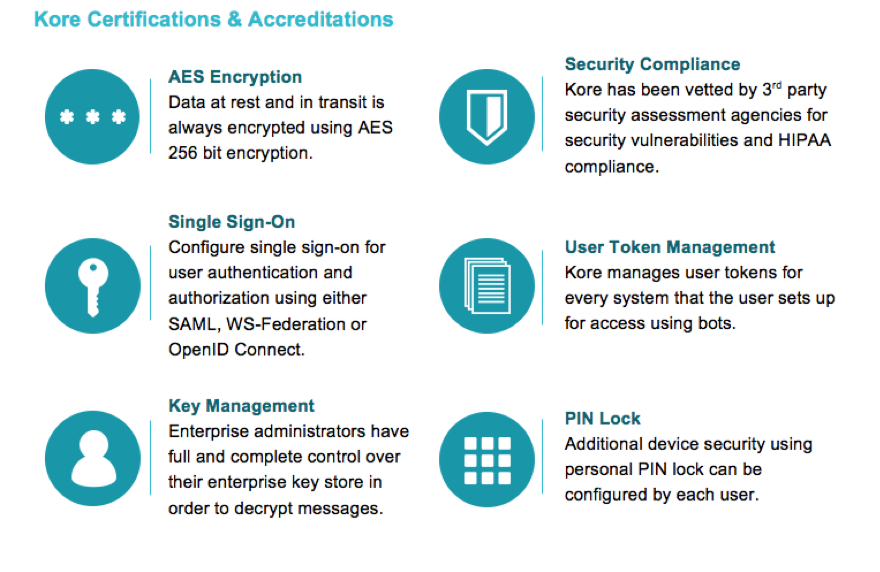

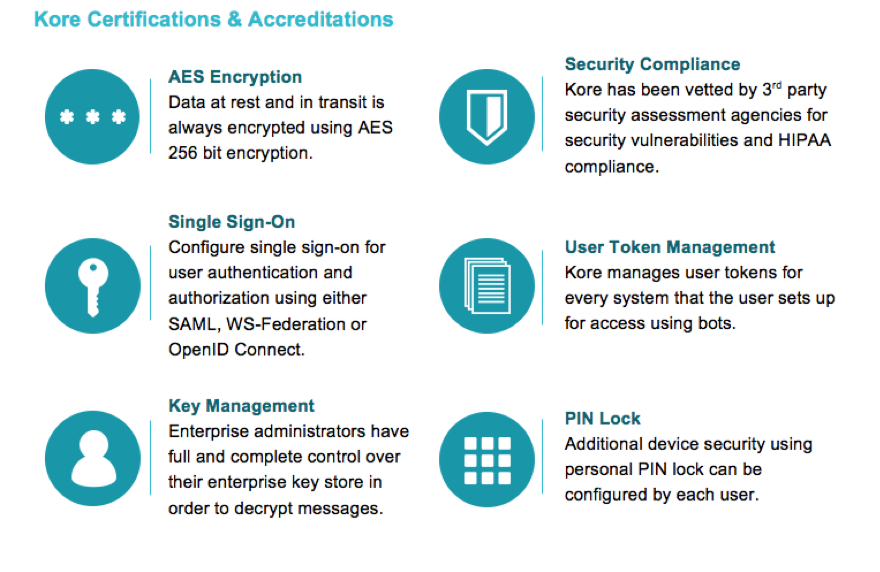

Enterprise software company Kore has a goal to simplify how customers engage with brands. The company’s out-of-the-box digital assistants and its Bots Platform offer a secure messaging service that fits highly regulated environments such as banks.

