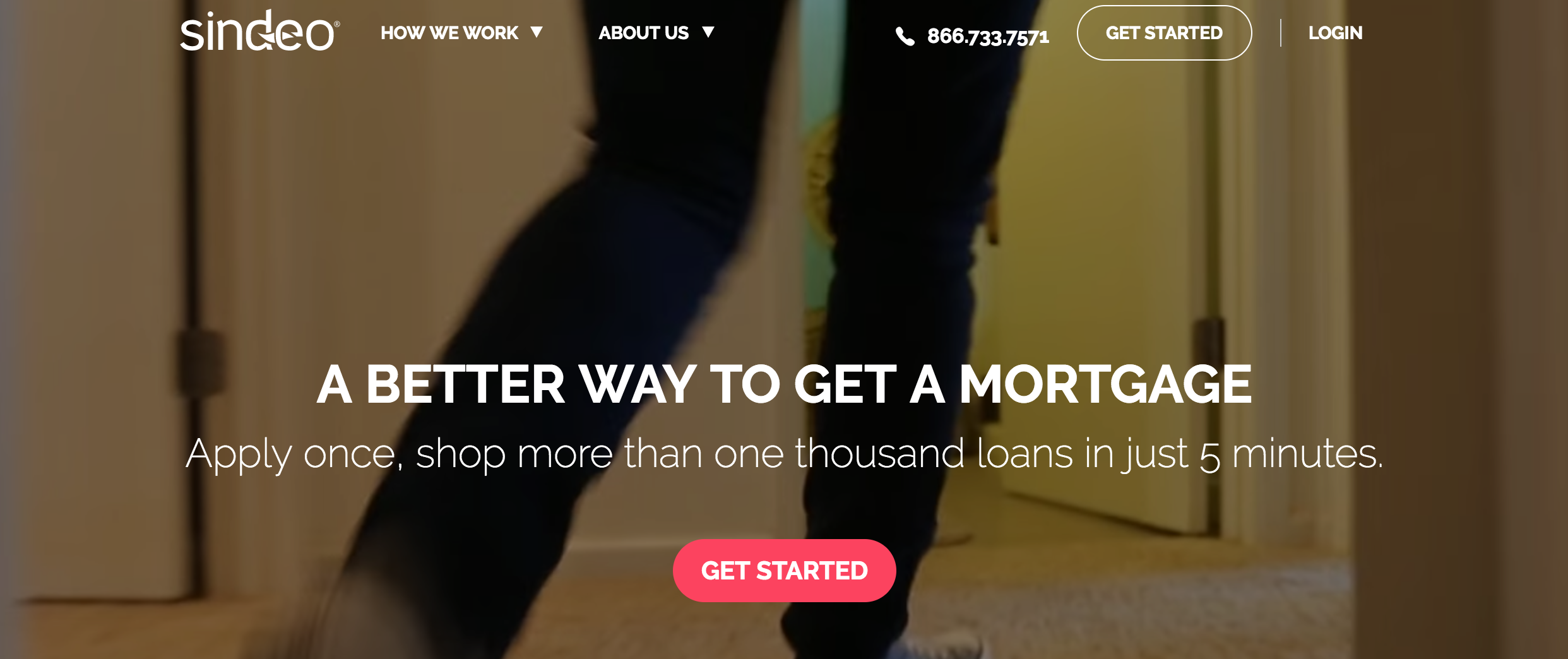

Home financing startup Sindeo offers customers access to a marketplace of over 1,000 loan programs to help them find the best mortgage. Its platform streamlines the mortgage application process and offers borrowers guidance from Mortgage Advisors.

Kicking off the company’s demo at FinovateFall 2016, Sindeo’s co-founder Ori Zohar described a home purchase as “the largest financial decision that most people are going to make in their lives” and added that getting a mortgage is a “difficult and confusing process.” Explaining his company’s proposed solution, Zohar said, “Sindeo is creating a streamlined online mortgage experience. We can get you a loan with any of the lenders in our growing marketplace which currently has over 45 lenders and over 1,000 loan products. We have technology integrated all the way from quotes to close.”

