This post is part of our live coverage of FinovateFall 2015.

![]() Next, Euronovate launched its Biometric Fusion Technologies:

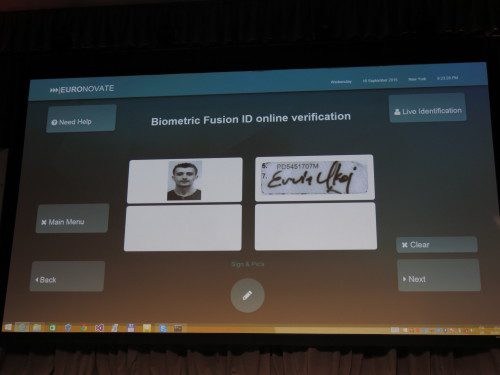

Next, Euronovate launched its Biometric Fusion Technologies:

“Our customers can rely on digital services that significantly provide increasing value by progressively enhancing the quality of identities throughout the customer relationship. Euronovate helps develop online and in branch services by providing state-of-the-art identification through brand new proprietary Biometric Fusion Technologies that combine more biometric data in order to establish remote 100% identification.

You can apply BFT on the entire digital chain: new customer onboarding for online and unattended areas, contract signature with strong authentication, secure transactions, proof management that relys on digital signatures to a digital vault that guarantees the long-term integrity, confidentiality, and legal value of contracts.”

Presenting Alberto Guidotti (CEO), Ervin Ukaj (R&D Director), and Pietro Lanza (Marketing & Sales)

Metrics: Raised ~$1M USD from start up in February 2012, revenues from 0 to 6.2M CHF in less than 3 years with over 20% net profit, estimated revenue 12M CHF in 2015 and exponential growth world wide, over 65 employees with 20 in Lugano (headquarters, R&D, design e hardware and software, production software) and 45 in the Far East (Shenzhen and Taipei, locations of factories manufacturing), 4 commercial branches in Italy, Bucharest for Balkans, Madrid for Iberia, and Mexico City for Central America, more than 45,000 active installations in Italy, Switzerland, Spain, China, and Middle East, more than 1.5M people sign with Euronovate solutions in 3 different continents every day.

Product distribution strategy: Direct to Business (B2B)

HQ: Lugano, Switzerland

Product Launch: October 2015

Website: euronovate.com