Second quarter 2016 closed with a frenzy of fintech fundings: 49 deals were announced the last week alone, 10 more than the previous weekly record. The total amount raised was $327 million across 34 fundings with announced amounts (15 deals had undisclosed amounts). Of the total, $61.5 million was debt.

Second quarter 2016 closed with a frenzy of fintech fundings: 49 deals were announced the last week alone, 10 more than the previous weekly record. The total amount raised was $327 million across 34 fundings with announced amounts (15 deals had undisclosed amounts). Of the total, $61.5 million was debt.

Four Finovate alums raised a total of $77 million during the week:

Total fundings worldwide in June: $1.6 billion from 186 deals compared to May which totaled $1.7 billion across 113 deals. (Note: Due to our weekly tracking methodology, there was an additional week in the June total.)

The weekly details can be found through the following links:

The total number of deals YTD stands at 737, double last year’s 371. Total dollars raised YTD is now $17.4 billion, more than double the $8.4 billion more raised during the same period a year ago.

——-

Fintech deals by size from 25 June to 1 July 2016:

Paycor

Online payroll system

Latest round: $45 million

Total raised: $164 million

HQ: Cincinnati, Ohio

Tags: SMB, payroll, employers, HR management, employee benefits, salary, payments

Source: FT Partners

Klarna

Ecommerce solution provider

Latest round: $35 million Debt

Total raised: $327 million ($291 million equity, $36 million debt)

HQ: Sweden

Tags: SMB, merchants, ecommerce, B2B2C, payments, Finovate alum

Source: Crunchbase, Finovate

Nvest

Crowd-sourced stock-recommendation platform

Latest round: $33 million Series D

Total raised: $60.15 million

HQ: Toronto, Ontario, Canada

Tags: Consumer, advisers, traders, investing, wealth management, trading

Source: Crunchbase

LendingKart

Alt-lender to small businesses

Latest round: $32 million Series B

Total raised: $42 million

HQ: Ahmedabad, India

Tags: SMB, lending, commercial credit, underwriting, loans

Source: Crunchbase

West Creek Financial

Consumer purchase financing

Latest round: $28.5 million ($3.5 million Equity, $25 million Debt)

Total raised: $28.5 million

HQ: Glen Allen, Virginia

Tags: SMB, B2B2C, lending, credit, underwriting, POS, point-of-sale

Source: Crunchbase

Bizfi

Alt-lending to small businesses

Latest round: $20 million

Total raised: $20 million

HQ: New York City, New York

Tags: SMB, lending, commercial credit, underwriting, Finovate alum

Source: Crunchbase, Finovate

Goji (formerly Consumers United)

Consumer insurance portal

Latest round: $19 million

Total raised: $89 million

HQ: Boston, Massachusetts

Tags: Automobile insurance, home insurance, life insurance, membership, price quotes, price comparison, lead gen

Source: FT Partners

D3 Banking

Banking platform

Latest round: $16.4 million

Total raised: $33.4 million

HQ: Omaha, Nebraska

Tags: Institutions, B2B2C, digital banking, small business, Finovate alum

Source: Crunchbase, Finovate

SpotCap (Rocket Internet)

Alt-lender to small businesses

Latest round: $14.4 million Series C

Total raised: $66.2 million

HQ: Berlin, Germany

Tags: SMB, lending, commercial credit, underwriting

Source: Crunchbase

Storm

Payment and trade finance for microbusinesses

Latest round: $13.2 million Series A

Total raised: $16.1 million

HQ: Barcelona, Spain

Tags: SMB, merchants, point-of-sale, ecommerce, acquiring, payments, credit/debit cards, trade finance, inventory management, BI

Source: Crunchbase

Avoka

Digital sales and account opening

Latest round: $12 million

Total raised: $12 million

HQ: Sydney, Australia; Broomfield, Colorado

Tags: Institutions, sales, marketing, online account opening, Finovate and FinDEVr alum

Source: Finovate

i3 Verticals

Payment processing

Latest round: $10 million

Total raised: $10 million

HQ: Nashville, Tennessee

Tags: SMB, merchants, payments, credit/debit cards, acquiring

Source: FT Partners

ForUsAll

401(k) platform

Latest round: $9.5 million Series A

Total raised: $12.84 million

HQ: San Francisco, California

Tags: Consumer, SMB, saving, investing, human resources, employee benefits, employers

