The writing is on the wall. The bank branch wall that is. In a world of ubiquitous smartphones, bank branch ROI continues to plummet. That leaves many financial institutions wondering how to replace the branch’s historic role as the center of customer acquisition.

The writing is on the wall. The bank branch wall that is. In a world of ubiquitous smartphones, bank branch ROI continues to plummet. That leaves many financial institutions wondering how to replace the branch’s historic role as the center of customer acquisition.

There are many strategies:

- Substantial digital marketing and sales efforts

- Relationships with major local employers

- Lending, and banking, small businesses

- Leadership in K-12 financial education

- Affinity programs with local retailers

- Social media and PR champion

None of those are particularly novel. But one you may not have tried recently is becoming the go-to financial institution in your area for homeowners and apartment renters. Being the local bank that helps people meet one of their top priorities in life, having a roof over their head, puts you in an enviable position.

Again, this is a strategy that goes back decades (e.g., Savings & Loans in the United States, Building Societies in the United Kingdom), but digital technologies open up new avenues of integrating partner services into a cohesive “Home for Homes” strategy:

- Finding a home/apartment: Integrations with Zillow, Redfin, newcomer Faira (which “wrapped” the Seattle Time Sunday paper this past weekend in 3-full-pages ad)

- Traditional home financing: Standard and jumbo mortgages, purchase and refi

- Alt-financing home/apartment (note 1): Rehab loans, crowdfunding integrations, rental-deposit loans, and so on

- Home/apartment repair loans: Smaller loans, potentially more of “emergency” type

- Traditional home equity lending: Installment loans, lines of credit, and so on

- Realtor support: While there is no shortage of independent mortgage brokers working with real estate agents, many (most?) can’t provide a flow of inbound leads to the agents; this is where established FI brands can leverage their standing in the community (within RESPA guidelines, naturally)

After you find a new home buyer/renter/refinancer, the hard part begins. How to convince them you are the long-term home for their home? A novel approach, but one fraught with regulatory/risk/ROI concerns, is the lifetime mortgage, e.g., a mortgage preapproval that moves with you from home to home provided you continue to meet down payment and income requirements (NOT the UK meaning, a reverse mortgage).

While reprising the Third Federal Mortgage Passport might not be possible in the current regulatory environment, there are ways to incent customers to move their other bank accounts (though, thanks to Wells Fargo, you better be super careful with sales incentives).

Here’s a list of perks to offer new homebuyers/renters:

