![]()

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

![]()

Each month we survey the Web-traffic performance of our alums, using data from Web-analytics company Compete to review the sites they operate.

Out of 255 alumni, 62 (24%) had more than 10,000 unique U.S. visitors in May 2011 (see tables below). Of the 62 reviewed, 25 (40%) had fewer visitors than in the previous month and 28 (45%) saw a decline year-over-year.

Private Companies

The 44 private companies are as follows:

Notable successes:

Private Finovate Alumni With More Than 10,000 Unique Visitors in May 2011

Source: Compete.com retrieved June 29, 2011

Public Companies

The 18 public companies are as follows:

Notable successes:

Public Finovate Alumni With More Than 10,000 Unique Visitors in May 2011

Source: Compete.com retrieved June 29, 2011

_____________________________________________________________________________

Notes:

1. We reviewed 255 unique sites. Data was unavailable or irrelevant for 201 sites because:

2. Numbers have been rounded to three significant digits.

3. The charts include companies that did not have measurable traffic in May 2011, indicated by “N/A.”

4. Compete draws its information from the online activity of a panel of more than 2 million U.S. Internet users. It is only an estimate of traffic, and may undercount at-work usage.

![]()

Aptys Solutions

Aptys Solutions signed with Banker’s Bank, a top check depositor with the Federal Reserve Link

Backbase

Backbase to host webinar on how to use social media in financial services Link

Betterment

![]()

Bill.com

Bill.com is working to improve its mobile offering for small and midsized businesses Link

Boku

Mobile Entertainment explained how Boku will revolutionize pay-by-mobile for digital goods Link

Capital Access Network

CNBC explained how Capital Access Network solves the need to use financial creativity Link

Credit Karma

WiseBread Blog interviewed Credit Karma CEO Link

doxo

Dwolla

edo Interactive

MyBankTracker interviewed edo Interactive COO about its Prewards service Link

Expensify

Slate explained how Expensify will help the ‘frequent flier’ Link

Kabbage

Technorati described how Kabbage works with eBay Link

Lending Club

LendingKarma

Entrepreneur featured LendingKarma as a good tool to use when borrowing money from family or friends Link

Lendio

San Francisco Chronicle reported that Lendio offers funding opportunities for new grads Link

Lodo Software

Lodo Software was described as a startup providing jobs in the “Silicon Prairie” region, a.k.a. Omaha Link

Monitise

Monitise released a report predicting that the majority of consumers will use mobile money services within the next three years Link

Mortgagebot

Mortgagebot reached 1000 clients, one of its goals from the beginning Link

PayDivvy

2MinuteFinanced interviewed PayDivvy about its services Link

![]()

PayNearMe

BillShrink examined PayNearMe’s cash payment service Link

peerTransfer

Mass High Tech interviewed Iker Marcaide from peerTransfer about becoming an entrepreneur Link

ProfitStars

ProfitStars announced a new version of Margin Maximizer that’s now available as a hosted solution Link

Robot Dough

2MiniuteFinance toured RobotDough’s demo during interview at Finovate Spring Link

SecondMarket

Smarty Pig

Smarty Pig launched new sharing features, including activity sharing and goal sharing Link

Striata

Striata will host a June 2 webinar for implementing successful ebilling strategies Link

ThreatMetrix

San Francisco Chronicle covered ThreatMetrix’s research around mobile transaction activity Link

TILE Financial

TILE Financial released a Financial Identity Profile to strengthen the connection between advisors and under-30 consumers Link

![]()

TradeKing

TradeKing divulged the lineup of its free webinars in June Link

Tyfone

Tyfone won 2010 Asia Pacific Smart Card Association Award for its NFC innovation and implementation Link

Wikinvest

Dow Jones Advisor highlighted Wikinvest as a way to analyze portfolios Link

Wonga

Xero

Zecco

Zopa

Zopa shows how it helps consumers protect against inflation Link

On April 27, Prosper gave 200 new lenders $104 to get started. The company is celebrating the news that prosper lenders are averaging 10.4% returns. http://bit.ly/finovate426111

I’ve long been impressed with the work done by Eric Bangerter (Director of Internet Services) and the UW Credit Union in the online channel. Nearly every one of its new features gets starred in my blog reader. And since its early-2008 launch, I’ve cited Eric’s blog, UW SourceCode, as the best example of how to communicate to your power users and online banking fans (see blog feed within the online banking dashboard in the first screenshot).

I’ve long been impressed with the work done by Eric Bangerter (Director of Internet Services) and the UW Credit Union in the online channel. Nearly every one of its new features gets starred in my blog reader. And since its early-2008 launch, I’ve cited Eric’s blog, UW SourceCode, as the best example of how to communicate to your power users and online banking fans (see blog feed within the online banking dashboard in the first screenshot).

But the latest innovation might be my favorite. The Madison, WI-based CU has integrated credit scores, powered by TransUnion, directly into the online banking interface (see first screenshot). This is exactly where it should be, so that users can keep tabs of their credit health, without needing to go through the tedious and oftentimes expensive process of authenticating yourself at a third-party site.

![]() Even if that’s all they did, I’d give them an A+. But there’s more. UW CU has become the first financial institution to offer a private-branded version of Credit Karma’s credit report portal. The credit union pays a license fee to Credit Karma in order to offer the private-branded, ad-free version (see second screenshot). Sears also offers a similar service for its store card (see previous post).