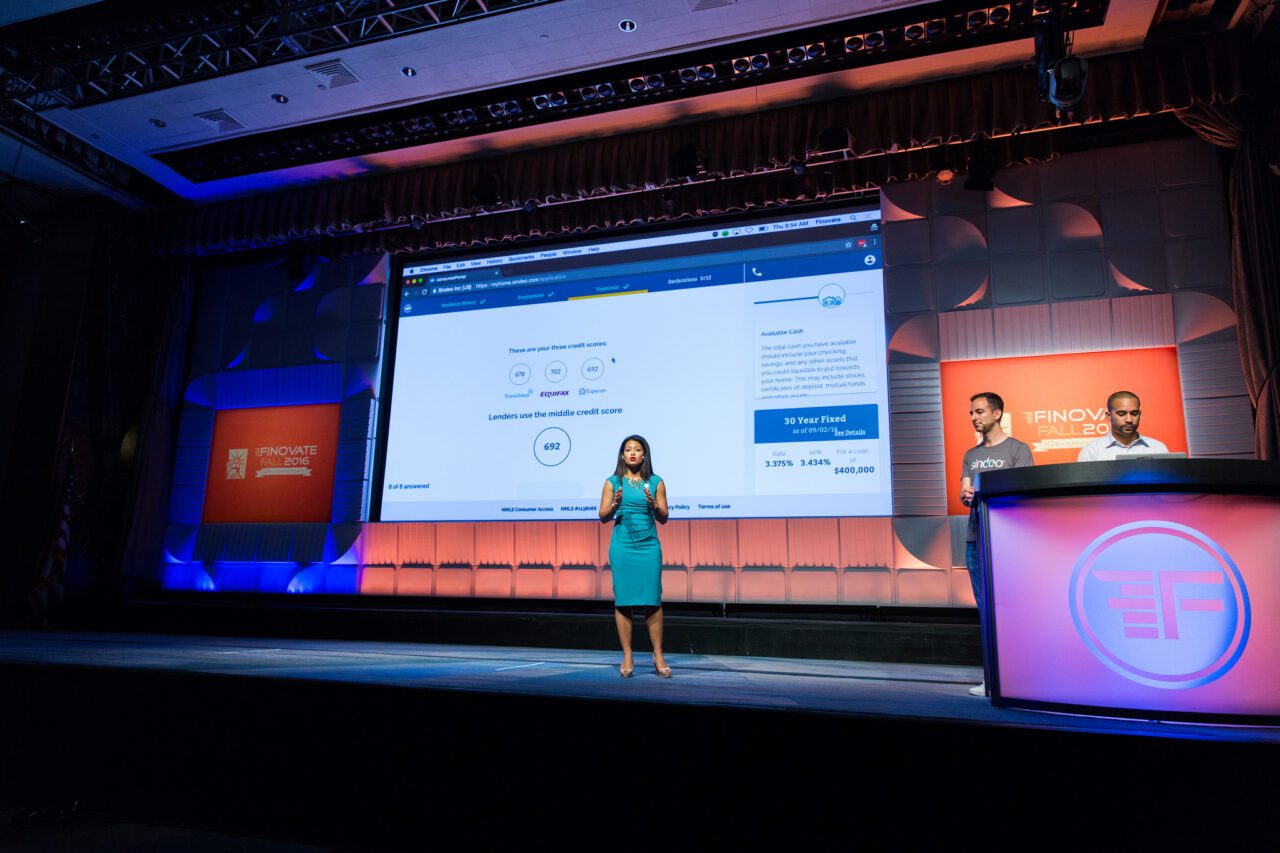

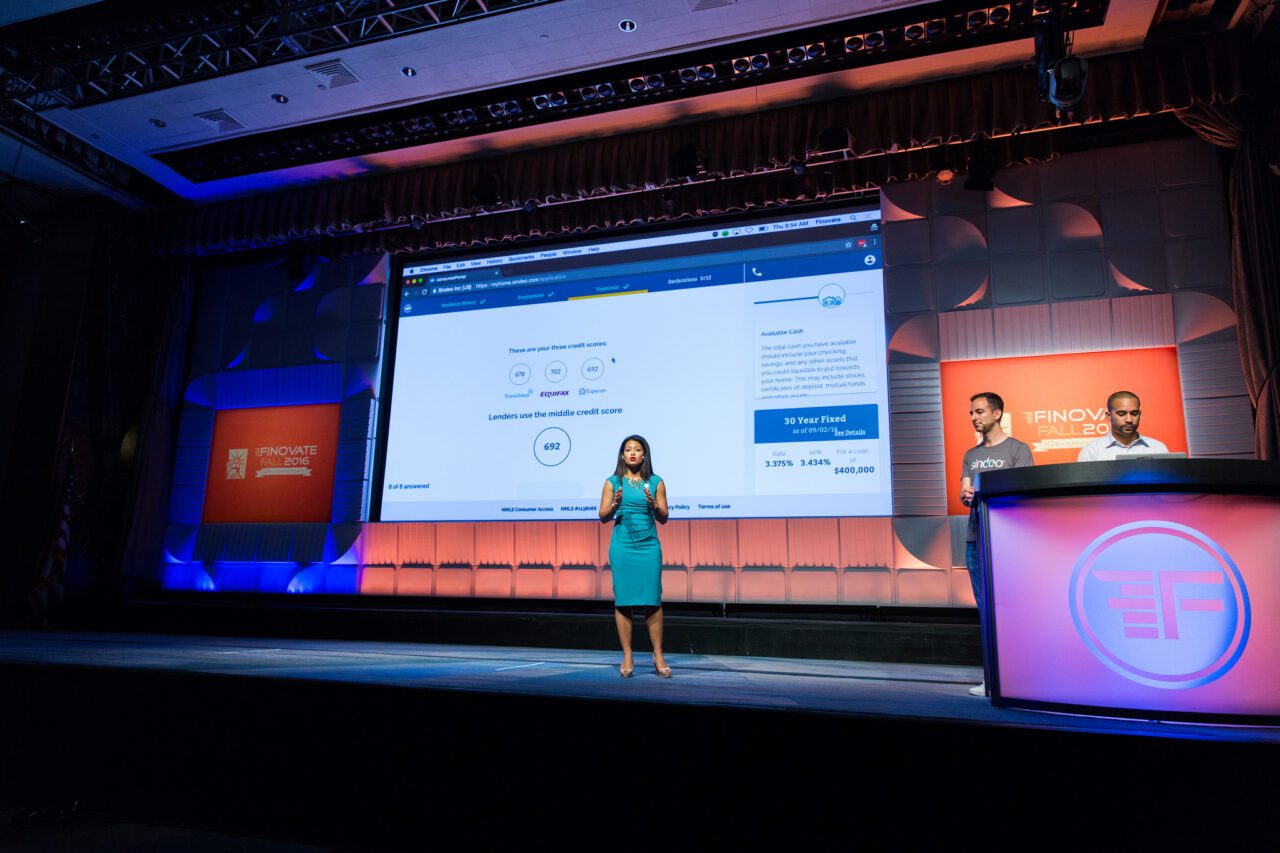

On the Finovate stage, the Sindeo team launched QuickStart, a CFPB compliant mortgage pre-qualification tool that helps borrowers find a home loan, complete the application and underwriting process, and generate a pre-qualification letter, all in less than 10 minutes.

Company facts

- 100+ employees

- Originating loans in eleven states

- $20+ million in funding to-date

- 60+ NPS

- Saved customers $17 million

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

We interviewed Ori Zohar (pictured right), Sindeo’s co-founder, to get a deeper look into Sindeo’s background and future plans.

Finovate: What problem does Sindeo solve?

Ori Zohar: Getting a mortgage today is a stressful, confusing, low-tech process. It’s rife with unnecessary delays and unexpected costs. It’s the biggest financial decision most people make in their lifetimes, yet there isn’t a good partner to guide customers in a high tech, friendly way.

Finovate: Who are your primary customers?

Zohar: Homeowners and future homeowners.

Finovate: How does Sindeo solve the problem better?

