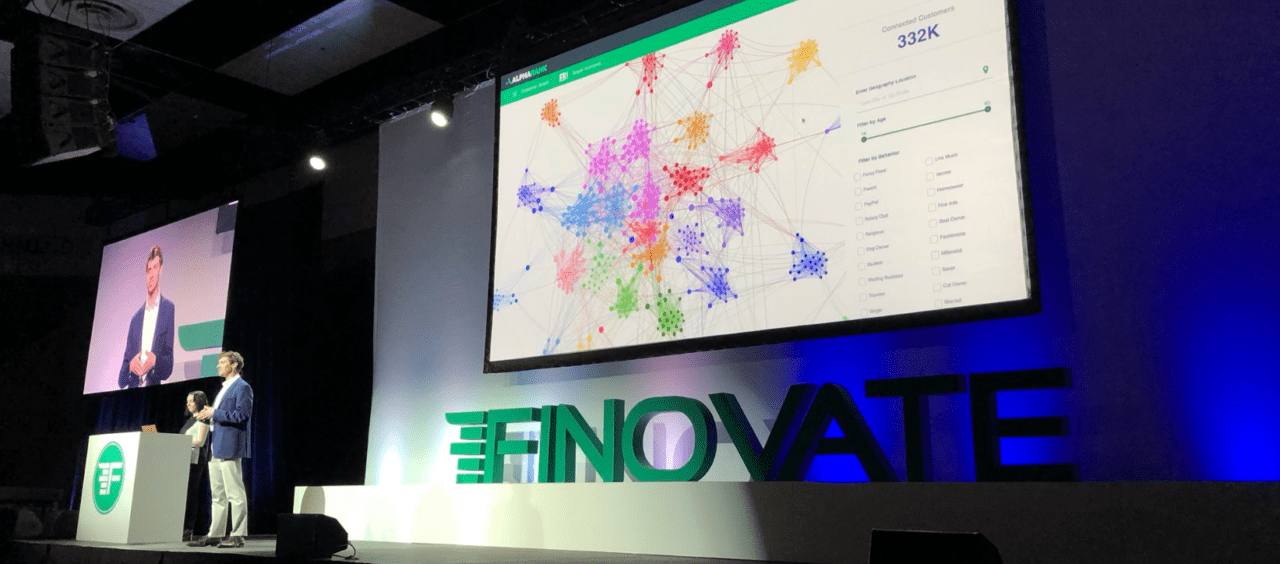

We wrapped up the demos at FinovateSpring yesterday and crowned the Best of Show winners. Today we’re switching gears to discuss some of the tools and trends we saw on stage, and look at what they mean for the future of fintech.

There’s a lot to fit in, so doors open earlier this morning at 8 AM and the general session kicks off at 9 AM here at the Santa Clara Convention Center. Tickets are still available at the door.

You can check out the full agenda on our website, but here’s what you can expect today:

8 AM to 9 AM Registration and Continental Breakfast

9:00 Opening Remarks

9:10 to 9:55 Analyst All Stars

- Shane Hubbell – Managing Director, Alkali Partners

- Jacob Jegher – Senior Vice President, Banking and Head of Strategy, Javelin Strategy & Research

