eToro is taking its social trading platform and cryptocurrency wallet to the States.

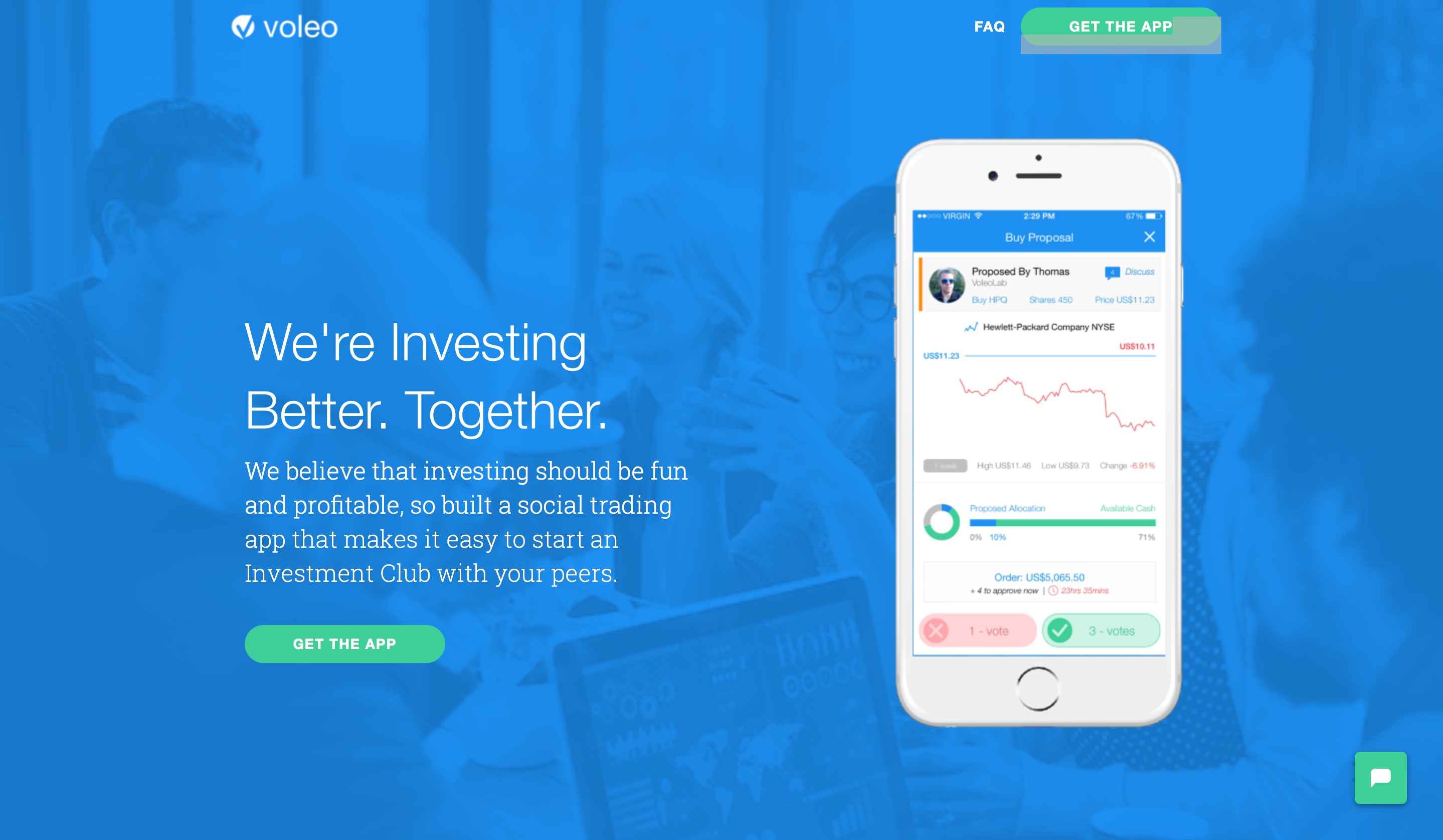

“For the first time, Americans can collaborate with other crypto traders when making buying and selling decisions,” eToro CEO Yoni Assia said. “Users can adjust their trading strategies by watching and learning from others on the platform.”

The company, a six-time Finovate Best of Show winner, demonstrated its CopyFunds for Partners technology at FinovateEurope 2017. Now known as CopyPortfolios, the solution enables investors to own a group of assets, aggregated based on specific market strategies. For the U.S. launch, three cryptoasset CopyPortfolios will be available initially.

eToro’s U.S. launch will enable customers in 32 states to trade and invest in six cryptocurrencies: BTC, ETH, LTC, BCH, XRO, and XLM. Additional cryptocurrencies are expected in the new future, with as many as 13 different digital assets and multi-asset trading enabled by the first quarter of 2020.

Left to right: Tal Ben-Simon (VP of Product) and Yoni Assia (CEO & Founder) demonstrating social trading technology at FinovateEurope 2017.

eToro customers can access the wallet feature from their existing eToro accounts, and transferring coins from trading accounts to the wallet is just a one-click process. Users can also securely send and receive cryptoassets via QR code or by sharing their wallet address.

“(eToro) acts as a bridge between the old world of investing and a blockchain-powered future, helping our users navigate and benefit from the transition to cryptoassets for wealth building,” Assia said. “People create the eToro experience and now Americans will play a major role in shaping our community and future.”

With more than 10 million registered users, eToro enables traders and investors to leverage the insights of top traders in the community to make better decisions in the financial markets. The platform supports a wide range of assets, from stocks and ETFs, to currencies, indicies, and commodities – including cryptocurrencies.

eToro makes it easy for traders to follow the best performing traders with its CopyTrader technology, and gives eligible winning traders the opportunity to earn as much as 2% annually on their assets as part of eToro’s Popular Investor Program.

Founded in 2007 and headquartered in Tel Aviv, Israel, eToro has raised $222.7 million in funding. The company includes Spark Capital, Social Leverage, BRM Capital, Cubit Investments, and CommerzVentures GmbH among its investors.