Even if that’s all they did, I’d give them an A+. But there’s more. UW CU has become the first financial institution to offer a private-branded version of Credit Karma’s credit report portal. The credit union pays a license fee to Credit Karma in order to offer the private-branded, ad-free version (see second screenshot). Sears also offers a similar service for its store card (see previous post).

UW CU members (120,000 active online bankers, see note 2) appear receptive to the info. In the first few days, more than 5,000 had clicked on the link, with more than 2,800 completing the registration process. That is a huge win for the members, the credit union, and Credit Karma.

Bottomline: Most of the time (98%/99%), end-users need see their credit score only for reassurance that nothing horrible has happened to their credit file. But the problem with posting ONLY the credit score is that those 1% to 2% who want more info often need it fast. And if you don’t offer a deeper dive complete with explanations of what’s going on, you are going to end up with confused and/or irate customers and a bunch of phone calls.

So, there needs to be a mechanism available for drilling down into the full report. And the Credit Karma portal is a relatively low-cost way to do that. Alternatively, you can upsell the full credit report for a fee in the $5 to $10 range or sell an annual subscription for unlimited access (see note 1).

UW Credit Union online banking homepage showing credit score and Credit Karma linkage (16 Sep 2010)

UW Credit Union co-branded credit portal powered by Credit Karma

Notes:

1. For more information, see our Online Banking Report: Credit Monitoring Services (published in 2007).

2. UW CU has 150,000 members in total; 120,000, or 80%, have used online banking in the past 90 days; 80,000 (53%) used it in the past 30 days.

![]() Finovate alum Credit Karma recently started providing a private-label version of its credit reporting service to Sears cardholders (see note 1). The service includes free credit scores and other data to help put those scores in an understandable context (see FinovateStartup 2009 video here).

Finovate alum Credit Karma recently started providing a private-label version of its credit reporting service to Sears cardholders (see note 1). The service includes free credit scores and other data to help put those scores in an understandable context (see FinovateStartup 2009 video here).

The new service, launched Sep. 2009, is delivered through a dedicated site, searscreditscore.com. Since Sears cardholders must make a purchase each year to use the site, it provides an ongoing usage incentive.

The new service, launched Sep. 2009, is delivered through a dedicated site, searscreditscore.com. Since Sears cardholders must make a purchase each year to use the site, it provides an ongoing usage incentive.

The Credit Karma-powered service is clearly branded as a Sears and Kmart offering (note 2, screenshot #1). Interestingly, Sears also takes the opportunity to offer targeted advertising space to financial companies (screenshot #3). It also markets the credit-analysis service on its own credit card site (screenshot #2).

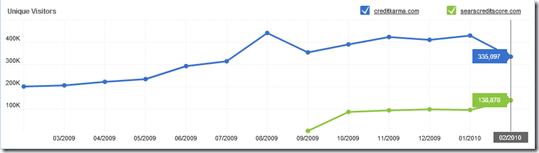

While Credit Karma traditionally derived revenue from advertising on its site, this move into the private-label channel provides additional growth opportunities. The Sears private-label site had nearly 140,000 unique visitors in February, about one-third the total at Credit Karma (see table below). It’s a good deal for Sears, too: Offering credit-score analysis differentiates it from other retail card providers and conveys concern about its customers’ financial well-being.

Website traffic at searscreditscore.com vs. creditkarma.com

Source: Compete.com, March 2010 (link)

1. The Sears credit score site, powered by Credit Karma

2. Sears promotes the credit score service on its website

3. Sample page from Searscreditscore.com

Note ads for Citi and ING Direct

Notes:

1. Sears cards are issued by Citibank, one of the advertisers in the private-label site.

2. Kmart acquired Sears in 2004.

I get dozens of newsletters and marketing pitches from my various financial accounts every month. While they are interesting to me as an analyst, for the average consumer there’s rarely any actionable information.

I get dozens of newsletters and marketing pitches from my various financial accounts every month. While they are interesting to me as an analyst, for the average consumer there’s rarely any actionable information.

However, one financial company consistently drives users to its site month over month with their email missives. And they don’t even have to change the creative.

Free-credit-score provider Credit Karma simply reminds users that it’s been more than two weeks since they last checked their credit score. The company goes on to encourage users to check in every month to to make sure no adverse changes have occurred (see first screenshot below). It’s a simple yet powerful message that drives traffic to the company’s ad-supported site (see second and third screenshots).

I’ve received this message on the 16th of each month this year, except May, when I must have already visited Credit Karma in the two weeks prior. A large yellow button invites the reader to click through to see the latest score (see first screenshot).

And the technique seems to be working. Traffic, measured in unique visitors by Compete, is up six-fold in the past 12 months, to 310,000 visitors in July (see chart below).

Credit Karma email (received 16 July 2009; 10:05 AM Pacific)

Subject: Credit Karma update

Current landing page after clicking “update” button in email (13 Aug 2009)

Note: Virgin Money’s friends-and-family mortgage offering is the lead product placement while The Easy Loan Site has the top banner. Lending Club is also running a banner across the top.

Landing page two months ago (16 June 2009)

Note: Virgin Money’s friends and family was also the lead product placement, while ING Direct’s Sharebuilder had the banner. Virgin Money also has a product offer in the middle of the page.

Note: For more info on the market for credit scores and monitoring see our Online Banking Report on Credit Report Monitoring (published Aug 2007).