The money-flow into fintech continued unabated this week with more than a half-billion ($557 million) raised by 24 companies. It was the eighth week this year that total fundings surpassed the $500-million mark. Year-to-date fintech firms have raised $13 billion.

The money-flow into fintech continued unabated this week with more than a half-billion ($557 million) raised by 24 companies. It was the eighth week this year that total fundings surpassed the $500-million mark. Year-to-date fintech firms have raised $13 billion.

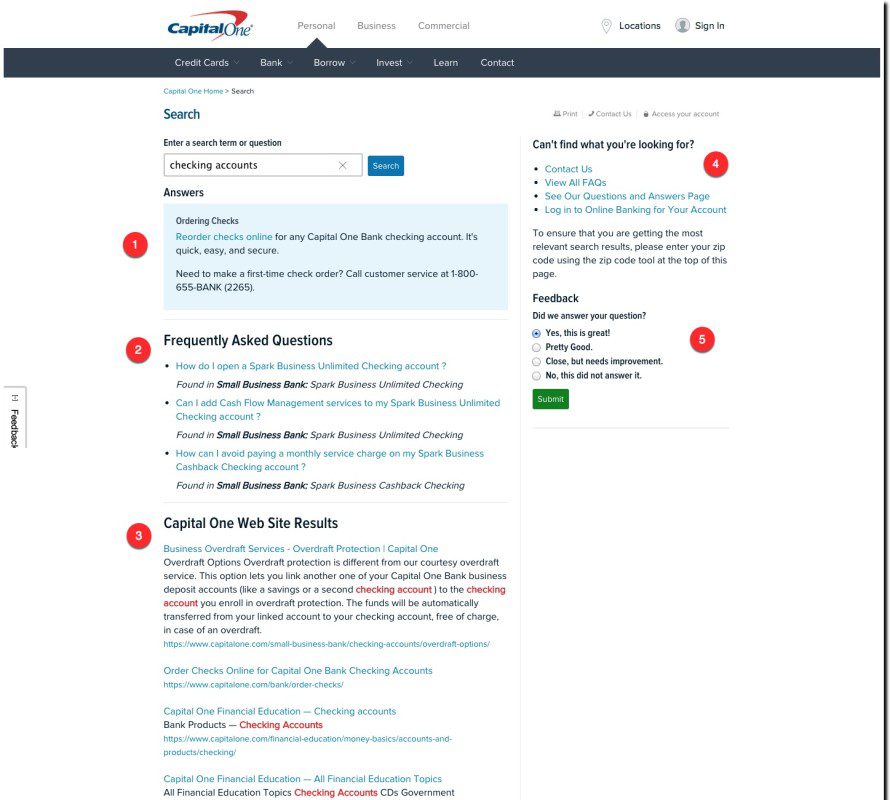

The total included one new alum, Praesidio, which will be presenting its security and fraud-control integrations at next month’s FinDEVr. The Seattle-based startup raised $3 million to bring its total funding to $5.3 million. Also, long-time alum Alkami Technology picked up $11 million on Friday to further their e-banking solutions business.

Here are the fundings by size from 12 Sep to 18 Sep 2015:

AvidXchange

Automated billpay and accounts-payables solutions

HQ: Charlotte, North Carolina

Latest round: $225 million Series E

Total raised: $225+ million

Tags: Bill payment, accounting, SMB, payments, billing

Source: Crunchbase

Clover Health

Health insurance targeting seniors

HQ: San Francisco, California

Latest round: $100 million

Total raised: $100 million

Tags: Consumer, health insurance, seniors

Source: Crunchbase

LightSpeed

Point-of-sale system

HQ: Montreal, Canada

Latest round: $61 million

Total raised: $126 million

Tags: SMB, payments, POS, acquiring, merchants

Source: Crunchbase

Compass

Real estate marketplace

HQ: New York City, New York

Latest round: $50 million

Total raised: $123 million

Tags: Consumer, home buying, mortgage

Source: Crunchbase

Oscar

Health insurance

HQ: New York City, New York

Latest round: $32.5 million

Total raised: $327.5 million

Tags: Consumer, health insurance, SMB, Google (investor)

