The dust is still settling in the wake of Circle’s “buzzy IPO” in the words of MarketWatch. We’ll see if the fintech headlines can keep up this week!

Digital banking

- KAF Digital Bank goes live with Temenos SaaS to bring Islamic digital banking services to customers in Malaysia.

- ABN AMRO’s payment app Tikkie has developed a full-service bank, BUUT, that caters to younger customers.

- Digital bank N26 unveils an updated version of its premium subscription, N26 Go.

- Open banking solutions provider Salt Edge partners with digital banking experience platform Plumery.

- Farsight raises $16 million in funding, announces Series A to automate financial workflows and decision-making.

Fraud prevention and identity verification

- FrankieOne launches new risk and compliance platform that offers fraud detection and identity verification.

- Cybercrime consultancy We Fight Fraud partners with Salv to facilitate intelligence sharing between financial institutions in Europe.

- Regtech iDenfy teams up with international hosting provider SpaceCore to bring optimized customer verification to global hosting.

- The Bank of International Settlements (BIS) and the Bank of England (BoE) collaborate on testing to see if AI can spot fraudulent activity in retail payments data.

- AML and CFT solutions provider AMLYZE onboards Advanzia Bank as part of its European expansion.

- Velera adds real-time account validation functionality to digital channels.

Payments

- Zimpler earns status as a Certified Payment Institution in Brazil.

- J.P. Morgan Payments expands its partnership with UK-based fintech Conferma.

- Stripe acquires crypto wallet developer Privy.

Crypto

- The UK’s Financial Conduct Authority (FCA) proposes allowing individual, retail investors to receive crypto exchange traded notes (cETNs).

- Legislation in California moves forward to give the state authority to seize unclaimed cryptocurrency assets held on exchanges after three years of inactivity.

Credit unions

- Triangle Credit Union to deploy Jack Henry’s Symitar platform.

- Alabama Credit Union goes live with Point Predictive’s AutoPass solution to enhance the lending process and help fight fraud.

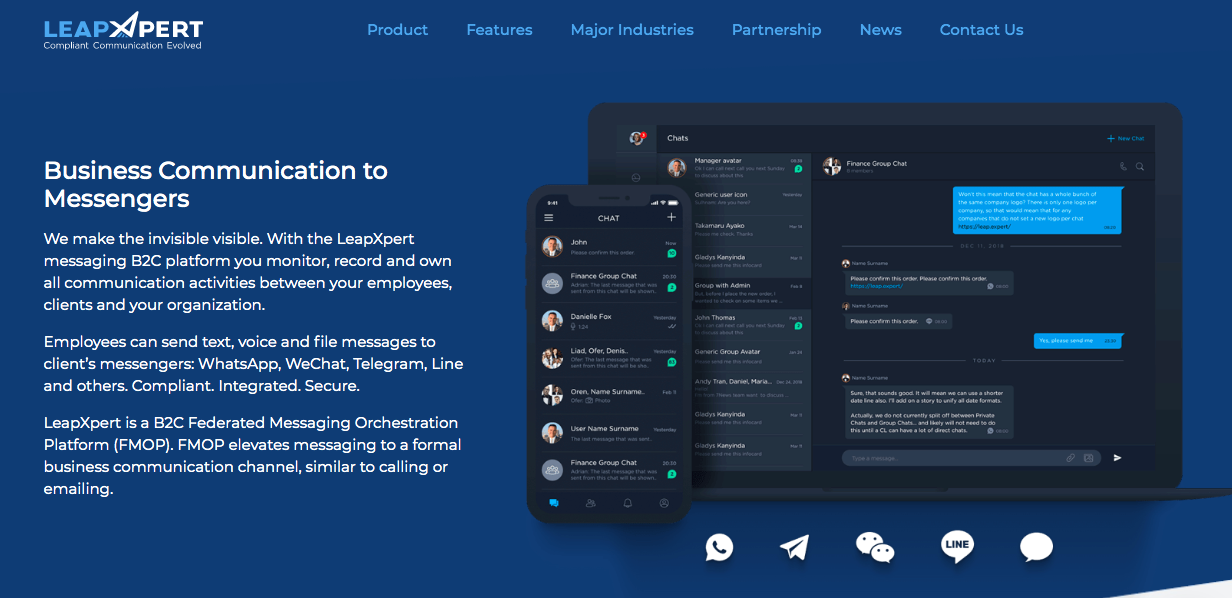

Business communications

- Business communications platform LeapXpert acquires AI-powered, cross-platform messaging startup, StartADAM.

Lending and credit

Global technology and data company Experian and financial data network Plaid announce strategic collaboration to help lenders to better assess risk.

Photo by Ambreen Hasan on Unsplash