- Homeowners club with content, discounts and offers

- Systematic savings program to save for down payment or rental deposits

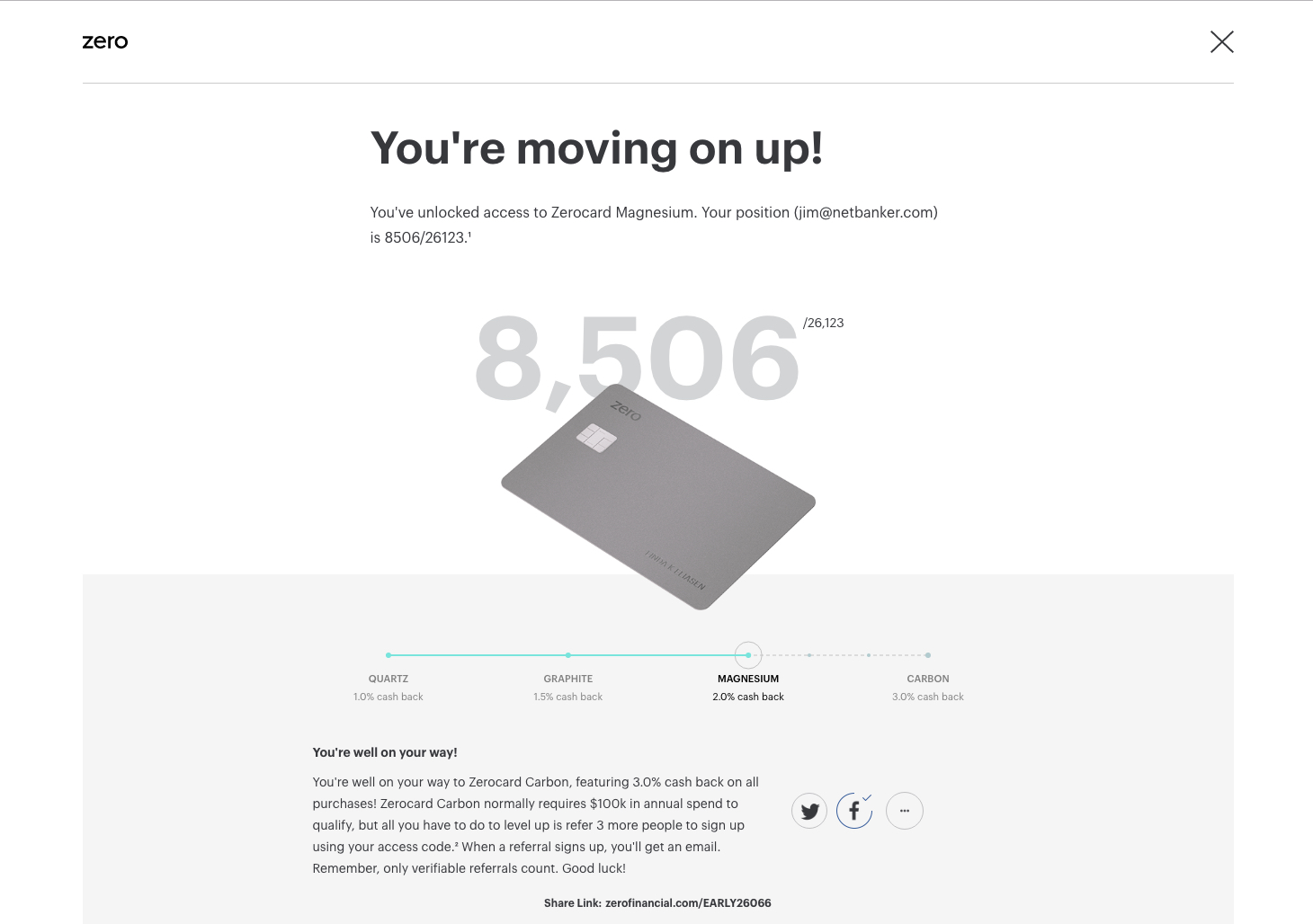

- Card rewards geared towards home expenditures

- Significant interest-rate kicker and/or bonuses on the first few thousand in savings (see CFCU Community Credit Union at right)

- Simple refi process (see PenFed’s program powered by Mortgage Harmony for example)

- Reward-point bonuses for home-related purchases on your credit/debit card

- Homeowner/rental insurance

- Homeowner repair services with financing discounts (integrate with Thumbtack, Angie’s List, etc.)

- Energy-conservation services with financing discounts

- AirBnB integration for renting out home/apartment

Bottom line: No matter how well your branches are doing today, most financial institutions need to pursue viable new-account generation alternatives to make up for falling branch traffic.

———

Notes:

Apartment financing is a relatively new need (see previous post). And the magnitude of it might surprise anyone who hasn’t checked out the urban rental market in recent years.

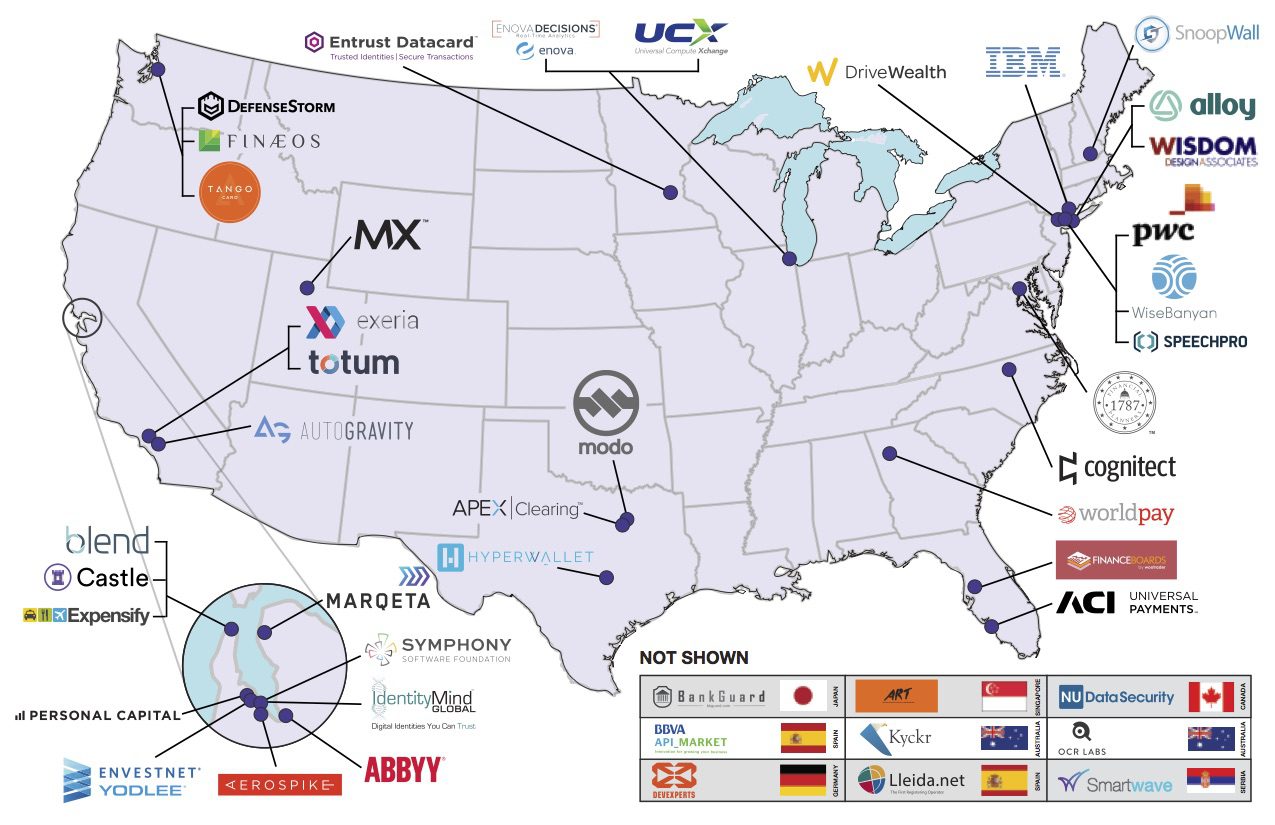

Apartment financing is a relatively new need (see previous post). And the magnitude of it might surprise anyone who hasn’t checked out the urban rental market in recent years.- Looking for more inspiration for your technology stack? Don’t miss our third annual FinDEVr Silicon Valley next week (18/19 Oct).