Source: Crunchbase

Final

Credit card with consumer controls

Latest round: $8 million Series A

Total raised: $9.1 million

HQ: California

Accelerator: Y Combinator

Tags: Consumer, lending, credit, credit/debit cards, spending controls, security

Source: Crunchbase

DV01

Marketplace lending analytics

Latest round: $7.5 million Seed

Total raised: $7.5 million

HQ: New York City, New York

Tags: Institutions, advisers, analytics, BI, lending, loans, securitization

Source: FT Partners

SMACC

Online accounting

Latest round: $3.9 million

Total raised: $3.9 million

HQ: Potsdam, Germany

Tags: SMB, accounting, bookkeeping, billing

Source: Crunchbase

TransferGo

International funds transfers

Latest round: $3.4 million Series A

Total raised: $6.1 million

HQ: London, England, United Kingdom

Tags: Consumer, SMB, funds transfer, remittances, foreign exchange, FX

Source: Crunchbase

Apruve

Trade finance and payments platform

Latest round: $3.1 million Series A

Total raised: $3.5 million

HQ: Minneapolis, Minnesota

Tags: Consumer, lending, peer-to-peer, credit, underwriting, investing

Source: Crunchbase

ProducePay

Payment solutions for the fresh-produce industry

Latest round: $2.5 million Seed

Total raised: $3.9 million

HQ: Los Angeles, California

Tags: SMB, payments, credit, underwriting, trade finance, factoring, agriculture

Source: Crunchbase

Zirra

Crowd-sourced investment rating service

Latest round: $1.6 million Series A

Total raised: $2.3 million

HQ: Tel Aviv, Israel

Tags: Consumer, investing, advisers, wealth management, information, analytics, crowdsourcing

Source: Crunchbase

Payzer

Mobile payment and financing platform for field sales

Latest round: $1.5 million Debt

Total raised: Unknown

HQ: Charlotte, North Carolina

Tags: SMB, lending, credit, underwriting, payments, point-of-sale, mobile, trade finance

Source: Crunchbase

TrueBill

Recurring bill management

Latest round: $1.4 million Seed

Total raised: $1.75 million

HQ: San Francisco, California

Accelerator: Y Combinator

Tags: Consumer, billpay, personal financial management, PFM, budgeting, spending, credit/debit cards

Source: Crunchbase

FundedByMe

Equity crowdfunding platform

Latest round: $1.3 million

Total raised: $1.3 million

HQ: Stockholm, Sweden

Tags: SMB, capital raising, VC, venture capital, p2p, peer-to-peer, investing

Source: Crunchbase

Flip

P2P apartment-leasing marketplace

Latest round: $1.2 million Seed

Total raised: $1.3 million

HQ: New York City, New York

Tags: Consumer, housing, rentals, marketplace

Source: Crunchbase

LeaseAccelerator

Equipment lease management software

Latest round: $1.2 million Series

Total raised: $7.1 million

HQ: Great Falls, Virginia

Tags: SMB, entrerprise, leasing, accounting, management, compliance

Source: Crunchbase

Tribe Insurance

Social insurance

Latest round: $1 million Seed

Total raised: $1 million

HQ: Oslo, Norway

Tags: Consumer, insurance, peer-to-peer, P2p

Source: Crunchbase

Amodo

Customer platform for insurers

Latest round: $500,000 Seed

Total raised: $536,000

HQ: Zagreb, Croatia

Tags: Institutions, B2B2C, insurance, customer service, CRM

Source: Crunchbase

Cindicator

Crowd-forecasting future events for financial markets

Latest round: $250,000 Convertible Note

Total raised: $270,000

HQ: New York City, New York

Tags: Institutions, advisers, traders, investing, wealth management, trading

Source: Crunchbase

Tabster

Mobile POS system for hospitality industry

Latest round: $250,000 Convertible Note

Total raised: $250,000

HQ: Amsterdam, The Netherlands

Tags: SMB, merchants, payments, acquiring, credit/debit cards, mobile

Source: Crunchbase

Factom

Blockchain technology

Latest round: $200,000

Total raised: $3.3 million

HQ: Austin, Texas

Tags: SMB, blockchain, distributed ledger, database, security

Source: FT Partners

ValChoice

Car insurance portal

Latest round: $120,000 (Microsoft BizSpark Plus Award)

Total raised: $620,000

HQ: Bedford, New Hampshire

Tags: Autombile insurance, price quotes, price comparison, lead generation

Source: FT Partners

BanQu

Blockchain-based identity for the unbanked

Latest round: $100,000 Convertible Note

Total raised: $100,000

HQ: Minneapolis, Minnesota

Tags: Consumer, blockchain, financial inclusion, unbanked, underbanked, banking, security, identity

