Stock market research platform Stockviews has raised £250,000 ($355,000 USD) in seed funding. Participating in the round were angel network Craigie Capital, the London Co-Investment Fund, and former head of Fidelity International, Thomas Balk, who will join Stockviews’ board of directors as chairman.

Stockviews CEO Tom Beevers called Balk’s decision to join the company “a huge validation of this new approach to equity research.” Beevers praised Balk’s 25 years of experience in global asset management, including 16 years at Fidelity. “We’re delighted to have such a high-caliber executive heading up our board,” Beevers said.

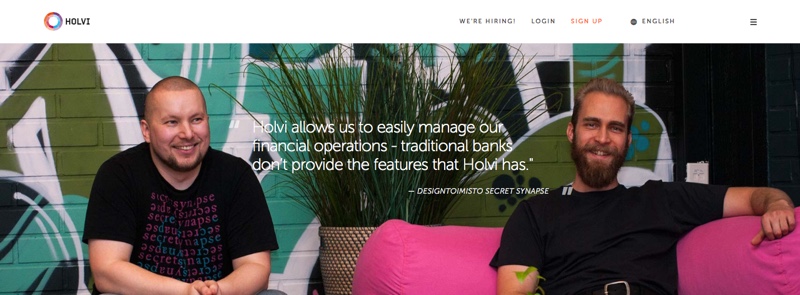

Pictured: StockViews CEO and Founder Tom Beevers demonstrated his company’s technology at FinovateSpring 2015.

Balk spoke to StockViews’ ability to help improve sell-side research, which he said “has long had a poor reputation for generating results.” Focusing on the competition among fund managers as a main driver of interest in new technologies, Balk sees StockViews as becoming the “leading marketplace for high-quality, independent investment research.”

The news comes almost a year since StockViews made its Finovate debut at FinovateSpring 2015. The company’s platform connects individual stock market investors with more than 500 independent equity analysts who make their research available online. The “StockViews Signal,” launched at FinovateSpring 2015, provides a straightforward buy or sell signal for stocks based on the aggregated recommendations of the platform’s highest-rated analysts.

Founded in 2014, StockViews is headquartered in London, United Kingdom.

The change comes amid a flurry of activity for the Polish division of the innovative Dutch bank. Current ING Bank Śląski CEO Małgorzata Kołakowska will be taking on new responsibilities as global head of network for wholesale banking.

The change comes amid a flurry of activity for the Polish division of the innovative Dutch bank. Current ING Bank Śląski CEO Małgorzata Kołakowska will be taking on new responsibilities as global head of network for wholesale banking.