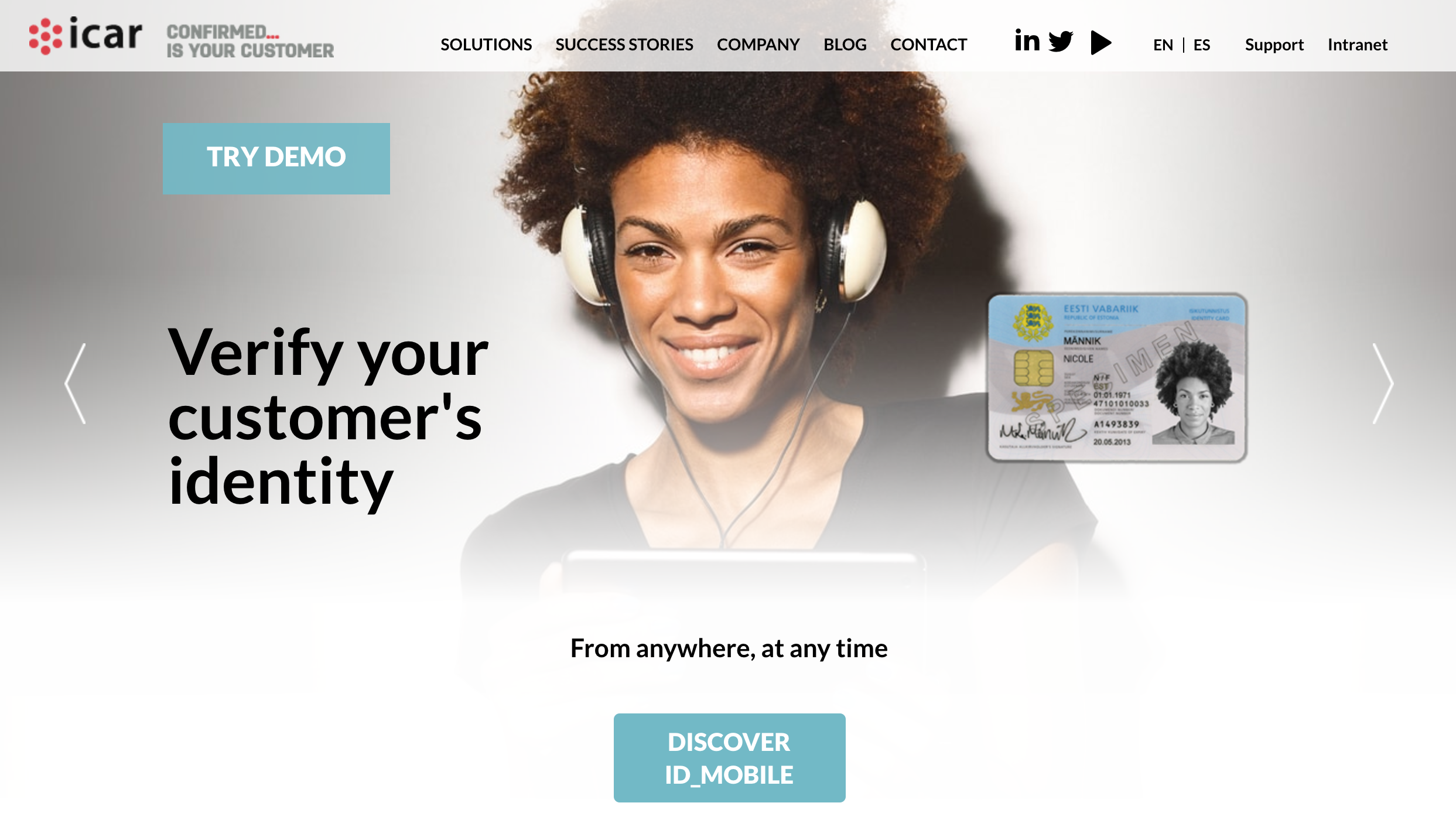

Based in Barcelona, Spain, ICAR launched in 2002 as a spin-off of the Computer Vision Center at the University of Barcelona. Since then, the company has matured; it now offers five solutions across mobile, web, and desktop to help large financial institutions combat onboarding fraud.

