FinovateSpring showcased credit unions and the fintechs that innovate for them in its Credit Union Spotlight last week. The closed-door session—”a safe space for credit unions” in the words of CURQL’s Nick Evens—was exclusively to provide credit union executives with a unique opportunity to discuss their challenges directly with fintech providers. The forum also gave these executives an opportunity to meet and network with each other to discuss common issues and new solutions.

Below is a sample of some of the most common concerns raised by credit union executives during the session, and a sense of what they need fintechs to offer in return.

“We want to do more with less”

The desire to maximize resources to accomplish more for customers and members is not unique to the credit union industry. The promise of enabling technologies like AI and the persistent competition for human talent make companies in virtually every industry today pursue efficiency as a way not only to keep costs low, but to offer more products and services faster and more seamlessly.

For credit unions, this challenge is all the more acute. These member-driven organizations face competition from larger rivals in the banking industry, as well as new entrants from technology and retail who are leveraging embedded finance to offer a widening range of financial services, including payments and lending. Further, these institutions often face pressure from their own members, whose lives are becoming more digitally oriented and who want more digital solutions when it comes to managing their finances and investing for the future.

Through technologies like AI, innovations like embedded finance, and strategic, third-party relationships, credit unions can do more faster, offering new products and services, and growing their membership communities.

“More automation”

There are few better examples of technology enabling companies to do “more with less” than automation. Whether driven by machine learning or agentic AI, automation is a key driver in technological modernization—and it is no different in financial services.

For credit unions, automation offers the ability to convert labor-intensive, manual, and relatively more error-prone human tasks into processes that are completed with technical tools. As these technical tools evolve—from apps and APIs to agents and AI bots—so does their capacity to operate increasingly complex workflows and customer lifecycles.

Many businesses stand to gain from automating many internal processes. But institutions like credit unions could disproportionately benefit from the ability of automation to “liberate” human workers from mundane tasks and enable them to participate in more higher-order activities. These include delivering better, more personalized engagement to members.

“Better authentication for diverse memberships”

How do the authentication needs differ for a credit union with a sizable number of members over the age of 70+? What about a credit union with a large number of Spanish-speaking members? How about a credit union with a special commitment to serving members with disabilities?

Unlike many other financial institutions, credit unions are often as unique as the members who make them. In case after case, we can draw a straight line from the communities of farmers, teachers, and small business owners who first launched their financial cooperatives decades ago directly to the present-day communities benefiting from the growth and success of those institutions right now.

Fintechs that help credit unions carry out their unique missions are the kind of partners that credit unions are looking for. Beyond avoiding one-size-fits-all approaches to providing solutions, fintechs should strive to understand not only what their credit union partner does, but what it values most. One fintech’s niche offering could be a decisive ingredient in helping a credit union fulfill its mission to its members.

“Better support for third-party integrations”

The opportunities—and challenges— of third-party integrations have become all too clear for most in fintech and financial services. While the rewards of getting it right have almost become table stakes, the penalties for getting it wrong remain powerful—and painful. The prospect of a less aggressive regulatory environment for financial services companies in the US only adds another level of uncertainty.

Along with empowering technologies like AI and AI-powered automation, third-party partnerships and integrations are a key way for credit unions to leverage creativity, hard work, and good decision-making to “punch above their weight” and compete with larger rivals. Additionally, providing better support for third-party integrations helps ensure that credit unions stay on the right side of regulatory scrutiny, and remain their community’s trusted financial partner.

“Better technology / credit union culture compatibility”

Underscoring the diversity of credit unions, one industry representative highlighted the fact that not every credit union wants every new fintech product or service. This credit union executive was referring specifically to Buy Now, Pay Later (BNPL) products, and his concern that offering the products could be considered a more general endorsement of BNPL by the credit union.

Whether it is alternative lending solutions, innovative payout services, digital assets, or other new fintech products, providers should be mindful of the culture of the credit union they are seeking to partner with. Even when the potential feature or service appears uncontroversial—such as a new, gamified interface designed to engage younger users—there is the possibility of a poor fit if the culture and current goals of the credit union are not just taken into consideration, but put front and center.