Source: Crunchbase

Taplend

P2P mobile lending platform

Latest round: $83,000 Seed

Total raised: $203,000

HQ: Kiev, Ukraine

Accelerator: SellaLab (Italy)/Level 39 (London)

Tags: Consumer, lending, peer-to-peer, credit, underwriting, investing

Source: Crunchbase

Daalder

Mobile payments platform

Latest round: $55,000 Convertible Note

Total raised: $500,000

HQ: Amsterdam, The Netherlands

Tags: Consumer, payments, mobile, credit/debit cards

Source: Crunchbase

ExtractAlpha

Investment tools for institutional investors

Latest round: Undisclosed Seed

Total raised: $41,000 (prior to most recent funding)

HQ: Hong Kong, China

Tags: Institutions, advisers, investing, wealth management, trading, information, analytics

Source: Crunchbase

Hello Tax

Income tax preparation app

Latest round: Undisclosed

Total raised: Unknown

HQ: New Delhi, India

Tags: Consumer, tax prep

Source: Crunchbase

Insurity

Insurance management platform

Latest round: Undisclosed Private Equity

Total raised: $49.75 million (prior to above)

HQ: Hartford, Connecticut

Tags: Institutions, insurance, management, analytics, BI

Source: Crunchbase

Karlo Compare

Financial services portal

Latest round: Undisclosed

Total raised: Unknown

HQ: Karachi, Pakistan

Tags: Consumer, lending, banking, loans, credit cards, quotes, price comparison, discovery, lead gen

Source: Crunchbase

LIQID Investments

Wealth management and digital family-office platform

Latest round: Undisclosed

Total raised: Unknown

HQ: Berlin, Germany

Tags: Advisers, wealth managers, investing, trading, retirement

Source: Crunchbase

Loansolutions.ph

Consumer loan portal

Latest round: Undisclosed

Total raised: Unknown

HQ: Cebu City, Philippines

Tags: Consumer, lending, peer-to-peer, credit, underwriting, investing

Source: Crunchbase

LoanStreet

Loan portal

Latest round: Undisclosed

Total raised: Unknown

HQ: Kuala Lumpur, Malaysia

Tags: Consumer, lending, price comparison, lead gen, discovery

Source: Crunchbase

Moneybay

Foreign exchange rate portal

Latest round: Undisclosed

Total raised: Unknown

HQ: Malaysia

Tags: Consumer, payments, FX, remittances, lead gen, price comparison

Source: Crunchbase

Musoni System

Banking software for microfinance organizations

Latest round: Undisclosed Seed

Total raised: Unknown

HQ: Amsterdam, The Netherlands

Tags: Institutions, SMB, lending, credit, underwriting, microfinance

Source: Crunchbase

MyCashOnline

Online banking services for migrants

Latest round: Undisclosed

Total raised: Unknown

HQ: Selangor, Malaysia

Tags: Consumer, payments, remittances, deposits, billpay, ecommerce

Source: Crunchbase

November First

International payments and transfers

Latest round: Undisclosed

Total raised: Unknown

HQ: Copenhagen, Denmark

Tags: Consumer, SMB, foreign exchange, FX, remittances, payments, peer-to-peer, P2P, foreign trade

Source: Crunchbase

Razorpay

Online payment gateway

Latest round: Undisclosed

Total raised: $11.6 million

HQ: Bangalore, India

Tags: SMB, payment processing, credit/debit cards, acquiring, merchants, mobile

Source: Crunchbase

Rundit

Revenue-based lending

Latest round: Undisclosed

Total raised: Unknown

HQ: Finland

Tags: SMB, lending, credit, underwriting, commercial loans, crowdfunding, P2P, investing

Source: Crunchbase

Scripbox

Online mutual fund investment platform

Latest round: Undisclosed Series B

Total raised: $2.5 million (prior to Series B)

HQ: Bangalore, India

Tags: Consumer, advisers, traders, investing, wealth management, funds

Source: Crunchbase

Surance

Retirement savings platform

Latest round: Undisclosed

Total raised: Unknown

HQ: Amsterdam, The Netherlands

Tags: Consumer, savings accounts, investing, retirement planning, wealth management

