The digital lending and finance sector has grown dramatically in the last few years but traditional banks still dominate lending and the financial services space, while digital-first challengers and fintechs are still facing an uphill battle to capture customers and take advantage of the opportunity the digital transformation has provided.

Customers are taking notice of these newcomers though, and efficient onboarding using digitized workflows, such as digital identity verification technology, are being used by both new entrants and incumbents to boost competitiveness in an era where many consumers are increasingly shifting from being digital-first to digital-only.

Watch this Finovate webinar to learn from leading experts in the digital space who will delve into how digital lenders, fintechs, and even incumbents can leverage digital to ward off inefficiency, drive the best possible customer experience, and enhance the speed and cost-effectiveness of the onboarding process.

Our experts will be covering topics including:

- The landscape for digital lenders in Europe: Explore the rapidly-expanding digital landscape and what digital lenders are competing with incumbents.

- The need for increased security: See methods for mitigating fraud and risk posed by financial transactions in the online world where face-to-face or traditional ways of verification aren’t possible.

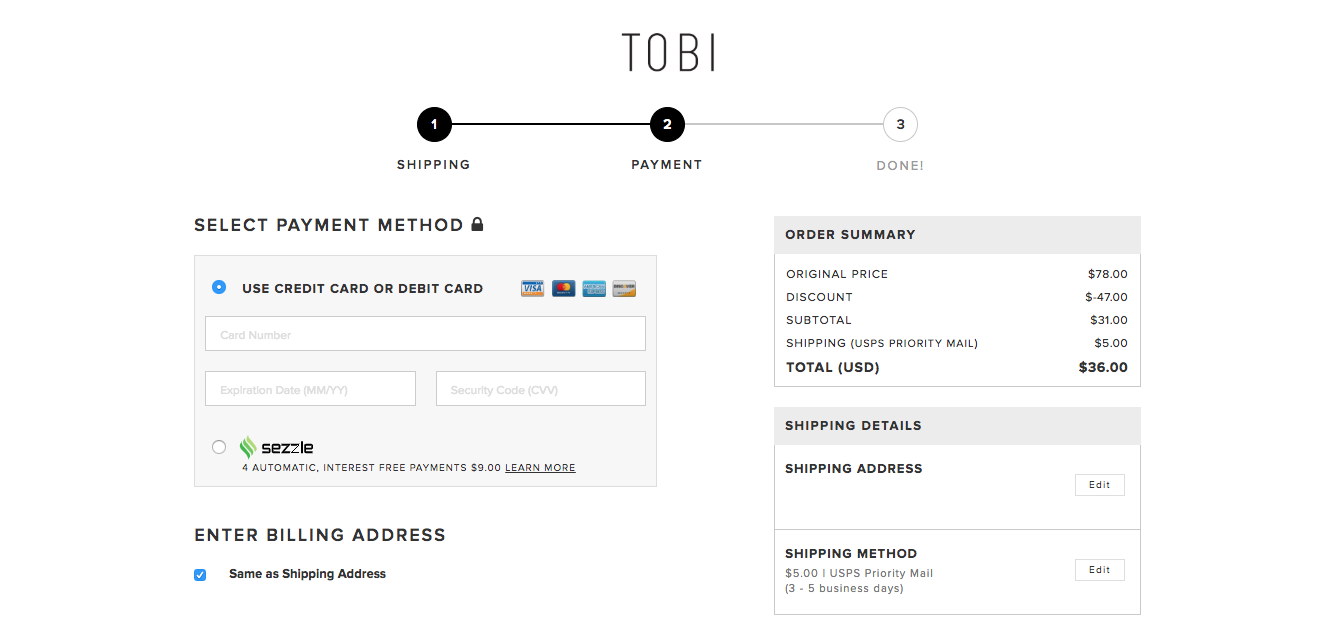

- Seamless user experience: Learn how leading companies are leveraging digital ID verification to bring on more customers, more quickly.

- Cutting compliance costs while boosting efficiency: See how, in a supposedly digital world, mandatory KYC and AML checks are still all too often a largely manual process. Digital processes have the potential to help to reduce KYC and AML compliance costs by up to 70% – and could improve the speed of these checks by up to 80%.

Featuring:

Global Director Fintech Strategy, Partner

Autonomous Research

Sokolin is a futurist and entrepreneur focused on the next generation of financial services. He directs Fintech Strategy at Autonomous Research, a global research firm for the financial sector, helping clients understand and leverage innovation. Covered themes include roboadvice, blockchain and cryptoeconomy, artificial intelligence, chatbots, neobanks, and banks-as-a-platform, insurtech, and regtech.

VP of Identity, EMEA

Mitek

Bloemendaal has long been actively involved in online identity and risk management, with 15+ years of experience in entrepreneurship, international sales and marketing in the field of internet technology, and SAAS. In his career, Bloemendaal has successfully founded and managed two businesses which still exist to this day. As VP of Identity for EU for Mitek, Bloemendaal is responsible for setting the strategy and continually driving growth for Mitek in digital identity verification across Europe.

Presenters

Presenters

The new marketplace aims to help students make smarter decisions when refinancing their existing student loans. By submitting a single application, users can receive actual rate quotes in real time from multiple lenders, including LendKey, CommonBond, and SoFi. Each offer transparently shows users a breakdown of monthly costs, payments, and fees so that they can make the best decision based on their circumstances.

The new marketplace aims to help students make smarter decisions when refinancing their existing student loans. By submitting a single application, users can receive actual rate quotes in real time from multiple lenders, including LendKey, CommonBond, and SoFi. Each offer transparently shows users a breakdown of monthly costs, payments, and fees so that they can make the best decision based on their circumstances.