Photo by Jonathan Cooper on Unsplash

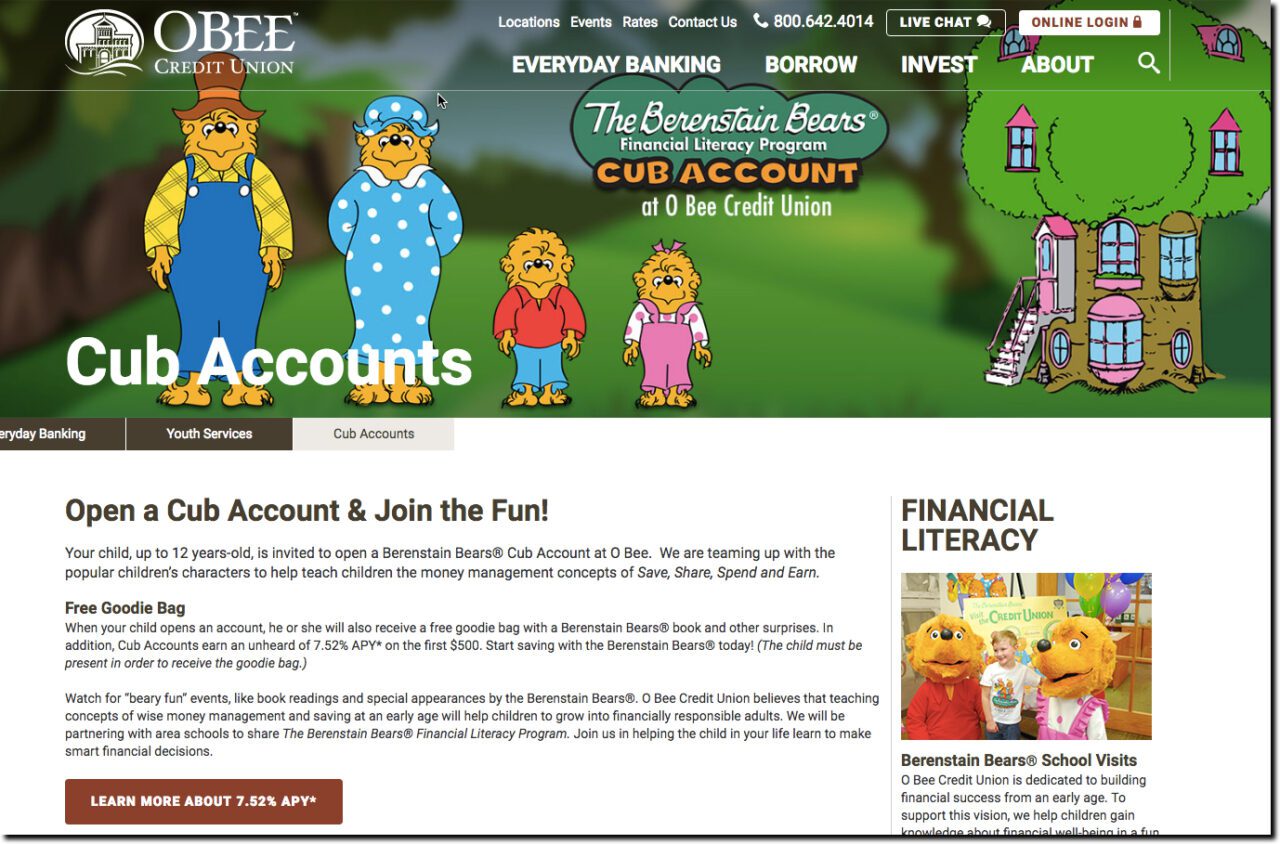

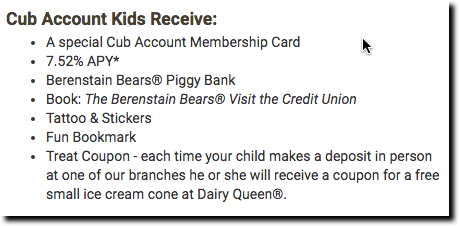

The book is in use at a number of credit unions, but none more prominently than

The book is in use at a number of credit unions, but none more prominently than