What’s changed between last year and the themes that are dominating FinovateSpring 2016?

“Mobile,” “Payments,” “Banking,” “Apps,” and “Investing” are key concepts again this year. But there may be no better metaphor for the changing landscape of fintech than the fact that “Billpay,” one of the larger themes of 2015, is out and “Blockchain” is in.

That said, there’s more to 12 months of fintech innovation than the spread of distributed-ledger technologies and the mainstreaming of personal finance (note that “PFM” failed to make FinovateSpring’s theme-cloud for the second year in a row). “Voice” appears for the first time as a significant theme in our cloud as more companies explore voice technologies as a solution for everything from authentication to customer engagement. And the rise of artificial intelligence is revealed by new themes, such as “Predictive,” as in Predictive Analytics, or “Cognitive,” as in cognitive computing, and even “Workflow,” which recognizes the way AI and machine learning are combining to automate and improve business processes for banks and other financial institutions.

That said, there’s more to 12 months of fintech innovation than the spread of distributed-ledger technologies and the mainstreaming of personal finance (note that “PFM” failed to make FinovateSpring’s theme-cloud for the second year in a row). “Voice” appears for the first time as a significant theme in our cloud as more companies explore voice technologies as a solution for everything from authentication to customer engagement. And the rise of artificial intelligence is revealed by new themes, such as “Predictive,” as in Predictive Analytics, or “Cognitive,” as in cognitive computing, and even “Workflow,” which recognizes the way AI and machine learning are combining to automate and improve business processes for banks and other financial institutions.

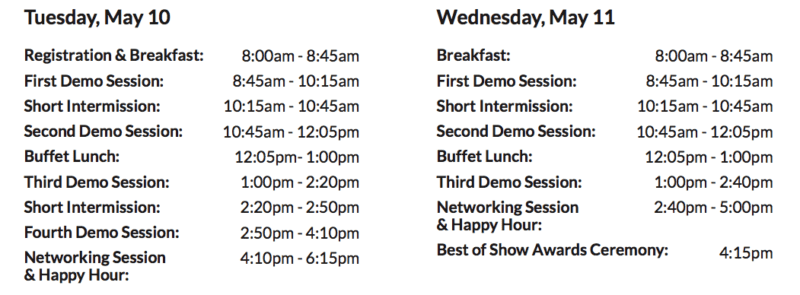

This is the kind of peek into the future of fintech that FinovateSpring provides. Join us next week in San Jose as 72 companies from around the world take the stage for two days of innovation and high-caliber networking. Tickets are on sale now, so be sure to register today and join more than 1,500 fellow fintech professionals, our biggest Bay Area event ever, at one of the key events in the fintech calendar.

