BizEquity just signed its first – really big – bank.

TD Bank has partnered with the online business valuation specialist to provide SMEs across the country with real-time insights into fair market, enterprise, and liquidation values based on current market conditions. Relationship managers at TD Bank will leverage BizEquity’s technology to produce detailed valuation and industry KPI reports, and then share them with business owners to help them create succession plans, formulate tax planning strategies, explore funding and M&A opportunities, and more.

“Without proper valuation knowledge, many of these business owners will not be adequately funded or have the right wealth or succession plans in place,” BizEquity founder and CEO Michael M. Carter said. “Together, we are helping to democratize this important knowledge for small and mid-size business owners from Maine to Florida.”

BizEquity, developer of Valuation-as-a-Service (VaaS) and the VaaS Business Valuation Cloud, enables companies to produce a customized valuation performance report that gives SME owners key insights into business valuation data as well as industry comparisons in 40 KPIs. BizEquity’s more than 500 financial services clients include KPMG, Mass Mutual Financial Group, and Mutual of Omaha; as well as fellow Finovate alums like Experian, Xero, and Equifax. TD Bank represents BizEquity’s first and only top-10 U.S. bank partner.

With headquarters in Wayne, Pennsylvania and offices in Tower Hamlets, London, Biz Equity was founded in 2010. The company began the year announcing an agreement with Windfall Data, in which the consumer financial data specialist will offer its wealth data on the BizEquity platform. Last month, BizEquity was honored at the FinTech Breakthrough Awards, earning the Innovation Award for Wealth Management.

BizEquity has raised $5.1 million in funding, courtesy of an investment from London-based venture capital firm, Frost Brooks. The company demonstrated its BizEquity One U.K. valuation-as-a-service technology at FinovateEurope 2015.

Based in Cherry Hill, New Jersey, TD Bank appeared with Moven at FinovateSpring 2016 for a live demonstration of the TD MySpend app. The app features a full integration of the Moven platform within TD Bank’s mobile banking ecosystem. Operating in the U.S. northeast and mid-Atlantic regions, as well as metropolitan D.C., the Carolinas, and Florida, TD Bank is a member of TD Bank Group and a subsidiary of The Toronto-Dominion Bank of Toronto, Canada.

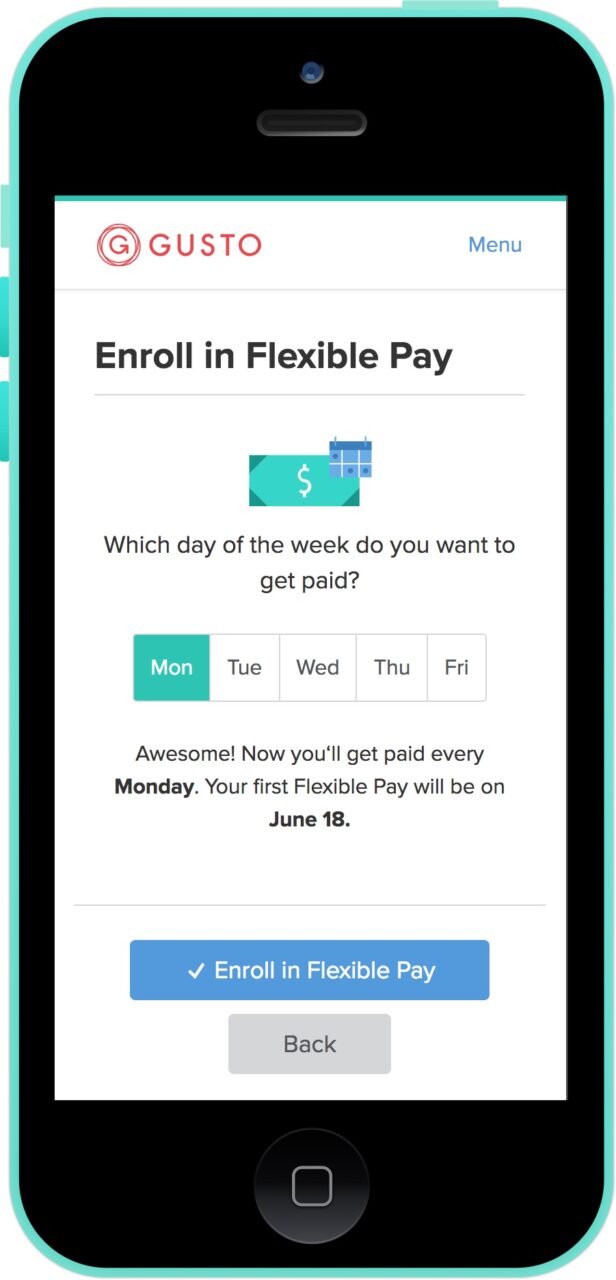

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”