There’s one perk that comes with working as a woman in a male-dominated field– there’s never a line for the ladies restroom. In fact, at a handful of Finovate conferences, we’ve had to convert some of the women’s restrooms into men’s rooms in order to make a the wait time for the men more reasonable. When that happens, you know there’s a problem– one that goes beyond toilets.

Lack of workforce diversity has many drawbacks, the most obvious of which is the gender pay gap. According to the film Equal Means Equal, a documentary that looks at how women in the U.S. are treated today, “Compared to white men, white women working full time, based on median annual full-time earnings, earn 78 cents to every dollar a man earns.”

In an effort to help tip the scales of the gender ratio and bring awareness to the wage gap, Finovate is offering female registrants tickets to FinovateFall for 78 cents on the dollar. That means women who register by this Friday, July 26, can purchase a ticket to FinovateFall for 22% off just by entering the code EQUALITY on page two of the booking form.

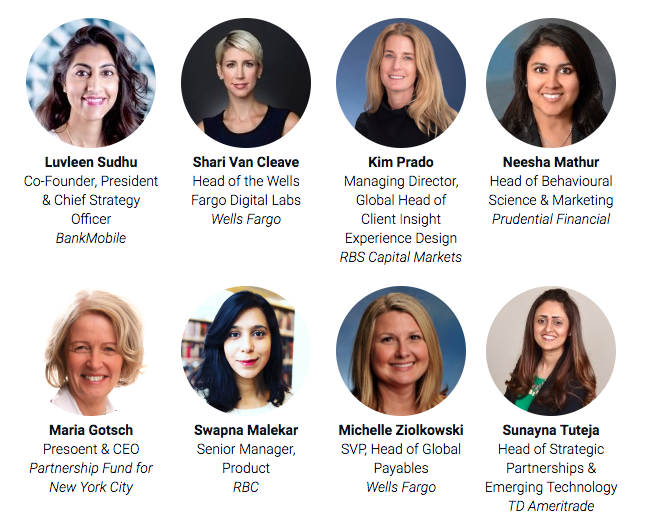

Here are a handful of speakers who are helping to bring the female quotient up a notch at FinovateFall this year:

The conference takes place September 23 through 25, with an additional summit day on September 26, at the New York Marriott Marquis.

To take advantage of this offer, book online today with code EQUALITY, contact our customer service team at +1 (888) 670-8200, or [email protected]. Rooms can be reserved at the New York Marriott Marquis.