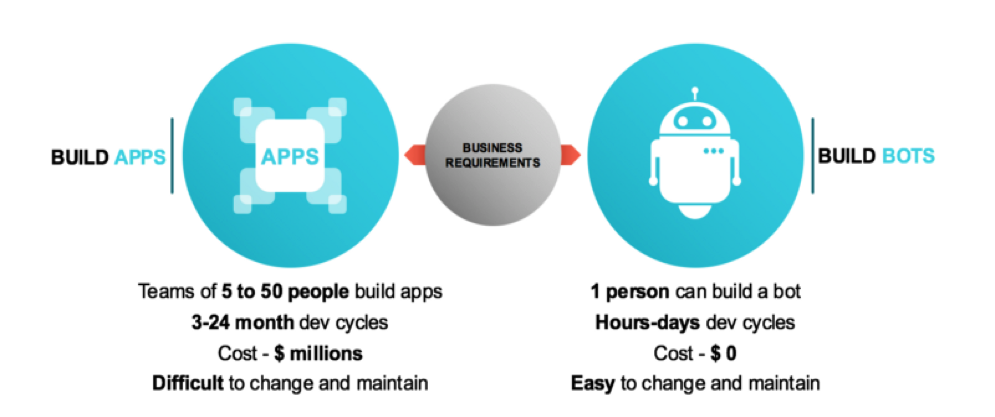

At FinovateSpring 2016 the company showcased Kore Bots, chatbots that deliver alerts, perform tasks, interact with customers, and generate reports. The bots offer an inexpensive way for a bank to interact with both employees and customers in a human-like way, making person-to-system interactions more conversational.

Banks have the option to use an “off-the-shelf” Kore Bot for a quick time-to-market messaging service or they can use the Bot Platform to build their own bots with a customized persona.

Company facts:

- Beta launch: October 2015

- Market launch of messaging platform with Kore Bots: February 2016

- Market launch of Bots Platform: July 2016

- 40+ customers in various stages of implementation

- ~200 employees

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

We spoke with Kore after the company’s demo at FinovateSpring 2016 in San Jose. Here’s our interview:

Finovate:Â What problem does Kore solve?

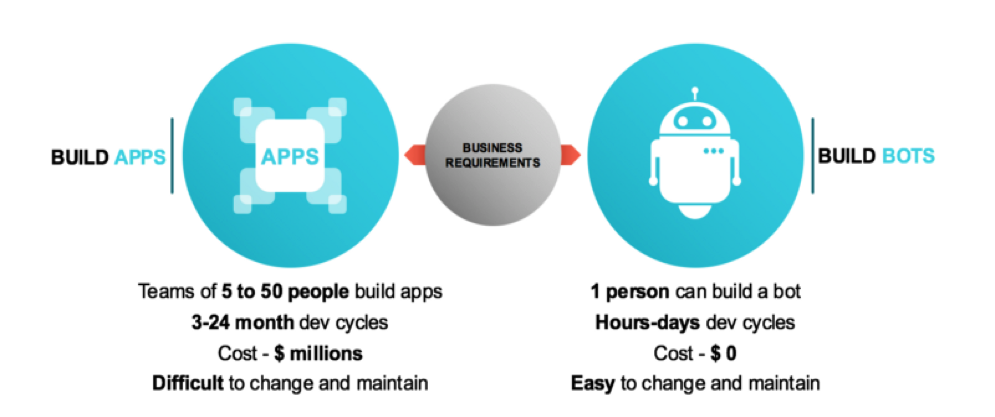

Kore: Kore bots take on the time-consuming, everyday tasks currently causing productivity barriers for today’s workforce, resulting from the number of systems and apps needed to do our jobs. This helps business leaders hit critical productivity rates by freeing staff of mundane tasks that weigh them down to focus on the work that matters—serving customers and growing the business.

Kore natural language processing, aka NLP-enabled bots also serve the customers of these businesses by infusing personalized, engaging, and instantly gratifying customer-service interactions where past omnichannel solutions have fallen short. For many businesses, this offers a solution for sustainable, personalized self-service. And via machine learning and artificial intelligence, the more that workforces and customers engage with Kore bots, the more they learn, and the more useful they become.

Finovate:Â Who are your primary customers?

Kore: Kore serves Fortune 500 companies that are leaders in technology, productivity, and customer experience. Some of our partners include SAP, Oracle, Microsoft, ServiceNow, Zendesk, IBM, and Salesforce.com.

Finovate: How does Kore solve the problem better?

Kore: Every Kore bot comes standard NLP-enabled [and uses] our NLP engine we’ve put 12 years into developing. This positions businesses for success at the onset, saving development work they’d typically need to do on their own. Kore also delivers a bots platform-as-a-service (PaaS), full of rich functions and features to support the most complex bot use-cases and requirements. Businesses can [either] choose from our more than 120 off-the-shelf bots, or choose to use our GUI-based bot-builder platform to easily design, develop, and deploy their own custom bots.