Source: FT Partners

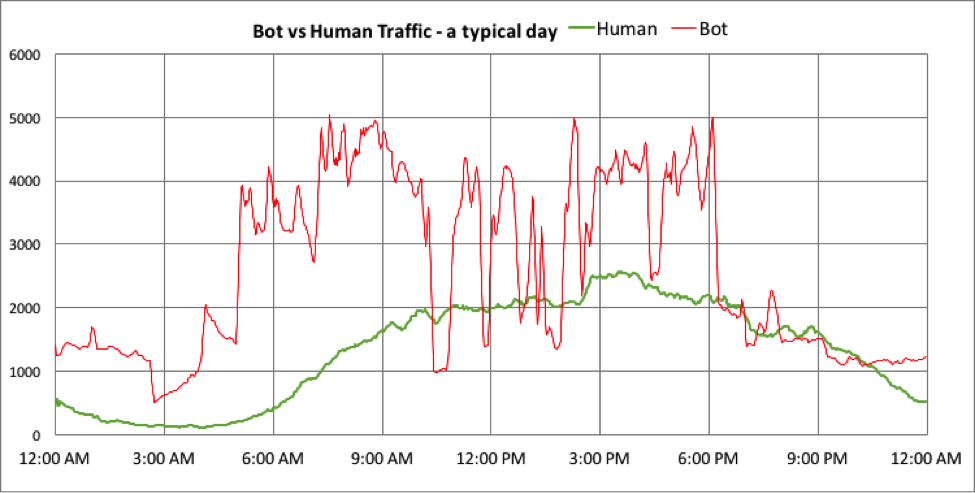

Bot traffic is up to 3x that of human traffic

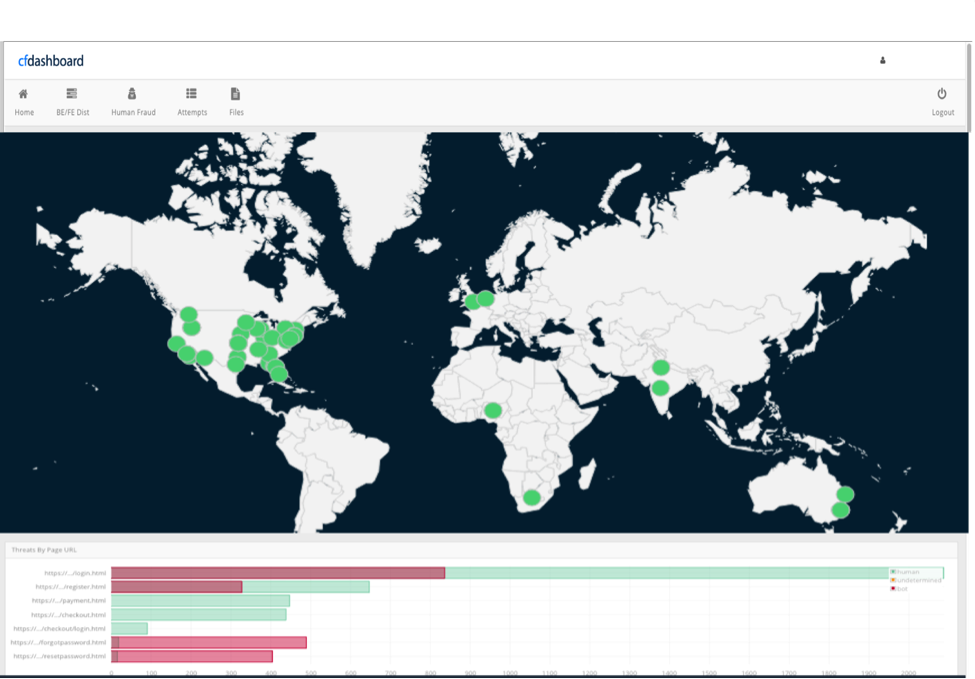

Bot traffic is up to 3x that of human traffic Cyberfend’s dashboard

Cyberfend’s dashboard

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016.

A look at the companies demoing live to 1,500+ fintech professionals on 8/9 September 2016.

Presenters

Presenters

Second quarter 2016 closed with a frenzy of fintech fundings: 49 deals were announced the last week alone, 10 more than the previous weekly record. The total amount raised was $327 million across 34 fundings with announced amounts (15 deals had undisclosed amounts). Of the total, $61.5 million was debt.

Second quarter 2016 closed with a frenzy of fintech fundings: 49 deals were announced the last week alone, 10 more than the previous weekly record. The total amount raised was $327 million across 34 fundings with announced amounts (15 deals had undisclosed amounts). Of the total, $61.5 million was debt.