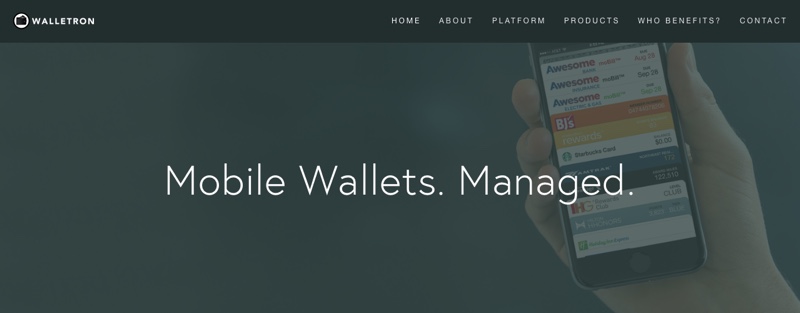

If you like having your boarding pass on your smartphone, then you’re going to love Walletron.

With a background in payments as well as loyalty, coupons, and rewards, CEO Garrett Baird and the Walletron team are trying to finish off paper statements for good. Walletron already leverages the technology that puts your boarding pass in your digital wallet to do the same for gift cards. Now they are doing the same thing for paper bills.

Baird says Walletron’s proposition is delivering their (brand) presence in the digital wallet, as well as “the communication that goes along with it, with the actual payment relying on the billers themselves to process.” Baird emphasized this point, insisting that FIs and organizations use their existing processes to complete the payment. “We are the communication part,” he underscored, “piggybacking on top.”

Walletron CEO Garrett Baird presented moBills at FinovateFall 2015 in New York.

At FinovateFall 2015, Walletron CEO Garrett Baird demonstrated moBills, the new billpay component of Walletron. moBills enables billers to open a payment and communication channel on their customer’s smartphones through which everything from payment reminders to confirmations can be provided. Payments can be made with a few taps on the app, and users remain authenticated after enrolling in moBills, so there is no need for a subsequent login process.

“People have been waiting for electronic payments to take over since 2000,” Baird said. “But it hasn’t happened yet. There are still very tiny adoption rates. This solution will finally move the needle.”

Company facts:

- Founded in 2013

- Headquartered in Philadelphia, Pennsylvania

Wallets as commerce and communication channel

For Baird, it all begins with the digital wallet and the idea that people cling to paper statements because they are both a reminder and a source of information to complete the transaction: account numbers, user names, routing numbers, and so on. “There are not enough brands taking advantage of the mobile wallet and other wallets,” Baird said. “Airlines have nailed it—great use-case for boarding passes.”

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

Within the digital wallet, the user sees all the billing relationships that have been set up: auto loans, mobile phone company, and so on. On the front of the individual card is basic billing information, with links to pay the bill, read the statement, or change notification preferences on the back. Customers enroll in the moBills program by visiting the company’s online billing website and selecting the moBills option for either Apple Wallet (formerly Passport) or Android Pay (formerly Google Wallet).

As soon as a customer makes a selection, the current billing statement appears in their digital wallet. The customer then makes notification preferences (i.e., due-in-five-days reminder, payment-received notification, etc.). “And there’s no app for the customer to download because they already have the app on their phone,” Baird said from the Finovate stage. “And now the relationship lives in the (digital) wallet.”

Walletron’s growth strategy involves working with the largest billers, including FIs, mortgage and auto loan companies, as well as processors (and fellow Finovate alums) such as FIS, Jack Henry, ACI Worldwide, and Fiserv. In March, the company inked its first deal with Australia-based FlexiGroup, which will offer moBills to hundreds of thousands of customers. “The industry hasn’t yet seen a mobile option which truly eliminates the need for a paper statement,” Baird said during the announcement, “We believe moBills has.”

Check out Walletron’s demonstration video from FinovateFall 2015.

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”