The votes are in. The judges have decided. And 11 Finovate alums have earned awards at the 2014 PYMNTS.com Innovation Project, including three gold medals.

Finovate alums won awards in a diverse range of categories, from “B2B Innovation” to “Best Comeback Story.” Areas where alums dominated included “Best Credit Innovation,” where Credit Karma, Lending Club, and Klarna swept the field, as well as “Best Innovation via ACH” and “Best Check Innovation.”

- International e-commerce payments and money transfers

- Finovate demo video: Europe 2012

- Best B2B Innovation

- Cash flow management solution for business integrating electronic payments, accounting, digital documents, and more

- Finovate demo video: Spring 2012

- Best Credit Innovation

- Aggregates consumer financial data from bank accounts and credit scores to mortgage loans in one location

- Finovate demo video: Startup 2009

- Best Check Innovation

- Enables check payments without having to write paper checks

- Finovate demo video: Spring 2012

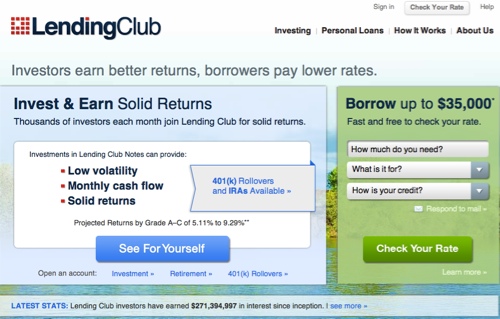

- Best Credit Innovation

- Online, peer-to-peer lender

- Finovate demo video: Startup 2009

- Best Cash Innovation

- Cash transaction network

- Finovate demo video: Spring 2013

- Best New Technology

- Open-source, distributed payment protocol

- Finovate demo video: Spring 2013

- Best Innovation via ACH

- Best Check Innovation

- Send money to a Venmo account, bank account or supported debit card for free

- Finovate demo video (with Braintree): Spring 2013

- Most Innovative Company

- E-commerce solution mitigates credit and fraud risk for online merchants

- Finovate demo video: Spring 2012

- Most Disruptive Innovation

- Best Comeback Story

- Peer-to-peer lending

- Finovate demo video: Finovate 2007

- Best Credit Innovation

- Best Innovation via ACH

- Solution leverages mobile device camera to enable check deposit, account opening, and bill pay.

- Finovate demo video: Fall 2013