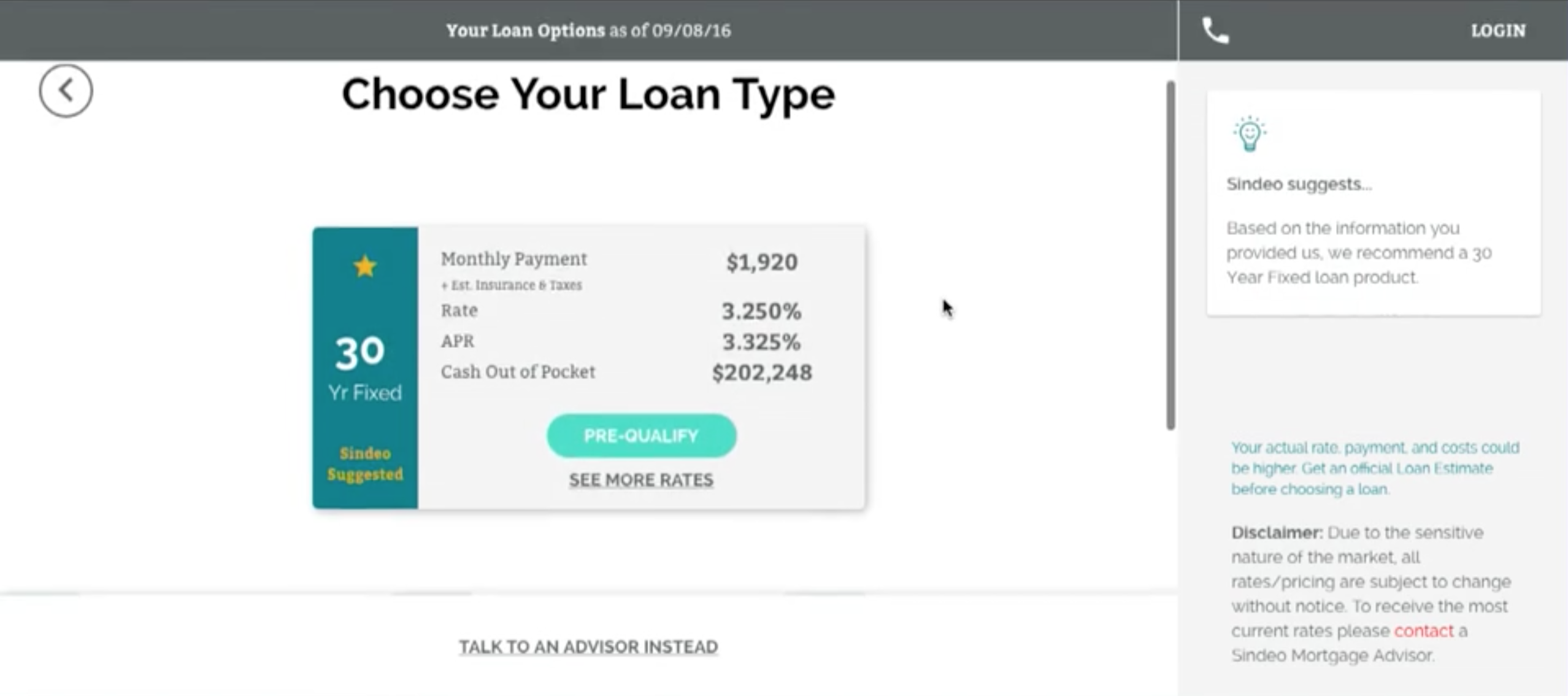

Zohar: We’ve created a mortgage marketplace where customers can shop one thousand loan products, apply in minutes by filling out just one application, and close with speed and transparency. Sindeo not only saves our customers time, but also tens of thousands of dollars over the life of the loan.