Source: Crunchbase

Aspiration

Online investment platform

HQ: Marina Del Rey, California

Latest round: $15.5 million

Total raised: $20 million

Tags: Consumer, investing, socially conscious, low-fee, wealth management

Source: FT Partners

Lumity

Health insurance selection for enterprises

HQ: San Mateo, California

Latest round: $14 million

Total raised: $14 million

Tags: Enterprise, SMB, insurance, benefits, human resources, HR

Source: Crunchbase

Fundera

Small-business loan marketplace

HQ: New York City, New York

Latest round: $11.5 million Series B

Total raised: $14.9 million

Tags: SMB, lending, commercial loans, lead gen

Source: Crunchbase

Alkami Technology

Digital banking solutions

HQ: Oklahoma City, Oklahoma

Latest round: $11 million

Total raised: $54 million

Tags: Online banking, mobile, Finovate alum

Source: FT Partners

Compte Nickel

French neo-bank

HQ: France

Latest round: $11.5 million

Total raised: $11.5 million

Tags: Consumer, debit card, banking, transaction account

Source: FT Partners

MarketInvoice

Receivables financing marketplace lender

HQ: London, England, United Kingdom

Latest round: $7.7 million

Total raised: $28.1 million

Tags: SMB, lending, underwriting, P2P, peer-to-peer, investing

Source: Crunchbase

Mighty

Financing to plaintiffs awaiting legal settlments

HQ: New York City, New York

Latest round: $5.3 million Series A

Total raised: $5.3 million

Tags: Consumer, legal, lending, loans, credit

Source: Crunchbase

Auger

Open-source predictions marketplace

HQ: San Francisco, California

Latest round: $4.7 million

Total raised: $4.7 million

Tags: Cryptocurrency, blockchain, Ethereum, security, payments

Source: Crunchbase

Satispay

Mobile payments

HQ: Milan, Italy

Latest round: $3.5 million

Total raised: $11.2 million

Tags: Consumer, payments, mobile, SMB

Source: Crunchbase

Praesidio

Cloud-based security for financial institutions

HQ: Seattle, Washington

Latest round: $3 million

Total raised: $5.3 million

Tags: Enterprise, security, fraud, risk management, FinDevR 2015 presenter

Source: Crunchbase

CompareIt4Me

Financial services comparison site

HQ: Dubai

Latest round: $3 million

Total raised: $3.3 million

Tags: Consumer, personal finance, price comparison, lead generation

Source: Crunchbase

PeerIQ

Risk management for P2P lending

HQ: New York City, New York

Latest round: $2.5 million

Total raised: $8.5 million

Tags: Enterprise, lending, credit, underwriting, peer-to-peer

Source: Crunchbase

AlphaClone

Stock trading strategies

HQ: San Francisco, California

Latest round: $2.3 million Series A

Total raised: $4.6 million

Tags: Consumer, advisers, investing, trading, wealth management

Source: Crunchbase

Bux

Simple mobile-trading app

HQ: Amsterdam, Netherlands

Latest round: $1.9 million

Total raised: $3.8 million

Tags: Consumer, trading, mobile, investing

Source: Crunchbase

Advizr

Financial planning software

HQ: New York City, New York

Latest round: $1.7 million Seed

Total raised: $1.7 million

Tags: Advisers, wealth management, personal financial management

Source: Crunchbase

Besepa

Direct debit management services

HQ: Madrid, Spain

Latest round: $200,000

Total raised: $300,000

Tags: Payments, billpay, SMB, accounts receivables, invoicing, billing

Source: Crunchbase

EquityZen

Secondary market for private equity

HQ: New York City, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Investing, private companies, trading, SMB

Source: Crunchbase

Mubble

Automatic bill payment for prepaid cards

HQ: Bangalore, India

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, prepaid, debit cards, payments, billpay

Source: Crunchbase

RateGator

Mortgage marketplace

HQ: Saratoga Springs, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, lead gen, lending, mortgage

Source: Crunchbase

—–

Graphic image licensed from 123rf.com

FinDEVr Previews

FinDEVr Previews