The U.S. Government’s Paycheck Protection Program (PPP) was set to expire yesterday, but the Senate voted to extend the loan program by five weeks, making the new deadline August 8, 2020.

Since it was initiated on April 3, the PPP has helped banks provide billions in working capital to 4.8 million small businesses. The extension offers businesses more time to apply for the $130 billion in unspent funds that remain in the program.

The PPP has had a rocky existence, caused by a muddy application system, confusion from both businesses and banks on the terms surrounding the funds, and the fraudulent (or at least unethical) acquisition of loan money by major corporations. That said, there are a handful of lessons learned we can take away from this experience. Here is a summary of the top three.

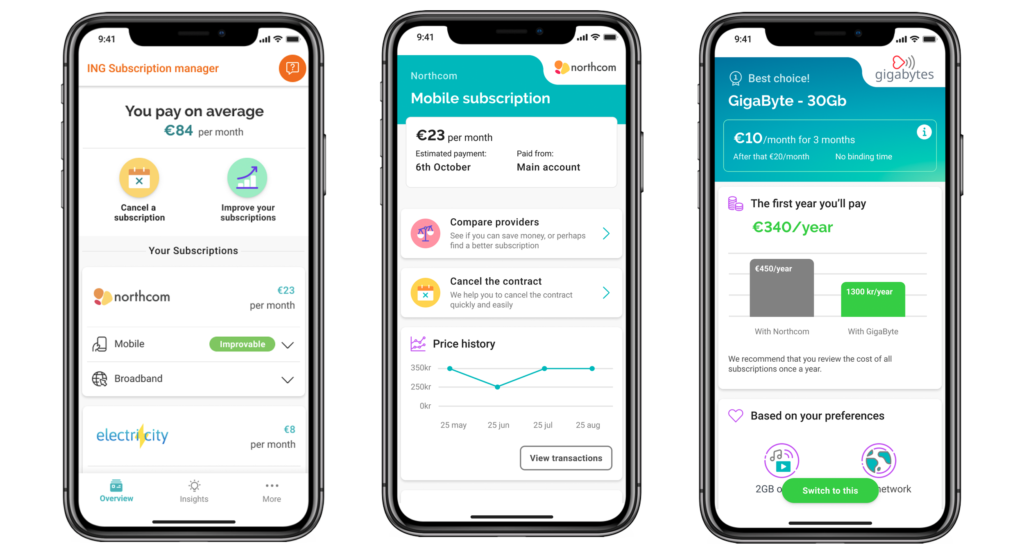

Open banking would have made a positive impact

In the height of the coronavirus, many small businesses struggled to find a bank that would lend PPP funds to them. Much of this was due to the fact that banks had difficulty underwriting loans of new clients. With open banking, businesses could opt to share their data with other financial institutions. This availability of data would not only help businesses speed up the application process at the bank of their choice, it would also offer banks access to crucial data regarding businesses’ historical finances.

It is possible for the government to move fast

“Move fast and break things” is typically a mantra of agile startups, and not a slow-moving government. However, given the serious economic threat that the coronavirus-induced stay-at-home orders posed, there was no time for a lengthy revision process and regulatory approvals.

The PPP is part of the CARES act, which includes multiple provisions for unemployment benefits, tax rebates, grants, and more. Early voting on the bill began March 22 and by the morning of March 25, Senate Democrats and Republicans announced they had come to an agreement on the 300-page document. A few hours after the agreement, the President signed the bill into law.

“Like all compromises, this bill is far from perfect, but we believe the legislation has been improved significantly to warrant its quick consideration and passage, and because many Democrats and Republicans were willing to do the serious and hard work, the bill is much better off than where it started,” said Democratic Senate Minority Leader Chuck Schumer.

Communication and transparency are king and queen

One of the biggest speed bumps encountered was confusion around the terms of the loans. Businesses not only had difficulty during the application process, many also had trouble in determining if they were eligible for the loans. And even if they were eligible, many businesses still didn’t understand if the funds needed to be repaid and what the stipulations for repayment were.

There is no other loan in America where the applicant is unaware of their responsibility to repay. Because of this confusion (and the legal and regulatory ramifications), in early June President Trump signed a new law relaxing some of the PPP regulations and addressing some of the original flaws.

This mistake is easy to excuse, given the tight deadline to organize and originate the program. However, it doesn’t discount the need for lenders to maintain transparency and ensure borrowers know what is expected when it comes to repayment. It reminds me of a millionaire I once met who, after originating a mortgage on his new home, didn’t understand that he was expected to pay his mortgage every month. He assumed that the bank would automatically deduct the funds from his account each month on his behalf. After 6 months of missed payments, his credit score was trashed.

Since we have yet to conquer the virus and are reeling from low unemployment, we still have a lot to learn. One of these lessons is to take things one day at a time. As we do so, let’s take stock of lessons learned so that we can help each other during this crisis.

Photo by Kyle Glenn on Unsplash