The number of traditional bank branches (1000+ square feet, fully staffed) are on the decline. In some European countries, more than half have already disappeared. In the U.S. (as of YE 2014), we are only down 5% from the peak (see inset below, note 1), but the trend will gain momentum as leases expire and revenues are squeezed by politicians (thank-you election year) “protecting” consumers and competition from non-banks (probably in that order).

While I appreciate the helpful people and wide-open space, most (note 2) bank branches are just too costly to support the declining “non-digital” customer base. That has led to eerily empty branches (not exactly a great branding statement) which no longer generate enough new business to pay their way (though they may support legacy deposit bases making them seem profitable).

While I appreciate the helpful people and wide-open space, most (note 2) bank branches are just too costly to support the declining “non-digital” customer base. That has led to eerily empty branches (not exactly a great branding statement) which no longer generate enough new business to pay their way (though they may support legacy deposit bases making them seem profitable).

Consider the four cornerstones of branch value:

- Opening accounts, especially for someone new to the bank

- Servicing accounts, especially when there is a problem

- Providing advice, especially for loans and business services

- Visible reinforcement of the brand (i.e., very expensive billboards)

Numbers 1, 2 & 3 can be more efficiently handled online, over the phone, or at the customer’s location. But what about #4, the branding value?

Banks don’t want to lose that, nor should they. But it’s time to find more cost-effective approaches. One answer: Locate micro-branches within established retailers or in other shared spaces. You keep your brand in front of the community, drive traffic for retail partners, and provide assistance for customers who absolutely need to see a smiling face in the real world.

What I mean by micro-branch isn’t really a branch at all, it’s more of a deposit-taking ATM/kiosk (or two) staffed by a single banker. Think airport check-in with roving staff helping at kiosks. And micro-branch/kiosks could be staffed only during peak-traffic times. For a good ROI, the banker must be able to close (or seamlessly refer to others) higher-value products such as loans (including purchase financing), credit cards, business services and insurance.

Most in-store bank branches are currently in grocery stores or Wal-Mart. But there are other retail locations that could benefit from micro-banking centers to draw traffic, provide services, share in the rent, and in some cases, assist with purchase financing:

- Office supply/shipping stores: One of the last places in the real world still frequented by businesses (and consumers) that need supplies to do their jobs and don’t have time to wait for Amazon delivery. Team with Office Depot/Staples or shipping locations to place micro-branches within their stores.

- Home improvement stores: Here’s another physical retailer likely to remain viable for a long time. Home project supplies are often not conducive to shipping, and many shoppers still need assistance figuring out what they need. There are good synergies for a micro-branch dispensing home improvement financing, along with other typical branch services.

- Other high-value retailers: If banks can get in-store staffing down to 1 FTE or less and fund consumer purchases in-store, it would be possible to expand into lower-volume locations such as electronic stores, department stores, popular furniture stores, outdoor equipment retailers, and others. Although ultimately, this opportunity is likely to be more efficiently handled through technology integrations with the retailer.

———

On the other hand, banks could reverse the in-store model by hosting other service providers within existing branches to share costs and generate activity:

- Ecommerce kiosks: The last mile of ecommerce, actually getting products delivered to the end user, is still expensive and problematic. Team with Amazon, eBay, et al to add kiosks, lockers, etc. installed within the bank branch. A branch with a RedBox, BestBuy vending machine, Amazon lockers, FedEx drop-box, maybe some coffee for us caffeine addicts, would be a much more vibrant space.

- Other professional services: Team with non-competing service providers such as Realtors, CPAs, tax prep services, law firms, tutors, insurance providers, investment advisors, to create a one-stop shop for a variety of needs.

It’s an exciting time to be involved in banking alt-delivery. Simultaneously maintaining a bank’s local presence, while dramatically decreasing long-term costs, is the kind of tricky business problem that will create new winners and propel the careers of those making the right bets.

——–

Notes:

1. Source: From the latest Digital Banking Report (formerly Online Banking Report), Bricks + Clicks: Building the Digital Branch, March 2015 (a great read and well-worth the price)

2. I am saying “most” traditional (i.e., large) branches are not viable in the long term, unless their business model or cost structures are dramatically changed. But that doesn’t mean there still won’t be thousands (maybe even tens of thousands) of profitable brick-and-mortar locations for the foreseeabl e future. There just won’t be 100,000+

e future. There just won’t be 100,000+

Picture credit: Retail Week

—–

PS. Don’t miss FinovateEurope next month.

e

e

imaginBank provides customers with a complete array of financial services such as a commission-free current account, a Visa imaginBank debit card, and PFM tools, as well as up-to-date mobile and P2P payment technology. imaginBank also offers consumer financing of up to €15,000 with no arrangement fee.

imaginBank provides customers with a complete array of financial services such as a commission-free current account, a Visa imaginBank debit card, and PFM tools, as well as up-to-date mobile and P2P payment technology. imaginBank also offers consumer financing of up to €15,000 with no arrangement fee. “This has enabled us to incorporate in this project all the features that our young customers look for in financial services, such as digital banking, simplicity and service excellence,” Fainé explained.

“This has enabled us to incorporate in this project all the features that our young customers look for in financial services, such as digital banking, simplicity and service excellence,” Fainé explained.

Derek Corcoran, Chief Experience Officer

Derek Corcoran, Chief Experience Officer

Lawrence Whittle, Chief Revenue Officer

Lawrence Whittle, Chief Revenue Officer

Christopher Kampshoff, CEO

Christopher Kampshoff, CEO

Simon Scheurer, Co-Founder & CTO

Simon Scheurer, Co-Founder & CTO Mathias Wegmueller, Co-Founder & Business Development

Mathias Wegmueller, Co-Founder & Business Development

Geraldine Critchley, Head of Product Marketing

Geraldine Critchley, Head of Product Marketing Antony Bream, U.K. Managing Director

Antony Bream, U.K. Managing Director

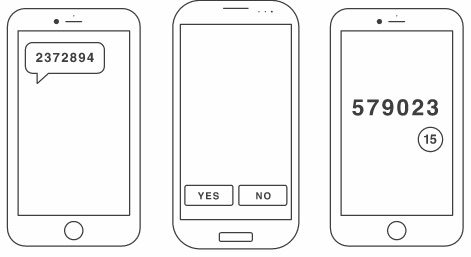

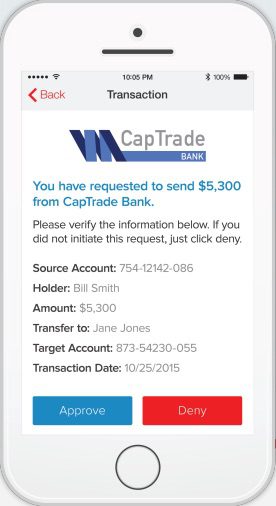

Here’s how Authy OneTouch works to authenticate a high-value money transfer:

Here’s how Authy OneTouch works to authenticate a high-value money transfer: