- Banking technology company Thought Machine has teamed up with technology services provider DXC Technology.

- The two companies are offering a joint solution that combines DXC Technology’s industry expertise with Thought Machine’s core banking platform, Vault Core, and payments processing platform, Vault Payments.

- London-based Thought Machine made its Finovate debut at FinovateEurope 2018.

A newly available joint solution from banking technology company Thought Machine and technology services provider DXC Technology will help small and medium-sized banks initiate and complete their digital transformations faster. The solution combines DXC Technology’s industry expertise and full-service management with Thought Machine’s core banking technology platform, Vault Core, and its payments processing platform, Vault Payments.

“This collaboration underscores our dedication to leveraging next-generation technology to enable banks to modernize faster and deliver exceptional financial products,” Thought Machine Global Head of Partnerships Randy McFarlane said. “With modern core systems, banks are empowered to develop more innovative, customer-centric services with speed and ease. We are excited to work with DXC to accelerate banking transformation and build the future of financial services globally.”

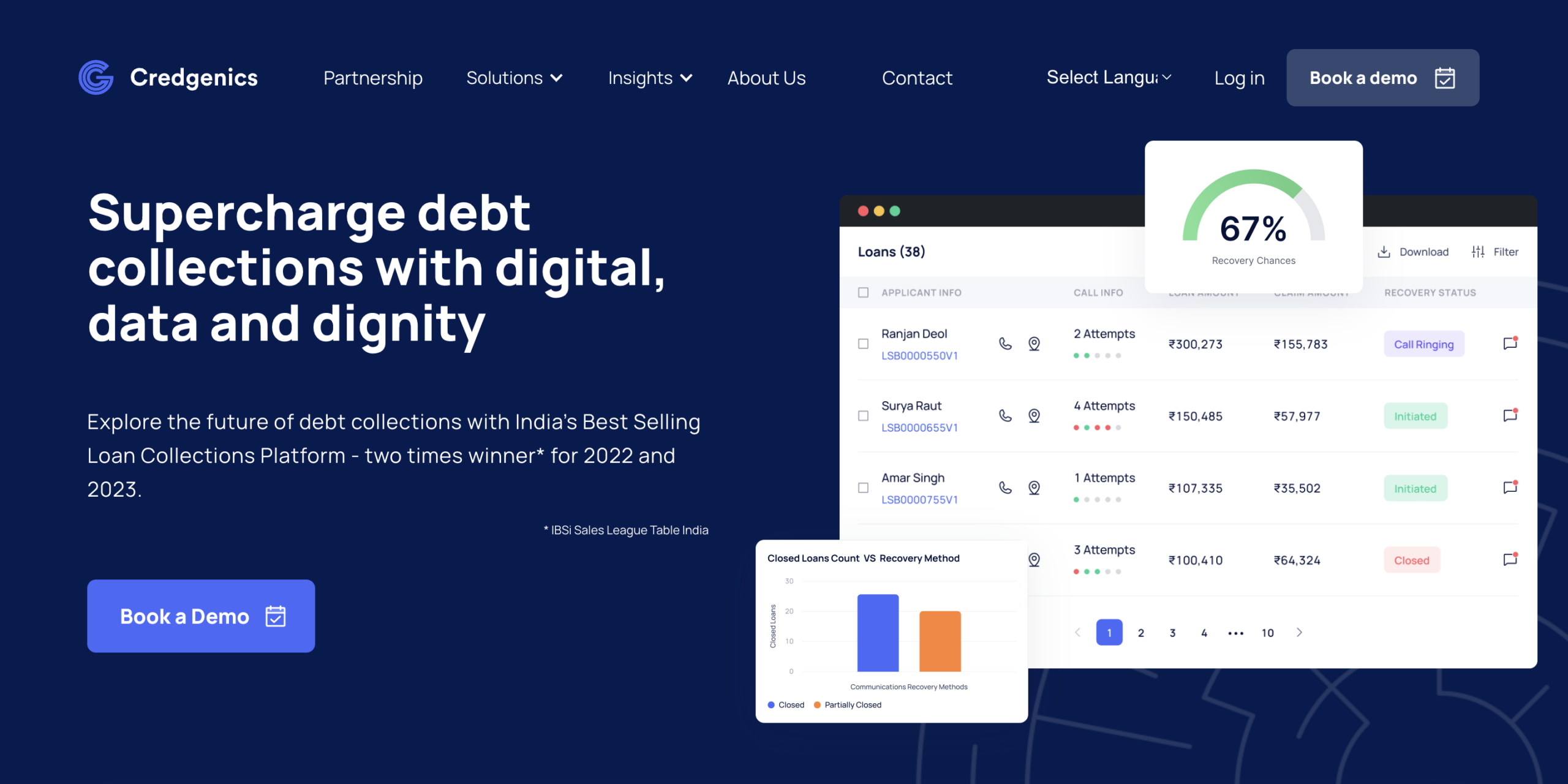

Vault Core is Thought Machine’s cloud-native core banking platform. As a cloud-agnostic solution, Vault Core gives banks the flexibility they need to select their preferred hosting option and provider. Institutions can leverage the technology to replicate their current back book of products, as well as create new financial products such as savings accounts, credit cards, loans, and mortgages. Vault Payments is the firm’s cloud-native payments processing platform and enables banks to work with all payment types regardless of method, scheme, or region. The technology embeds new and existing financial products into the payments platform, and gives users control over the entire payment life cycle.

The joint solution is designed to help smaller and midsized banks and financial institutions compete with their larger, global rivals who are able to build innovative, proprietary platforms in-house. Given the obstacles of complex vendor ecosystems and legacy infrastructures, the new offering from Thought Machine and DXC provides smaller and midsized bank with a one-stop managed service offering the technology, tools, and human talent to help them modernize legacy core banking systems, get new digital products to market faster, and ensure operational efficiency and compliance.

“With more than 45 years of experience in banking operations, DXC is deeply committed to delivering best-in-class digital solutions to the world’s leading financial institutions,” DXC Technology President, Global Infrastructure Services, Chris Drumgoole said. “Our joint solution with Thought Machine provides a comprehensive, future-ready path to modernization—enabling banks to accelerate innovation, improve operational efficiency, and reduce risk.”

Virginia-based DXC Technology partners with companies around the world to help them modernize IT systems, optimize data architectures, and ensure both security and scalability across public, private, and hybrid clouds. With more than 200 technology partners, DXC was created in 2017 in the wake of the merger between Computer Sciences Corporation and Hewlett Packard Enterprise’s Enterprise Services business.

Headquartered in London, UK, Thought Machine made its Finovate debut at FinovateEurope 2018. In the years since then, the company has grown into a leading core banking and payments technology provider for banks and financial institutions around the world, including Intesa Sanpaolo, Lloyds Banking Group, Standard Chartered, Lunar, Atom bank, and more.