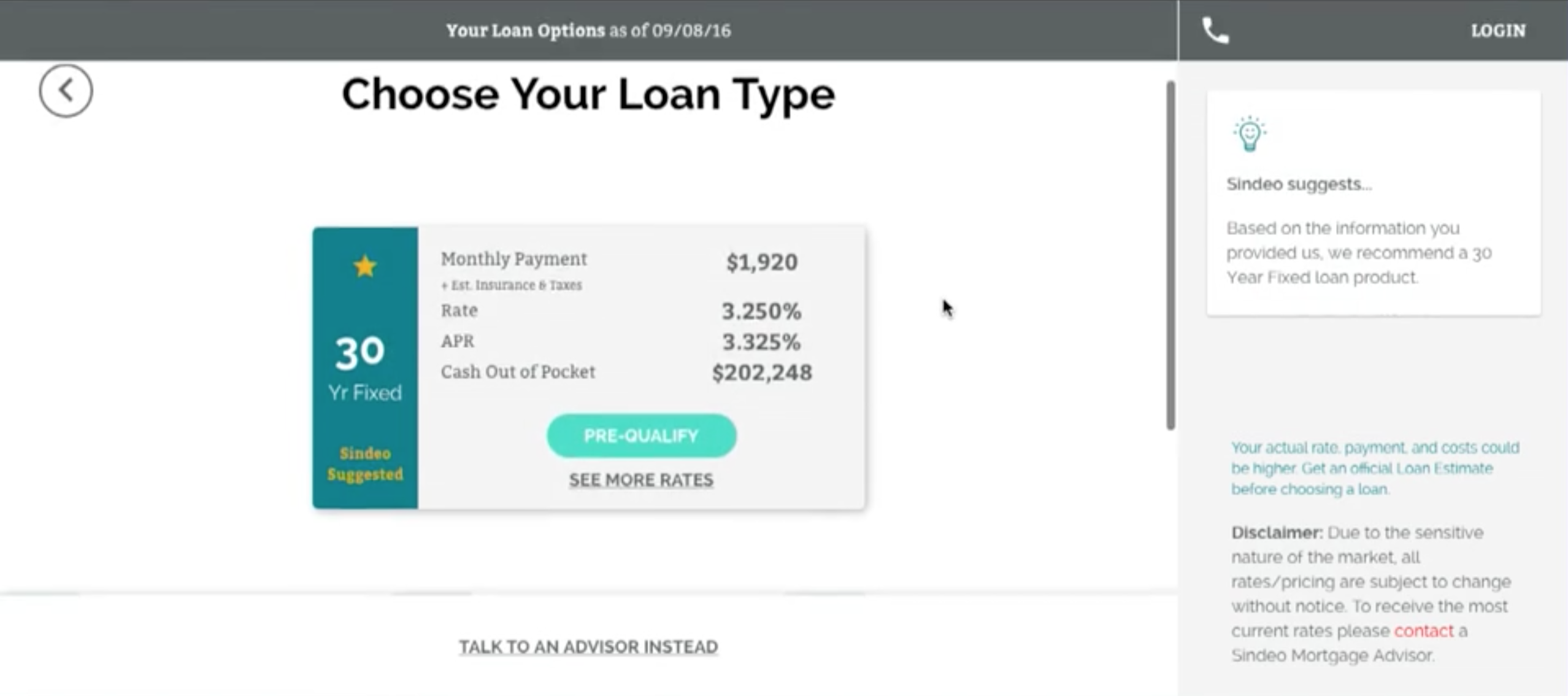

(above) A screenshot from Sindeo’s loan marketplace

(above) A screenshot from Sindeo’s loan marketplace

Finovate: Tell us about your favorite implementation of your solution.

Zohar: After a couple of years of some really hard work, it’s fantastic to see us delivering on our vision – especially with the technology. From the start, Sindeo has been about rebuilding the home financing experience from the ground up by providing customers with access to a broad marketplace of loan programs, expert and unbiased guidance from Mortgage Advisors that are compensated based on customer satisfaction, and innovative technology that streamlines the entire mortgage process.

Finovate: What in your background gave you the confidence to tackle this challenge?

Zohar: I’m a serial entrepreneur, having started my first business when I was 15. After graduating from college, I began working with global ad agencies on solving complex problems for clients in the luxury clothing, automotive, and financial services industries. Eventually, I started looking for my next entrepreneurial opportunity. After I met Nick Stamos, my co-founder, we knew we found a huge opportunity to create a new path to bring home financing into the modern era.

Finovate: What are some upcoming initiatives from Sindeo that we can look forward to over the next few months?