- Daniel Latimore – Senior Vice President, Banking Group, Celent

- Tiffani Montez – Retail Banking Senior Analyst, Aite Group

- Ron Shevlin – Director of Research, Cornerstone Advisors

- Jerry Silva – Global Retail Banking Research Director, IDC Financial Insights

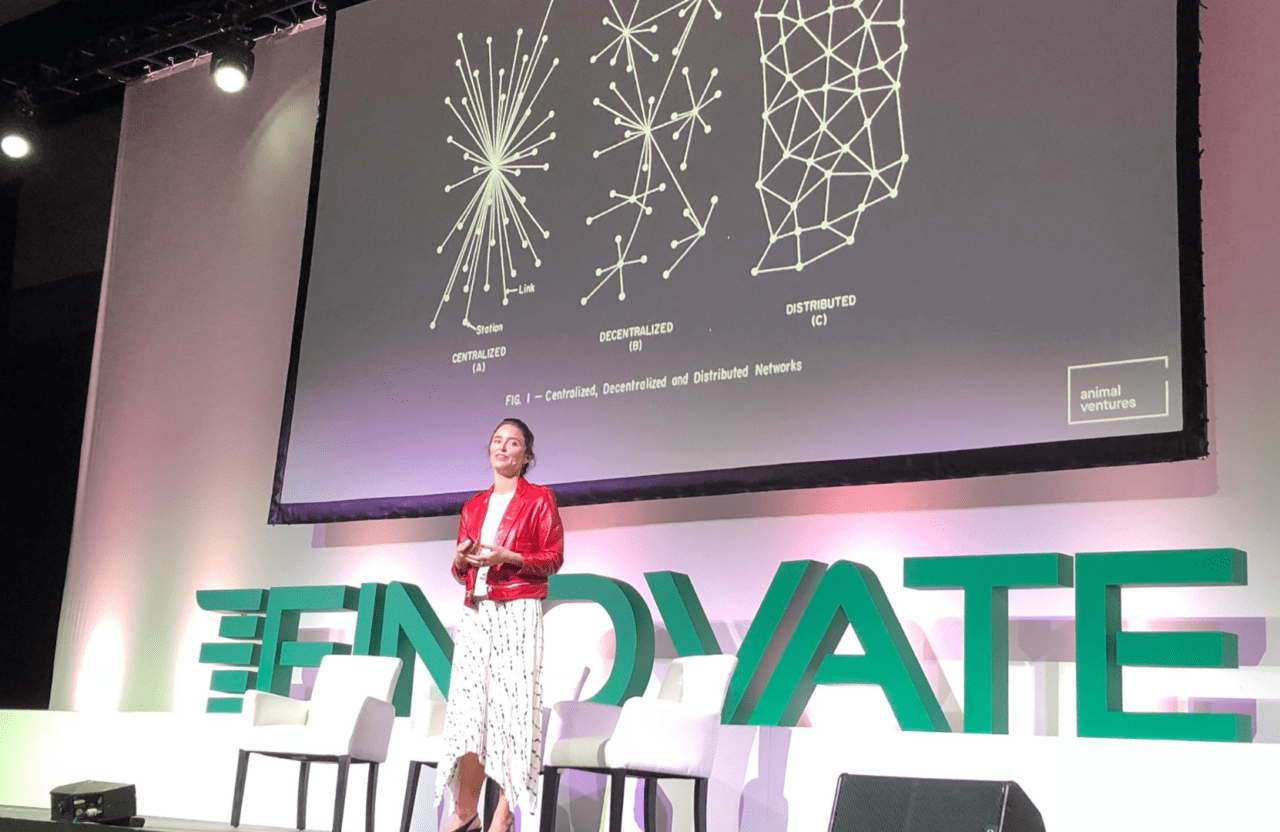

9:55 to 10:35 Keynote Address: How Blockchain will revolutionize the industry

- Bettina Warburg – Blockchain Researcher, Entrepreneur and Educator, Animal Ventures

10:35 to 10:55 Strategy Session: Is the future digital interface voice activated?

- Mark Schwanhausser – Director Digital Banking, Javelin Strategy

- Theodora (Theo) Lau – Innovator Technologist and Connector, Unconventional Ventures

- Windsor Tanner – VP, Voice Biometrics for Real-Time Authentication, NICE

10:55 to 11:30 Refreshments and Networking Break

11:30 to 12:00 Panel Discussion: Open Banking, APIs & Regulation – Shifting sands of the US banking industry

- Jacob Jegher – Senior Vice President, Banking and Head of Strategy, Javelin Strategy & Research

- Kerry Warwicker – Head of Research & Intelligence, Digital Cash Products – Global Transaction Banking, Deutsche Bank

- Dan Quan – Head of Catalyst, Consumer Financial Protection Bureau (CFPB)

- Oded Shoshany – CEO, CeleritiFinTech

12:00 to 12:20 Question Time: Customer Acquisition and Retention Models – New technologies and ideas being used to sell to and service client accounts in order to increase growth and profits

- Steven Ramirez – CEO, Beyond the Arc

- Mahima Chawla – Growth Lead at Square Capital, Square

- Vaduvur Bharghavan – CEO, Ondot Systems

12:20 to 1:00 Thriving in an Era of Digital Disruption

- JP Nicols – Managing Director, Fintech Forge

1:00 to 2:00 Lunch and Networking

2:00 to 3:25 Summit Sessions

- Banking & Payments

- Digital Lending

- Customer Experience

- Cyber Security

3:25 to 4:00 Afternoon Coffee & Networking Break

4:00 to 5:05 Summit Sessions

- Banking & Payments

- Digital Lending

- Customer Experience

- Cyber Security

5:05 to 6:30 Reception & Networking

We’re excited to continue this momentum tomorrow, when registration opens at 8 AM and the general session content begins at 9 AM.

If you need to bring your bags, free coat check will be available.

Dynamics, Inc.

Dynamics, Inc.