At FinovateEurope last month, the company showed off its mobile onboarding solution, ID_Mobile, that leverages biometric technology combined with the social network and geolocation of the user. These additional factors verify that the user matches their identity document and builds their digital identity profile in the background.

At FinovateEurope last month, The company’s CEO Xavier Codó began his demo saying, “We provide a fully automatic solution which validates identity, but also helps you build your customer digital identity profile.” Codó continued, “We focus on three main market needs: user experience, fraud prevention and how to connect digital identity to physical identity.”

Company facts

- 30 employees

- Over 20 million online ID validations every year

- Turnover increase of 20% every year

- Blog with 5,000 readers per month

Above: Xavier Codó (CEO) and Mariona Campmany (CMO) debut ICAR’s ID_Mobile at FinovateEurope 2017 in London

We chatted with ICAR’s Chief Marketing Officer, Mariona Campmany (pictured), at FinovateEurope last month about the history of the company and its path to launching ID_Mobile. We followed up with the below interview questions via email.

We chatted with ICAR’s Chief Marketing Officer, Mariona Campmany (pictured), at FinovateEurope last month about the history of the company and its path to launching ID_Mobile. We followed up with the below interview questions via email.

Finovate: What problem does ICAR solve?

Campmany: ICAR offers online and e-business solutions for the correct customer identification in order to prevent identity fraud and reduce operating costs, while providing a good user experience. We aim to bring the new generation of identity verification systems to the market, introducing a cloud system to automatically verify the authenticity of identity documents and customer identity in less than 20 seconds.

Finovate: Who are your primary customers?

Campmany: ICAR has been positioning in the market as the leading company in identity validation. Our entrance into the financial and telecommunication sectors allowed us to land top clients such as BBVA, GSMA, CaixaBank, and Telefonica.

Finovate: How does ICAR solve the problem better?

Campmany: Our solution takes a vital technological lead in prevention of identity fraud, ending the bottleneck of limited numbers of desktop scanning devices, avoiding negative customer experiences waiting for ID validation and opening new models of on-the-spot customer capture. We found that other processes depend on a manual double-check, and one “click away” is not possible. Our solution is based on our own fully-automatic technology which validates customer identity and incorporates the necessary features to be the best, easiest-to-use, online ID-verification tool.

Finovate: Tell us about your favorite implementation of your solution.

Campmany: We offer a solution for customer onboarding validation that also helps build the digital identity profile of the user. We make sure that it is a real user at the time of onboarding by validating the identity document, doing a biometric comparison of the photo in ID against the customer’s selfie, doing a liveness test (biometric), analyzing the geolocalization and mobile security, and checking dynamic information like the customer’s email, phone number, and social networks.

Finovate: What in your background gave you the confidence to tackle this challenge?

Campmany: Services for validating customer identity have been available for several years; we have carried out several projects. Among them include working with IKEA to introduce a mobile solution for agents at the kitchen section so the customers can finance the purchase at the time they choose the product, saving time waiting at the financing stand, and integrating with Nationale Nederlanden to read and authenticate the ID document from a tablet or mobile into an application that undertakes the whole process of selling insurance.

Finovate: What are some upcoming initiatives from ICAR that we can look forward to over the next few months?

Campmany: We will keep focus in three main market needs:

- User experience, because we never get a second chance to make a good first impression, and if it is not easy to use, they’ll go somewhere else.

- Fraud prevention, critical for the bank.

- And the third one was a question we asked ourselves: “How do we connect the digital identity to the physical identity?”

Finovate: Where do you see ICAR a year or two from now?

Campmany: It’s not a secret that we live in a digital world. And with this reality comes the increasingly complex task of matching a person’s digital identity to their physical world. Moreover, nowadays, every agreement, every process, every new product or service acquisition has a digital record that must be identified and validated.

Offering an omnichannel identity verification platform is critical for the users and the entities. We want to improve the customer user experience and at the same time work with entities in order to offer a secure process, and increase customer acquisition. Digital identities are a fundamental requirement of our new world. But it is not a simple process; we need innovation to make it happen. We are part of this innovation.

