- Mastercard has agreed to acquire subscription management platform Minna Technologies. Terms were not disclosed.

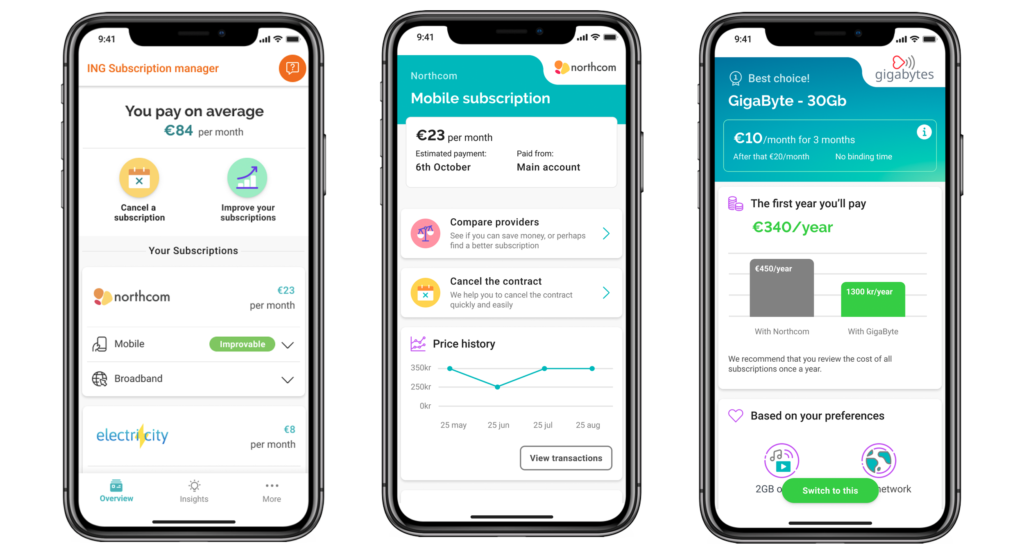

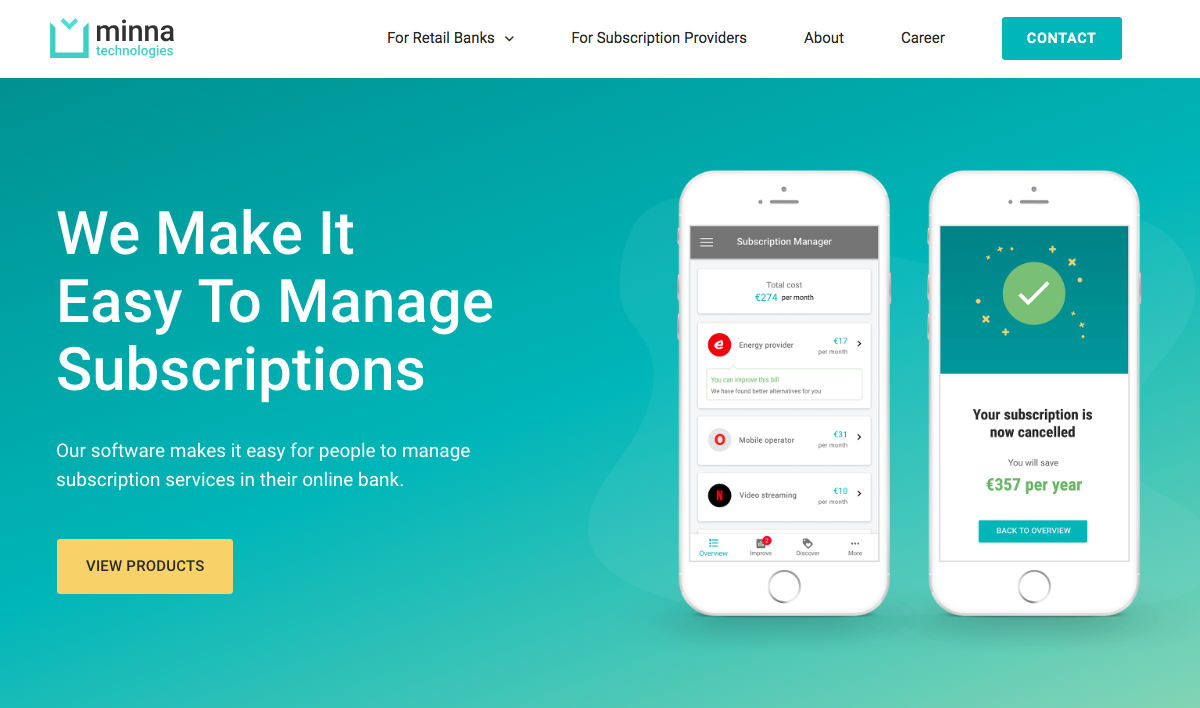

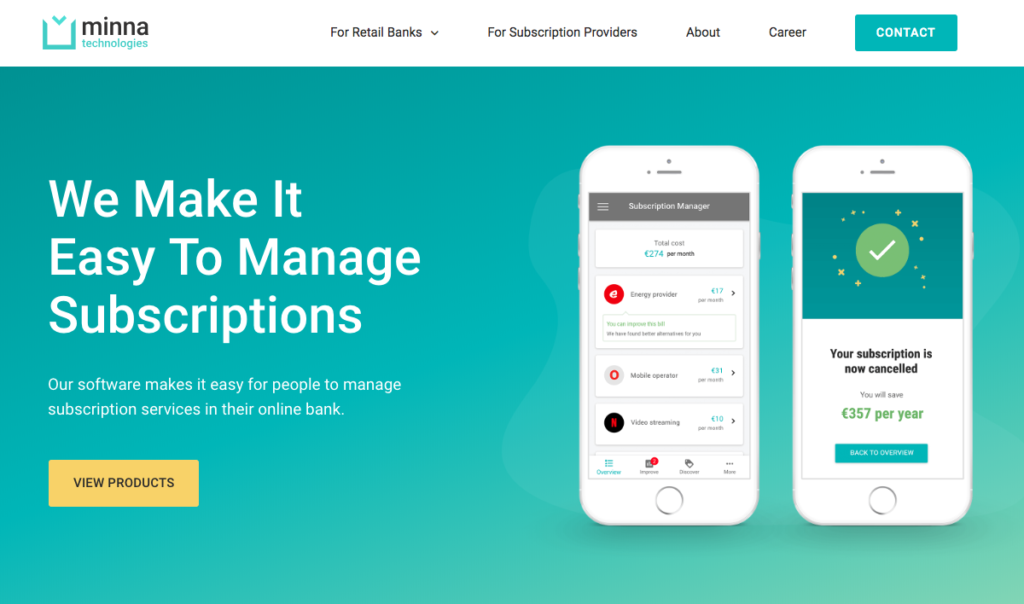

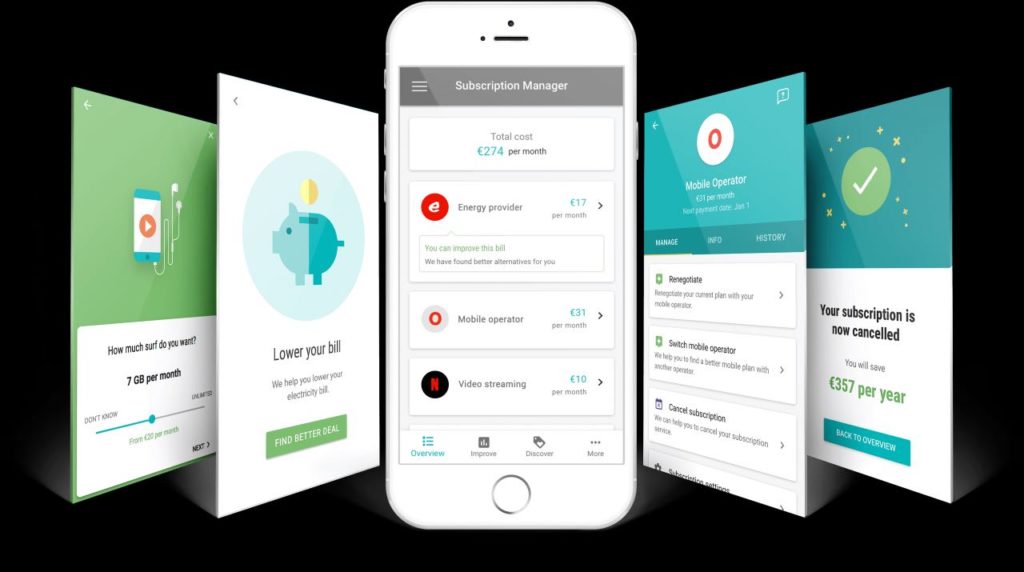

- Minna Technologies offers technology that enables users to manage their subscriptions from within their bank app or website, saving users millions of dollars in spending on unwanted subscriptions.

- Minna Technologies made its Finovate debut at FinovateEurope 2019. The company is headquartered in Gothenburg, Sweden.

Terms were not disclosed. But Mastercard announced today that it has agreed to acquire Swedish subscription management platform Minna Technologies. The transaction, which is subject to regulatory approval, will bring greater simplicity and clarity to the subscription process and help enhance the engagement between merchants and their customers.

“This is significant recognition of the strength, growth, and impact of Minna Technologies in powering the global subscription economy, partnering with top-tier banks, fintechs, and subscription businesses,” Minna Technologies CEO and Chair Amanda Mesler said. “We look forward to joining Mastercard’s world-class team and helping businesses to empower consumers with control, convenience, and flexibility in managing their subscriptions and recurring payments.”

Minna Technologies offers banks and other financial institutions a subscription management platform that enables users to take control over their subscriptions via an automatically generated overview of all the user’s recurring expenses. Individuals can use Minna to cancel unwanted subscriptions as well as identify and quickly switch to new utility service providers. Mastercard’s acquisition comes as the number of subscriptions globally has climbed to 6.8 billion, with analysts at Juniper Research expecting that number to climb to 9.3 billion by 2028.

That said, the experience of our subscription economy can be a mixed one for consumers. Changing, extending, or canceling a subscription is often much more difficult than it needs to be. Additionally, the proliferation of subscription-based services means that many people have trouble keeping track of what they subscribe to, and when those subscriptions will be renewed. In the U.S., for example, the average person has 4.5 subscriptions. Additionally, more than 85% of Americans say that they have at least one paid subscription that goes unused each month.

Minna provides a payment-scheme agnostic service that empowers subscribers to manage their subscriptions from within their banking apps and websites. Bringing this technology into Mastercard’s suite of offerings is yet another example of how some of the biggest companies in financial services are leveraging acquisitions to add new solutions – from account-to-account payment functionality to enhanced cybersecurity – to their product mix. To that point, just last week, we shared news that Mastercard rival Visa had agreed to acquire fraud prevention company (and Finovate alum) Featurespace.

Founded in 2014, Minna Technologies demoed its technology at FinovateEurope in 2019. Today, the Sweden-based company has connected with more than 22,000 subscription businesses, served more than 120 million retail bank and fintech users, and saved customers more than $1 billion in spending on unwanted subscriptions.