Speaking at FinovateEurope 2018, Rohit Talwar – global futurist, author, and the CEO of Fast Future – discussed The Rise Of The Machines – The AI Revolution And The Road To Superintelligence. He specialises in the future of financial services and the challenges of preparing society for the disruptive impacts of exponential technologies.

Speaking at FinovateEurope 2018, Rohit Talwar – global futurist, author, and the CEO of Fast Future – discussed The Rise Of The Machines – The AI Revolution And The Road To Superintelligence. He specialises in the future of financial services and the challenges of preparing society for the disruptive impacts of exponential technologies.

Clear away the vendor hype and desperate “me too” announcements from across the sector, and the evidence is starting to mount that financial services is exploring serious applications of artificial intelligence (AI). The technology is being deployed in everything from complex internal reconciliations, risk identification, and fraud detection through to customer service chatbots, robo trading, and targeted marketing based on deep customer profiling. Furthermore, in the fast-paced world of fintech start-ups, we are seeing AI-powered hedge funds and advisory firms, personal finance managers, and a host of sites that offer us the potential to streamline traditionally slow and expensive processes for everything from invoice financing to personal insurance.

So, now the game is on, where can we see it evolving to in the coming years? One area is in real-time fraud detection for banking and credit card transactions – spotting and preventing situations that might otherwise take us weeks to resolve. At another level, investors and regulators could eventually be able to monitor the behaviour of fund managers and personal advisors. These systems would examine transactional behaviour, personal spending patterns, and social media activity to detect the potential for insider trading, market manipulation, and misuse of client funds.

For individuals, the aggregation of our personal data with that of millions of other people will allow our intelligent finance advisors to recommend cheaper alternatives for goods and services we buy regularly. The next step would be to aggregate our purchasing to secure discounts from key suppliers. Indeed, we might authorize these advanced comparison tools to switch our purchases, insurances, and even savings on a continuous basis to whoever is offering us the best deal.

Taking this a stage further, new opportunities might arise for those who have a detailed understanding of our lifestyles from travel, to dining, and clothing purchases and link this to our personal financial management. Such sites might be authorised to trade unused airmiles and store loyalty points on our behalf, negotiate entertainment discounts for us, accept paid adverts to our social networks, and rent out our driveway as a parking space. Such systems would then invest any cash surpluses earned on a moment by moment basis using our preferred risk profile as a guide.

The next evolution might to employ a personal AI clone or “digital twin”. These applications would build a detailed understanding of our lifestyles and be authorized to buy, save, sell, or trade on our behalf. Depending on the level of authorization, they might undertake credit card purchases, bank transactions, and bill payments, complete loan or mortgage applications, and even make impulse buys. The system might report back on every transaction or simply deliver an end of day voice or video mail to update on the day’s activities.

The list of potential applications is literally limitless. From streamlining and reducing the cost of activities that are currently an expensive hassle, through to finding new ways of making our finances go further, AI seems increasingly likely to become a vital part of the financial ecosystem. While many of the new AI ventures will go the way of most start-ups and fade away, some will survive. Furthermore, the best ideas are likely to be adopted by more established players as they seek to transform themselves into more customer centric enterprises. The hope is that successive waves of AI innovation will help us make far better use of all the assets at our disposal – not just our cash.

![What’s the Fuss? Amazon Already Offers Full Suite of Banking Services [Updated]](https://finovate.com/wp-content/uploads/2018/03/amazon-banking-product-line.jpg)

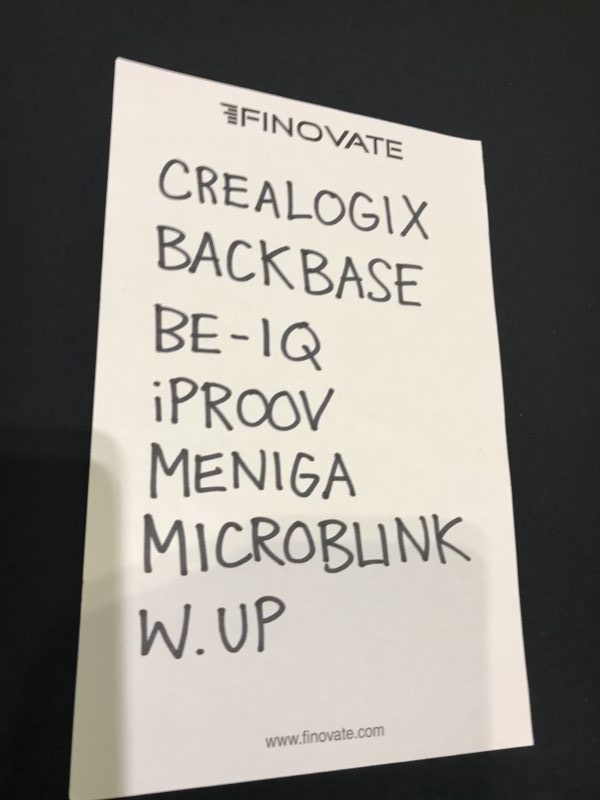

iProov

iProov Microblink

Microblink