This is the final post in our blog series about the savings technology horizon. Last week we discussed how savings technology works in goals-based PFM platforms and standalone, automated savings platforms. So far this week, we’ve looked at solutions targeted to Generation Z, crowdfunded savings technology, and advice-only solutions. Today, we’ll consider the final category– passive investing.

Savings tech isn’t sexy, and because it is often built into a larger, more robust product, sometimes it is difficult to notice. With the diversity of savers in this world, it only makes sense to have a wide variety of tools to help them save. Not all savings tools are built the same, and that’s a good thing. Missed the other five savings categories? Check them out:

Today’s category borders on wealth tech (okay, it is wealth tech). It is also, however, one of the major methods people use to set aside money for their future. I felt this series would be incomplete without considering a few examples of how passive investing helps people save.

Passive investing

A wide spectrum of companies, many of which will sound familiar, fall into this group. I’ve picked out three– Acorns, Betterment, and Prosper— to illustrate a variety of examples.

- Acorns

Most likely, you’re already familiar with Acorns. This millennial-focused app offers an easy way to helppooryoung, tech-savvy investors make the jump into the stock market. Founded in 2012, Acorns launched an app that connects with a user’s debit account, helping them invest the “spare change” from their daily transactions. To keep things simple for novice investors, the company charges a straightforward fee of $1 per month.

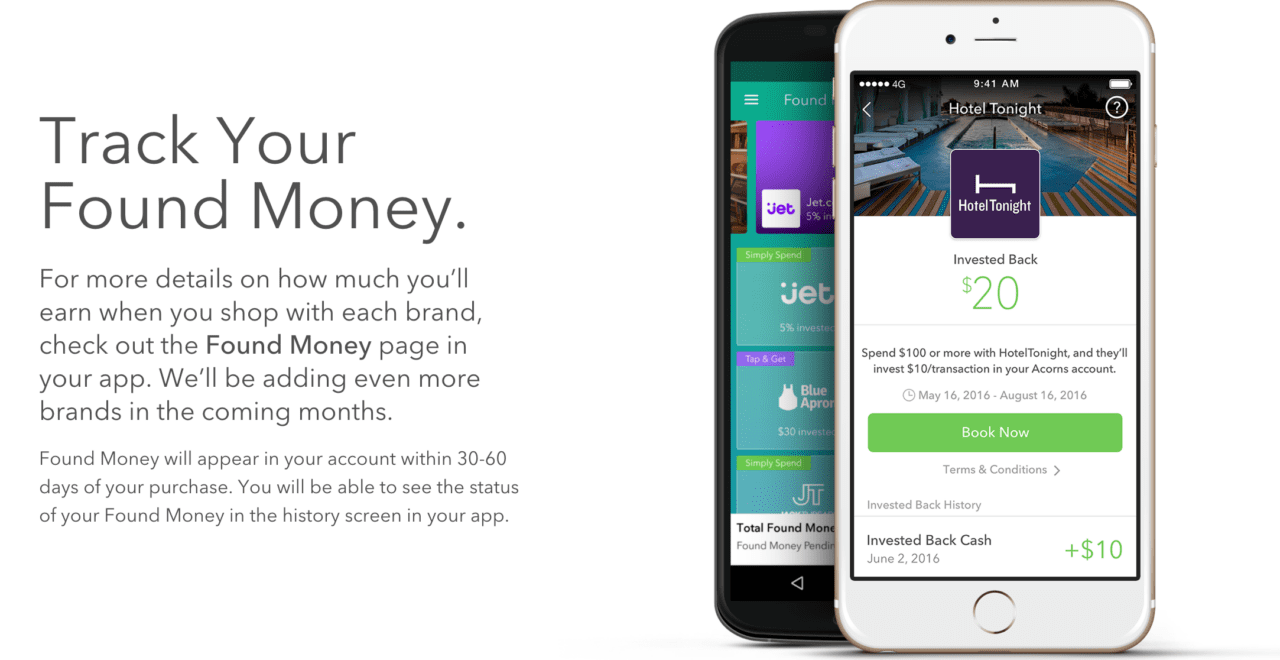

Acorns’ Found Money feature leverages brand partnerships

Tying in saving and investing with spending, Acorns recently launched a FoundMoney feature (pictured above). With Found Money, Acorns’ merchant partners deposit bonus cash into the user’s Acorns account. When consumers spend money with select companies, the brand to invest back. Acorns currently boasts 10 millennial-friendly brand partnerships, including Airbnb and Dollar Shave Club.

- Betterment

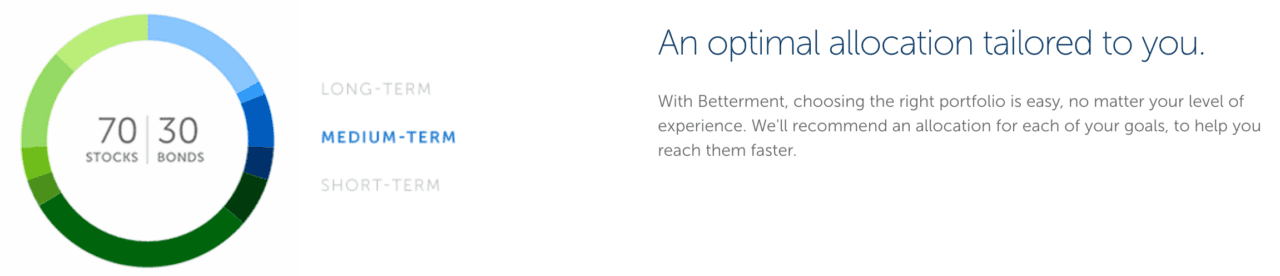

Another savings/investment tool that will sound familiar is Betterment; the New York-based company made its first Finovate appearance at FinovateFall 2010. One of the first automated investment platforms in the U.S., Betterment was founded in 2008 to create an algorithmically-managed investment account with lower fees than a financial advisor.The company recently introduced a set of hybrid robo advice offerings with a personal touch; for a higher annual fee, users can opt for a robo advisory service blended with a certified financial planner (CFP). The service options range from a yearly call with Betterment’s team of CFP professionals to a one-on-one relationship with a financial advisor.

