On Finovate.com

- Credit Karma Acquires Noddle to Launch in the U.K.

Around the web

- Moneyhub announces integration with PensionBee API.

- Outsystems unveils new program, outsystems.ai, to leverage AI and machine learning to improve software development.

- Finastra introduces Open Banking Readiness Index for Asia Pacific region.

- Trulioo reports ability to verify five billion people via its identity verification platform, Global Gateway.

- Wipro collaborates with Check Point Software to offer cloud security services.

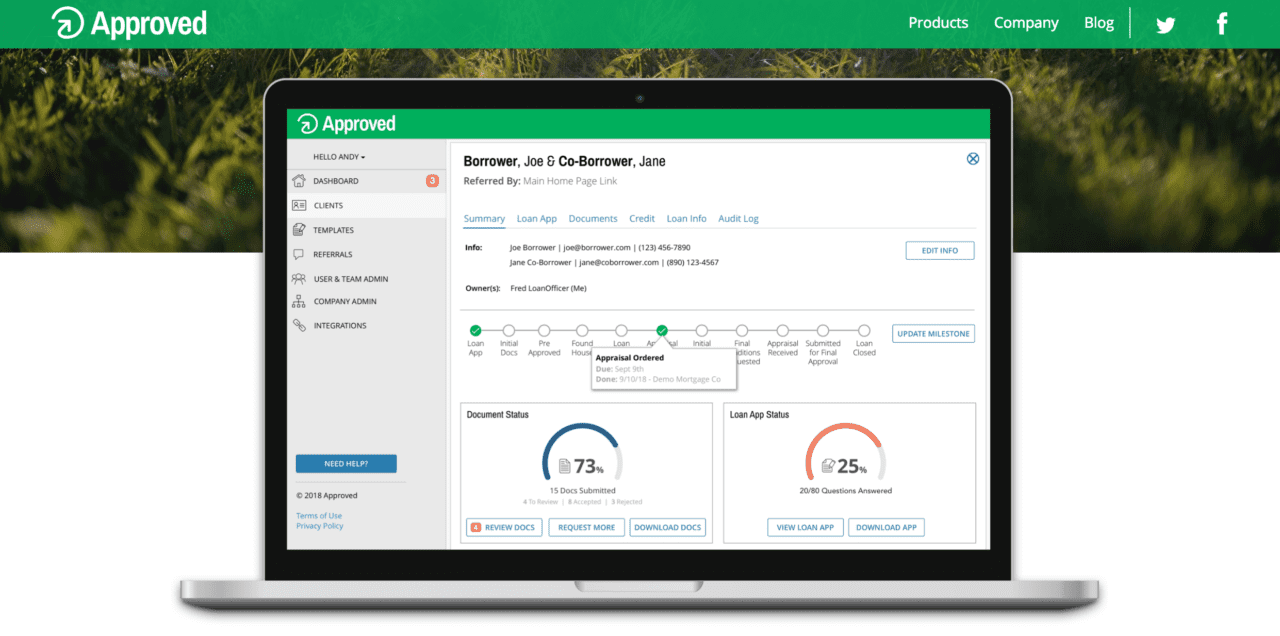

- Unison expands with Goldwater Bank Partnership.

- Flywire partners with the Dallas-Fort Worth Hospital Council to offer members payment solutions.

- How I Built This podcast features Betterment founder Jon Stein.

- Roostify names Courtney Keating Chakarun as new Chief Marketing Officer.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?