Xavier Codó (CEO) and Mariona Campmany (CMO) debuting ICAR’s IDMobile at FinovateEurope 2017 in London:

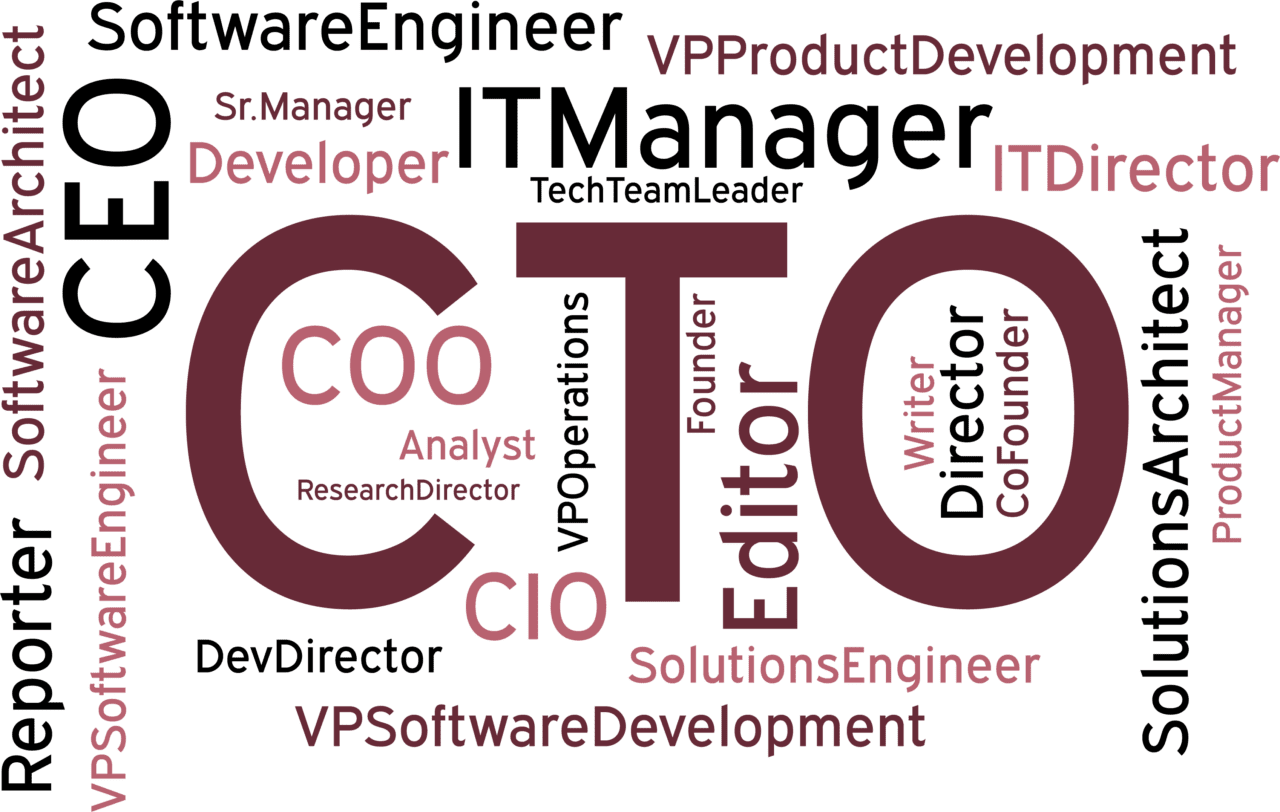

FinDEVr New York will be here in less than one week! Check out company features and take a look at the previews from upcoming presentations. And of course, don’t forget to register today to save!

FinDEVr New York will be here in less than one week! Check out company features and take a look at the previews from upcoming presentations. And of course, don’t forget to register today to save!

We chatted with ICAR’s Chief Marketing Officer, Mariona Campmany (pictured), at FinovateEurope last month about the history of the company and its path to launching ID_Mobile. We followed up with the below interview questions via email.

We chatted with ICAR’s Chief Marketing Officer, Mariona Campmany (pictured), at FinovateEurope last month about the history of the company and its path to launching ID_Mobile. We followed up with the below interview questions via email.