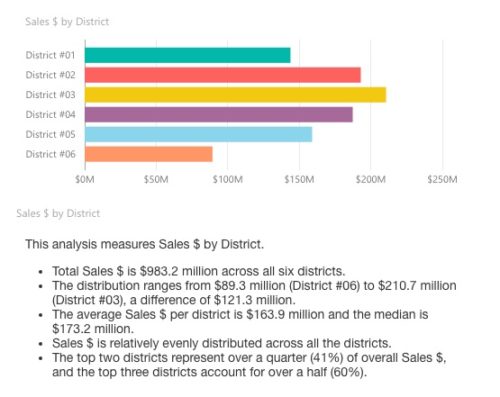

With the launch of Narratives for Power BI, Narrative Science unveils the latest integration of its advanced natural language generation (NLG) technology. The new extension, developed in collaboration with Microsoft, will give Microsoft Power BI users advanced analytics and data-visualization tools to help them read and understand corporate data.

“Integrating Advanced NLG into Microsoft Power BI enables our customers to automatically turn complex data into insightful stories,” says Nick Caldwell, general manager of Microsoft Power BI. Both companies emphasized the importance of making technologies like advanced NLG accessible to the business. This collaboration is, according to Narrative Science CEO Stuart Frankel, key to “maximiz(ing) the value of their business intelligence efforts.”

“Put simply, this collaboration not only enhances and amplifies the user experience for customers of Power BI,” Frankel wrote in a blog post about the launch, “but also further drives the democratization of information, where users don’t need to interpret data and visualizations—they simply need to read.” Microsoft Power BI has more than 5 million users and works with Adobe Analytics, Github, Salesforce, and more than 50 other data sources.

“Put simply, this collaboration not only enhances and amplifies the user experience for customers of Power BI,” Frankel wrote in a blog post about the launch, “but also further drives the democratization of information, where users don’t need to interpret data and visualizations—they simply need to read.” Microsoft Power BI has more than 5 million users and works with Adobe Analytics, Github, Salesforce, and more than 50 other data sources.

Download Narratives for Power BI. Notes and tips on using the extension are published at the Microsoft Power BI Blog.

Narratives for Power BI is the second major new innovation from Narrative Science this year. In January, Narrative Science launched Narratives for Qlik, bringing its advanced NLG technology to the Pennsylvania-based company’s visual analytics and business-intelligence platform. Narrative Science was featured in Forbes earlier this month, and in the New York Times in February. The company has raised more than $29 million in funding; most recently picking up $10 million in a round led by USAA.

Founded in 2010 and headquartered in Chicago, Illinois, Narrative Science demoed Quill Financial at FinovateFall 2013.

of us to continue to expand and diversify the firm’s solution-based lending platform,” Deitch said. In addition to his more than seven years at Oaktree Capital Management, Deitch served as COO at Countrywide Bank, a Management Consulting Partner at KPMG, as well as in a number of executive roles at Bank of America. He has a bachelor’s fegree from UCLA and an MBA from University of Southern California.

of us to continue to expand and diversify the firm’s solution-based lending platform,” Deitch said. In addition to his more than seven years at Oaktree Capital Management, Deitch served as COO at Countrywide Bank, a Management Consulting Partner at KPMG, as well as in a number of executive roles at Bank of America. He has a bachelor’s fegree from UCLA and an MBA from University of Southern California.

Jennifer Hughes, Business Development

Jennifer Hughes, Business Development Marco Piovesan, General Manager

Marco Piovesan, General Manager

Kimberly Prieto, Director of Business Development and Alliances, Digital Insight

Kimberly Prieto, Director of Business Development and Alliances, Digital Insight Shuki Licht, Senior Enterprise Architect, NCR Corporation

Shuki Licht, Senior Enterprise Architect, NCR Corporation

Formerly an executive at VISA and First Data as well as an engineer who patented key payments analytic technologies, Tavares leads CardLinx and is a frequent speaker at industry and media events.

Formerly an executive at VISA and First Data as well as an engineer who patented key payments analytic technologies, Tavares leads CardLinx and is a frequent speaker at industry and media events.

Yang is a 16-year finance vet, last as a partner at a $13 billion alternative asset management firm. He left an MD/PhD in computational neuroscience to design financial products and wants to make up for that.

Yang is a 16-year finance vet, last as a partner at a $13 billion alternative asset management firm. He left an MD/PhD in computational neuroscience to design financial products and wants to make up for that.

Victor Yefremov, CEO

Victor Yefremov, CEO Sam Fleming, CTO

Sam Fleming, CTO

Lowell Doppelt, VP of Sales

Lowell Doppelt, VP of Sales Sarah Pilewski, Principal

Sarah Pilewski, Principal