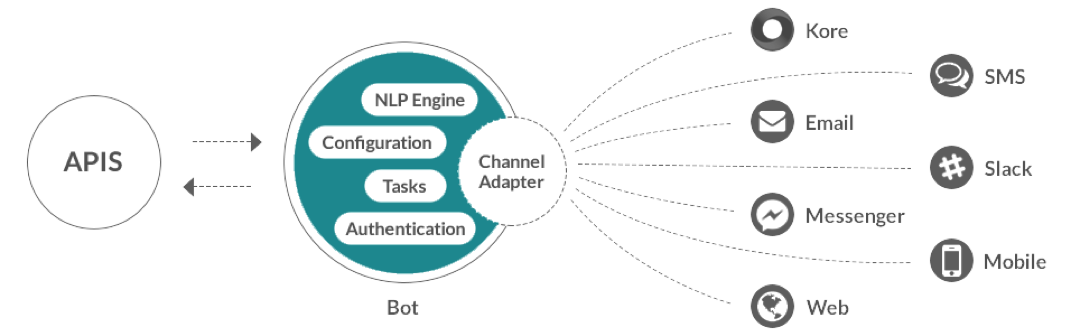

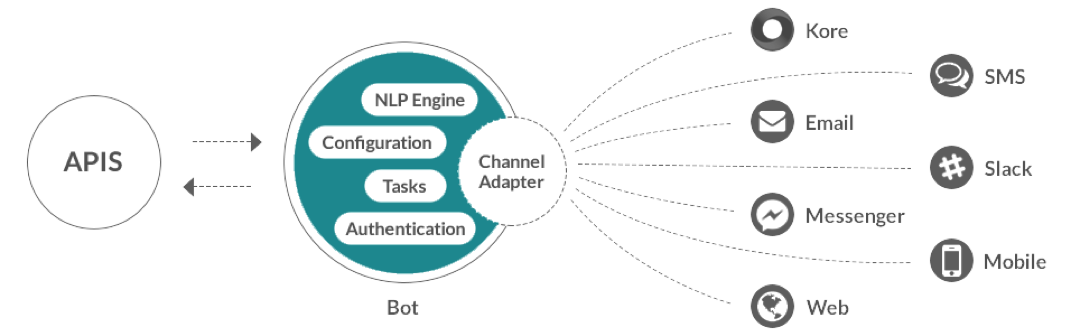

Whether it’s pre-built by Kore, or custom built, every Kore bot is NLP-enabled, to automatically process requests and execute commands via speech and text. Kore bots equip businesses to elevate systems and mobile apps already in place. Kore bots aren’t channel/device specific, making it possible for them to go across the channels and devices people use to communicate.

Finovate: What in your background gave you the confidence to tackle this challenge?

Kore: Kore is founded by Raj Koneru, also the founder of KONY, the market leader in the mobility space of MADP, used by leading global corporate and government organizations (www.kony.com). KONY has reached the leader position in the Gartner’s magic quadrant in the shortest span of its existence. Prior to KONY, Raj also led successful ventures such as Intelligroup and Seranova.

In addition to our CEO’s vast success in the technology market, Kore also has an executive board of highly accomplished players, in addition to a development group with a strong track record in developing forward-thinking technological solutions.

Finovate:Â What are some upcoming initiatives from Kore that we can look forward to over the next few months?

Kore: In a world where digital channels matter as much as physical channels, and customer experience has proven to impact loyalty, referrals, and the number of products and services bought or used per customer, businesses must invest to remain competitive. And they need to do so quickly. Kore is making this new conversational banking paradigm a reality through a concentrated set of solution bots to serve niche markets and functions within. Additional platform enhancements are underway to offer even greater flexibility for how companies choose to deploy bots. Messaging templates, video chat capabilities, and geo-fencing will be some of the additional features added to enhance the overall user experience.

Finovate:Â Where do you see Kore a year or two from now?

Kore: We anticipate bots will be woven into the fabric of enterprises everywhere, helping businesses reduce operating costs, freeing employees to focus on the work that matters, and satisfying customers with a consistent, engaging experience across channels. With Kore as the leader for enterprise-grade bots and messaging, our success will only continue to grow as more top players harness the critical advantage of bots and their impact on enterprise employees and consumers alike.

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016. Register today.

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016. Register today.

Cathryn Chen, CEO and Founder

Cathryn Chen, CEO and Founder Lai worked for HSBC and PayPal before becoming an angel investor. At PayPal, he led the merchant product conversion and revenue optimization of 2,500 enterprise, SMB, and distribution partners.

Lai worked for HSBC and PayPal before becoming an angel investor. At PayPal, he led the merchant product conversion and revenue optimization of 2,500 enterprise, SMB, and distribution partners.

Presenters

Presenters Jaroslaw Nowotka, CTO

Jaroslaw Nowotka, CTO

Presenter: Badri Rajasekar, CTO and SVP of Engineering

Presenter: Badri Rajasekar, CTO and SVP of Engineering

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.