Zohar: Sindeo is an end-to-end solution, and SindeoOne is just the beginning! We’re going to continue to add features to SindeoOne like verification of assets, income and employment directly into the application. We’re also streamlining and automating our back-end processes, so that our mortgage advisors can spend more time helping our customers.

Finovate: Where do you see Sindeo a year or two from now?

Zohar: I expect that not only will Sindeo be available to consumers in every state, but we will have introduced a fully digital mortgage that will allow consumers to find the right loan at the right price and close as quickly as possible.

Watch Sindeo’s demo from FinovateFall 2016 in New York with Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder)

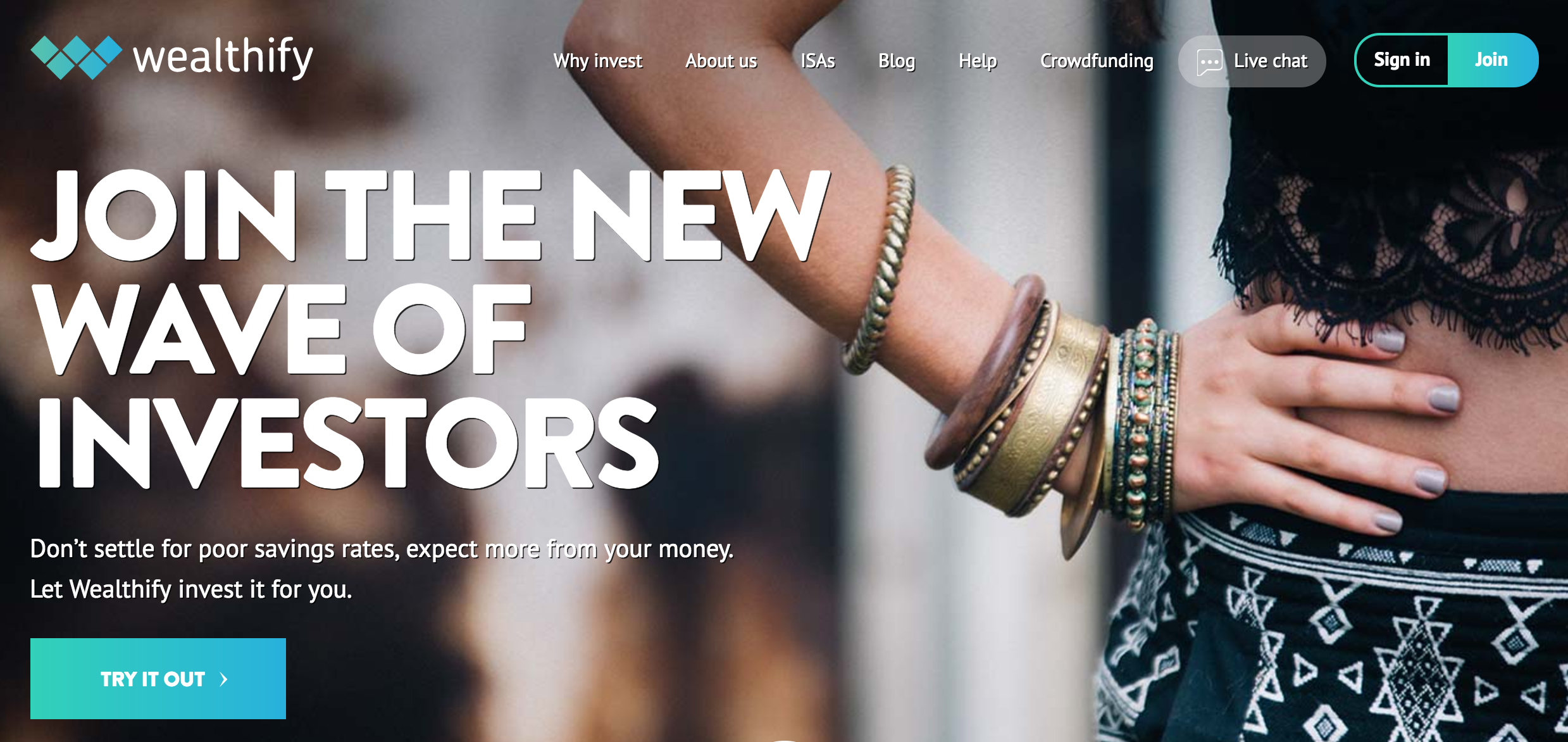

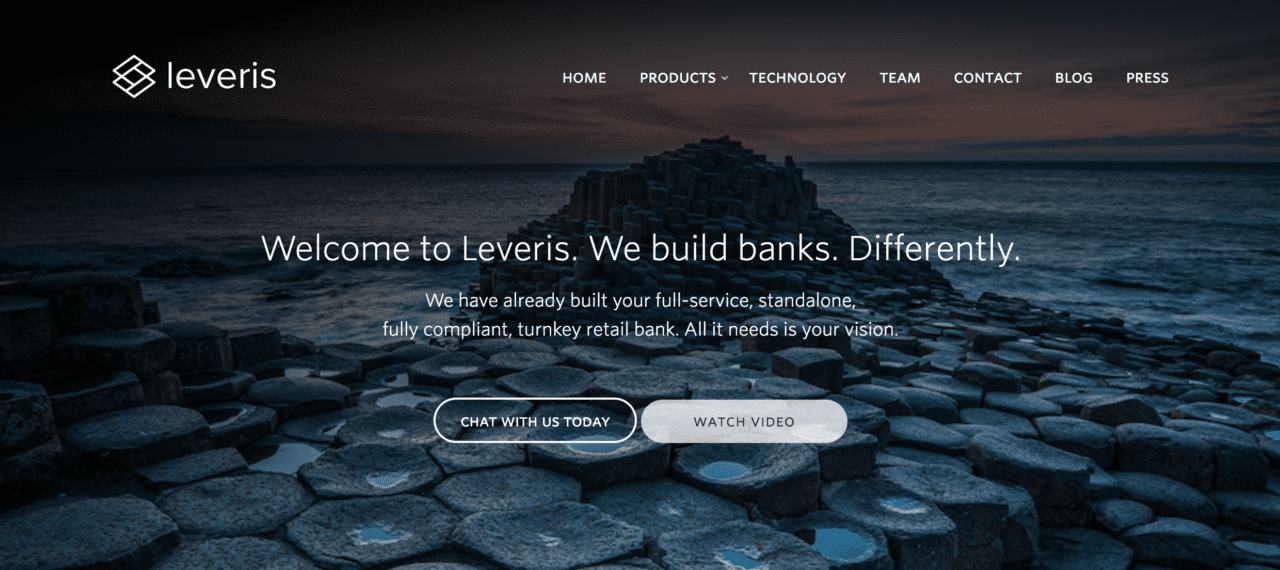

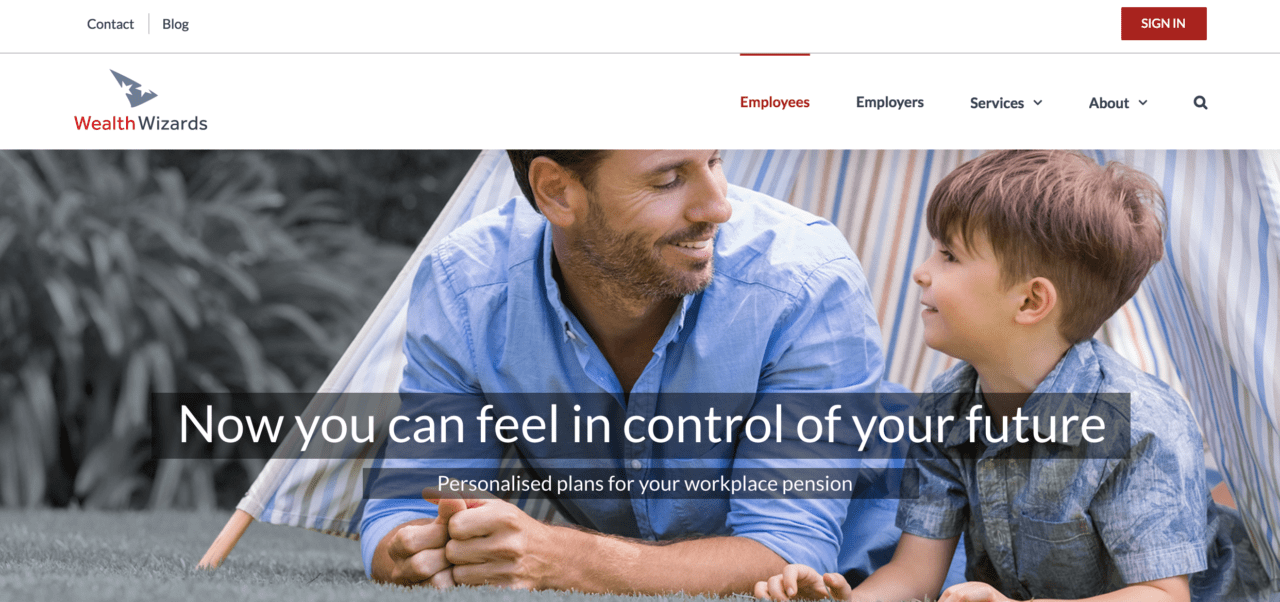

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

Janousek has more than eight years of experience building start-ups. He sold his last venture to O2. He is focused on delivering products with high added value and building a brand customers love.