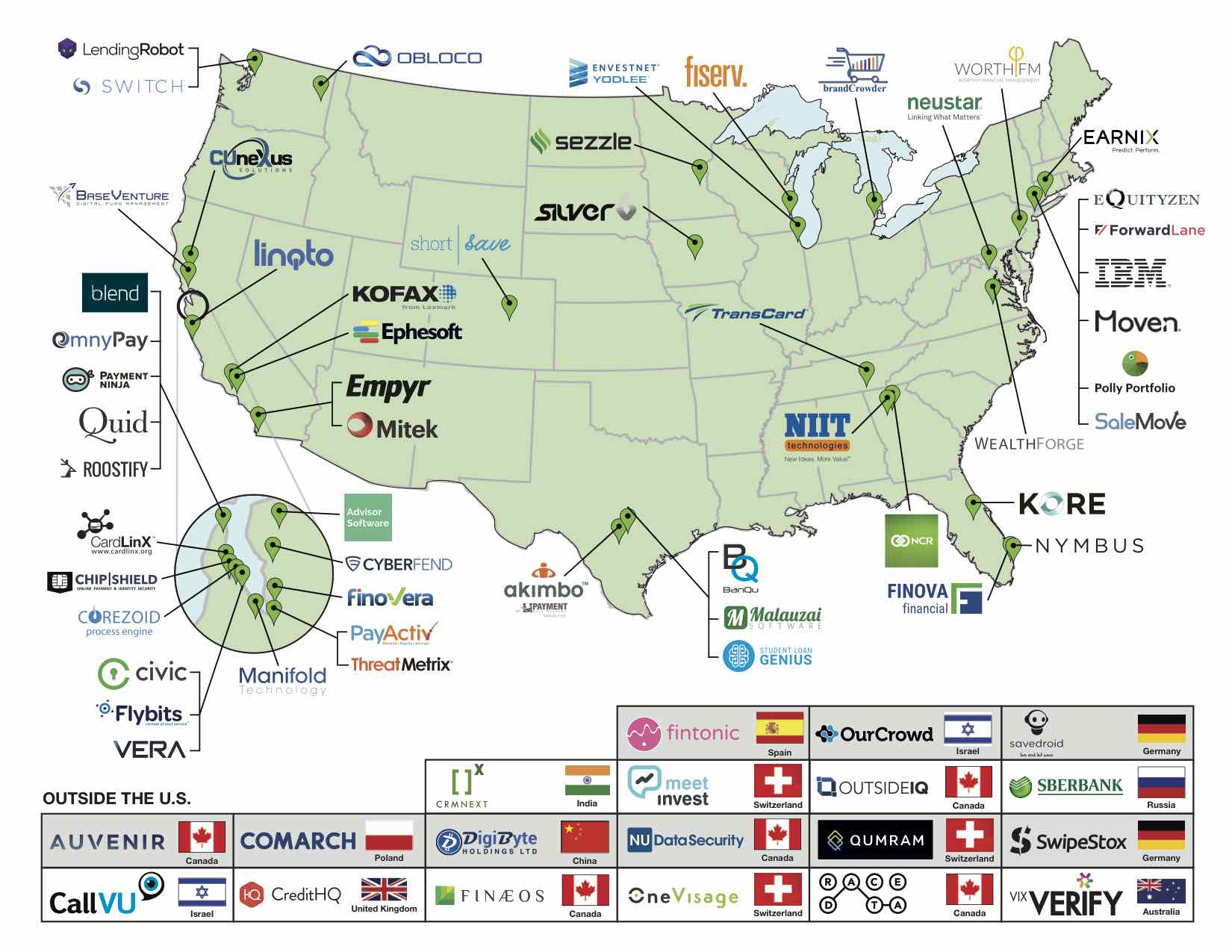

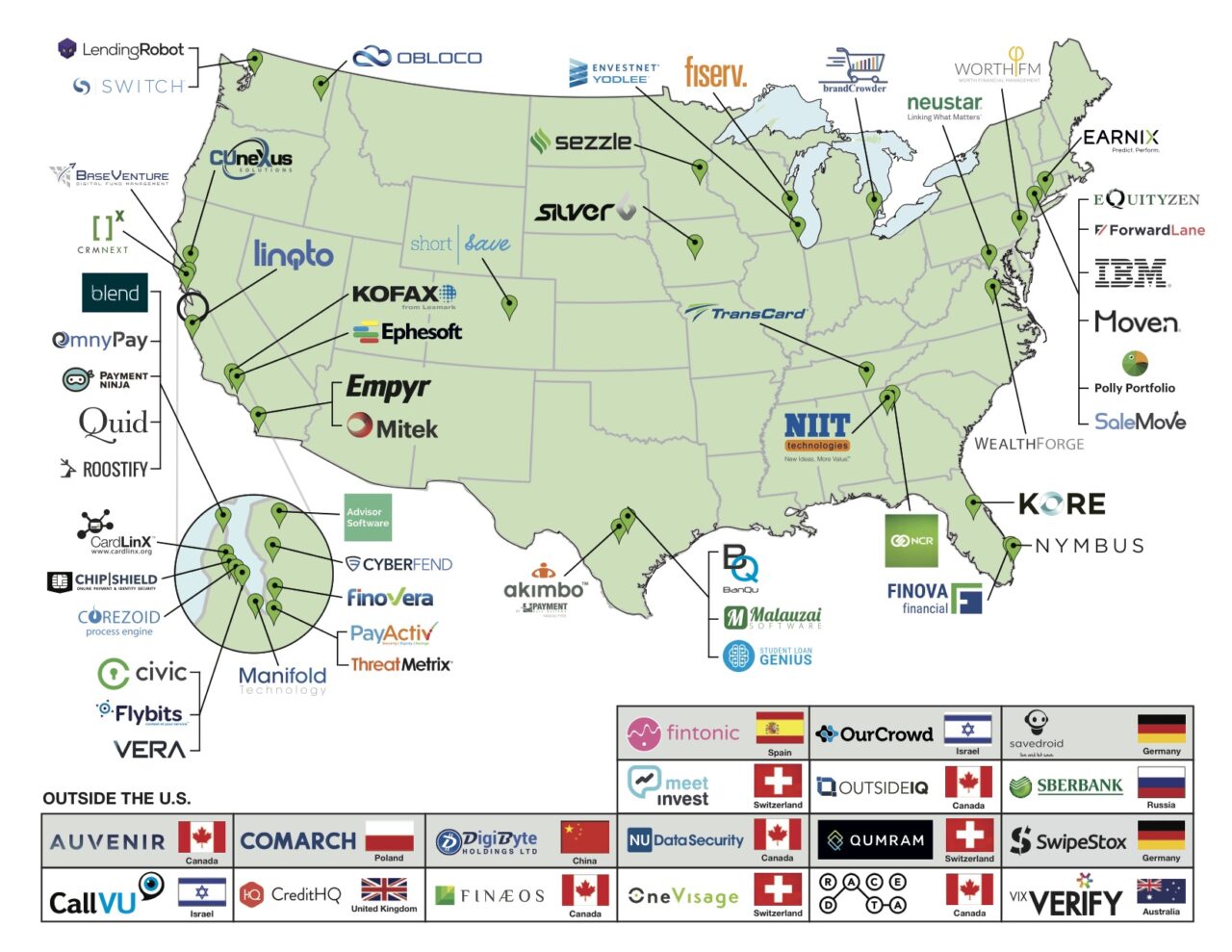

And if your appetite needs further whetting, here’s an updated look at the innovators that will be demoing their technologies live on stage May 10 & 11.

We hope we’ll see you there! In the meanwhile, learn more about the companies that will be on stage in our FinovateSpring Sneak Peek series, and please visit our FAQ or email us at [email protected] with any questions.

FinovateSpring 2016 is sponsored by The Bancorp, Accenture, Association for Financial Technology, Cyberport/InvestHK, FT Partners, Greater Zurich Area/Swiss Business Hub, Hudson Cook, KPMG, and Leverage PR.

FinovateSpring 2016 is partnered with Acuity Market Intelligence, Aite Group, American Bankers Association, Bank Innovators Council, BankersHub, Bankless Times, BayPay Forum, Bitcoin Magazine, bobsguide, Breaking Banks, Byte Academy, California Bankers Association, Canadian Trade Commissioner Service, Celent, Cointelegraph, Digital Currency Council, EbankingNews, FemTechLeaders, Filene Research Institute, The Fintech Times, IDC Financial Insights, Javelin, Juniper Research, Korea FinTech Forum, Mercator Advisory Group, Payments & Cards Network, The Paypers,PitchBook, Plug and Play, SME Finance Forum, and Western Independent Bankers.

Our

Our

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

Ashley Luke, Director, Data Science

Ashley Luke, Director, Data Science James De Cicco, Head of Sales, Banking and Financial Services

James De Cicco, Head of Sales, Banking and Financial Services Gaurav Mistry, Manager, Business Development, Banking and Financial Services

Gaurav Mistry, Manager, Business Development, Banking and Financial Services