Betterment uses an algorithmic approach to investing

- Prosper

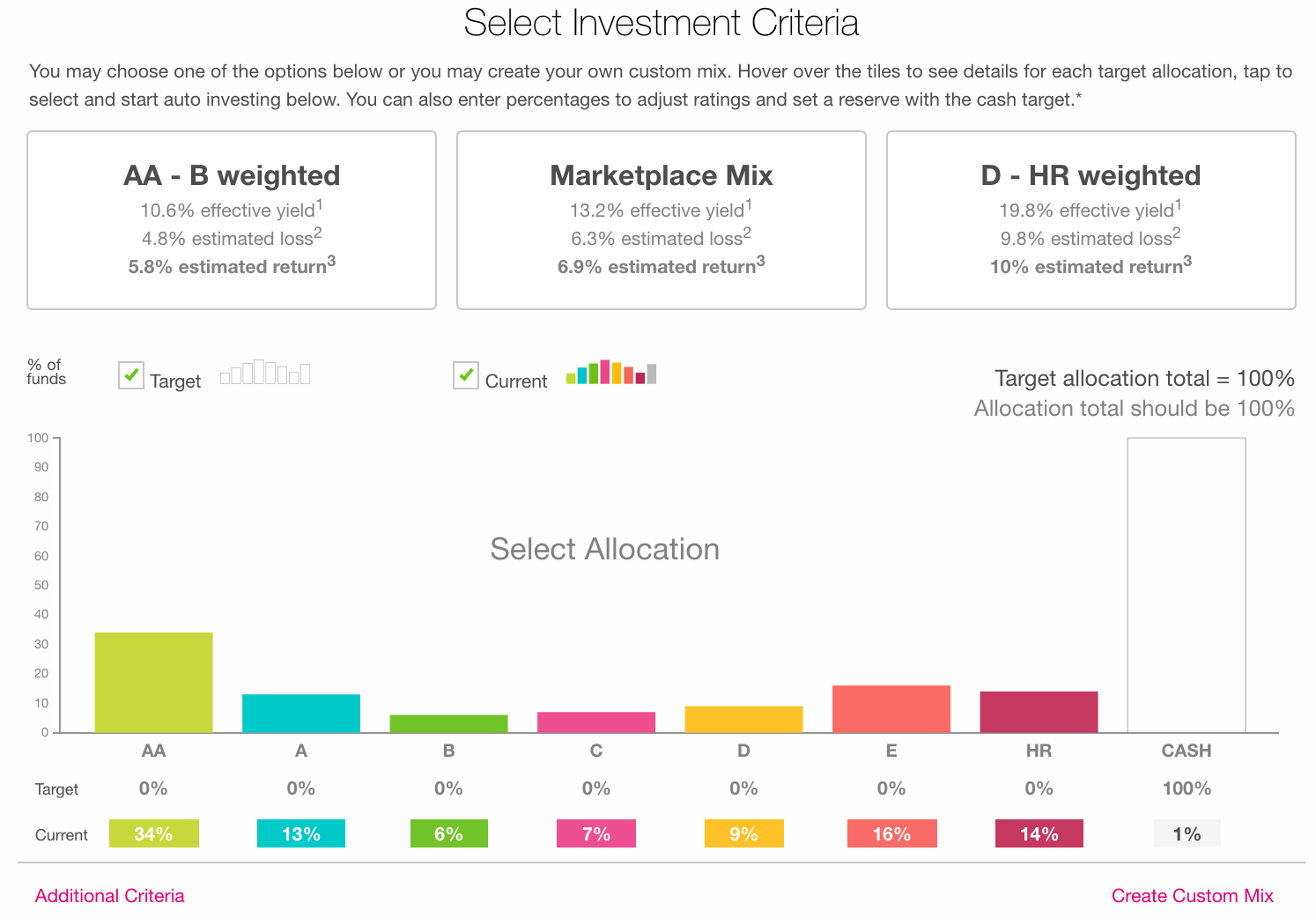

This P2P pioneer also may sound familiar. Prosper launched in 2006 and has since become one of the largest P2P marketplaces in the U.S. The company offers investors an Auto Invest feature that lets users set investment rules based on the risk and type of loans in which they want to invest. When the user has liquid cash in their account Prosper will automatically re-invest those funds into loans that match the user’s criteria. Prosper debuted at the first ever Finovate in 2007.

Prosper’s Auto Invest feature helps users take a “set it and forget it” approach to saving

Prosper’s Auto Invest feature helps users take a “set it and forget it” approach to saving

Next week, our analyst David Penn will pick up the series as he talks to industry experts and looks that the future of savings technology.