Janousek has more than eight years of experience building start-ups. He sold his last venture to O2. He is focused on delivering products with high added value and building a brand customers love.

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

(above) A screenshot from Sindeo’s loan marketplace

(above) A screenshot from Sindeo’s loan marketplace

Presenters

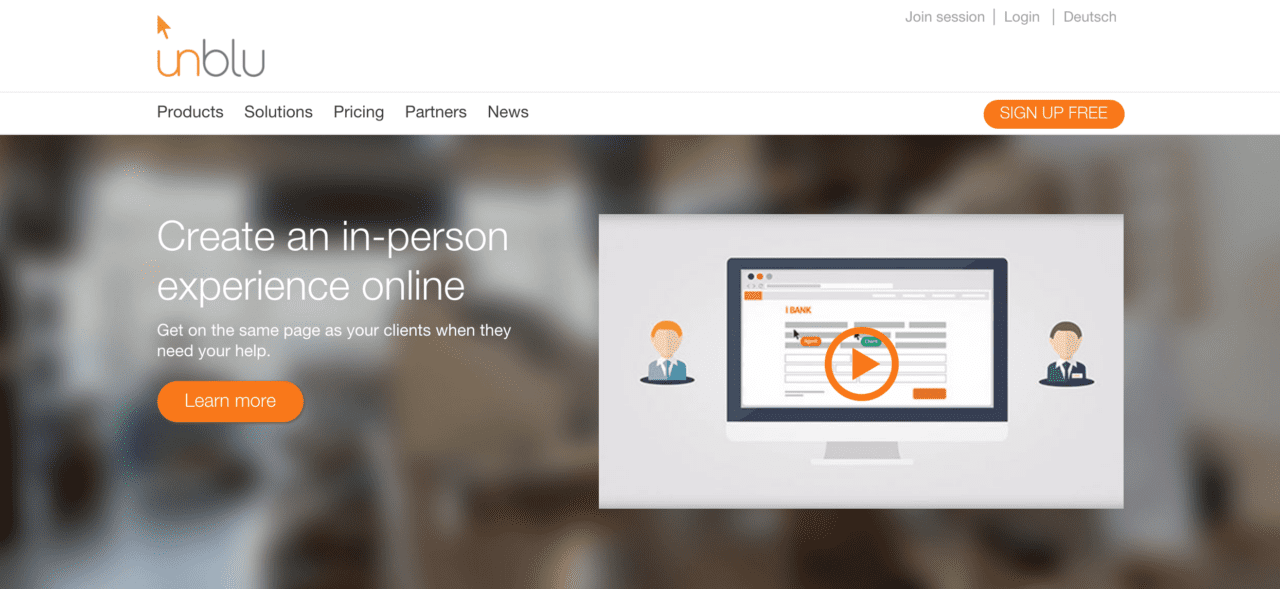

Presenters Luc Haldimann, CEO, unblu

Luc Haldimann, CEO, unblu

Presenters

Presenters Peet Denny, Chief Technology Officer

Peet Denny, Chief Technology Officer