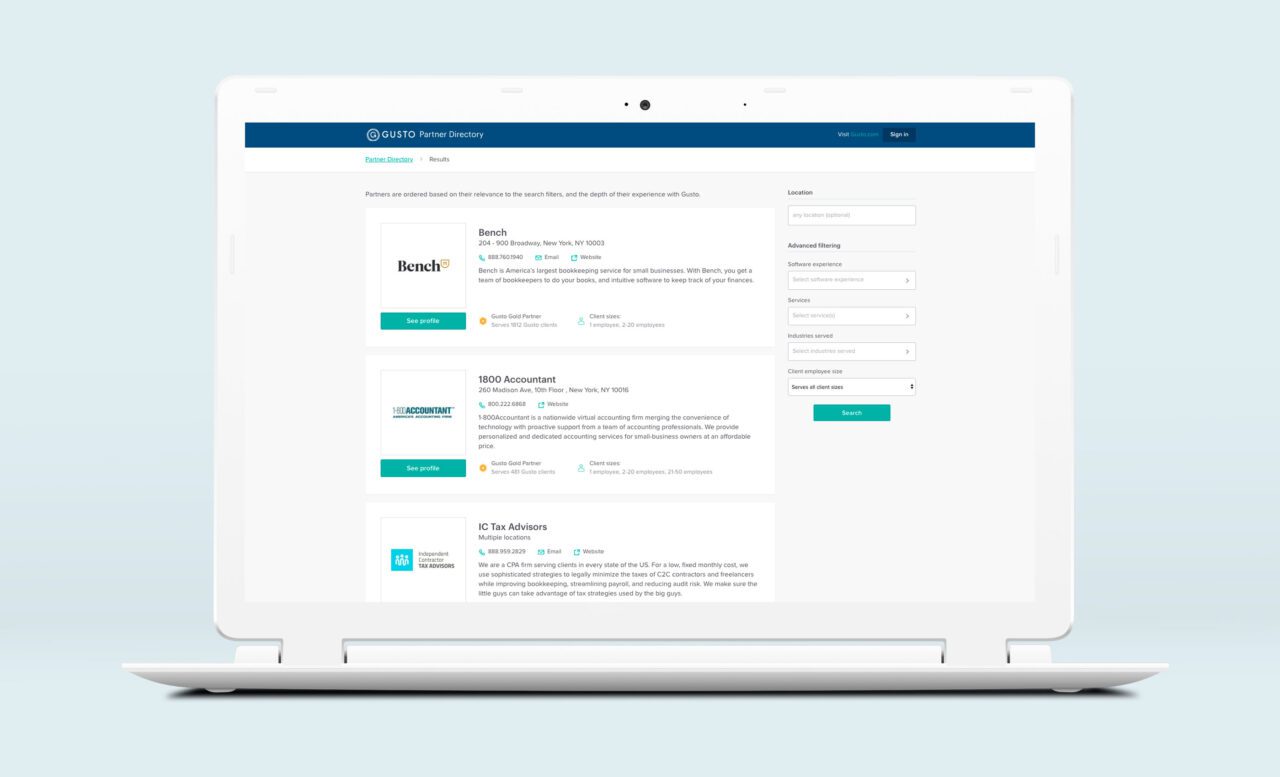

Online payroll and HR services provider Gusto is unveiling its Partner Directory today, a directory of accounting firms suitable for small and medium-sized businesses.

The directory offers Yelp-like reviews of accountants and is available to any business– both Gusto customers and non-customers– for free. The tool allows businesses to filter the search results by geography, services offered, software expertise, and industries served.

“We noticed a growing trend of accountants that are competing effectively against larger accounting firms by advising small businesses more holistically. These accountants are differentiating and ‘future proofing’ their practices by offering non-traditional services like benefits and human resources for their clients,” said Gusto Senior Product Manager Mike Lyngaas. “Recommendations for accountants and trusted partners are one of the top requests we get from small businesses, and the Partner Directory allows modern accountants and entrepreneurs to grow their businesses together.”

To curate the directory, Gusto screened more than 4,000 of its accounting firm partners for their payroll expertise, benefits and HR services, ability to help businesses claim the federal R&D tax credit, or even acting as an outsourced CFO. The company adds more accountants regularly to both its list of partners as well as to the directory.

Accountants can leverage Gusto’s technology to run payroll or provide benefits and HR services for all of their business clients. They can also tap into Gusto’s relationships with third party software providers.

Founded in 2011 as ZenPayroll, Gusto serves over 60,000 companies across the U.S. and has offices in San Francisco and Denver. At FinovateSpring 2014, Gusto CEO Joshua Reeves showcased the company’s payroll solution. In March, the company launched a freemium model for its payroll solution and in February was highlighted in Forbes for its diversity efforts. Of the company’s 525 employees, 51% are women.

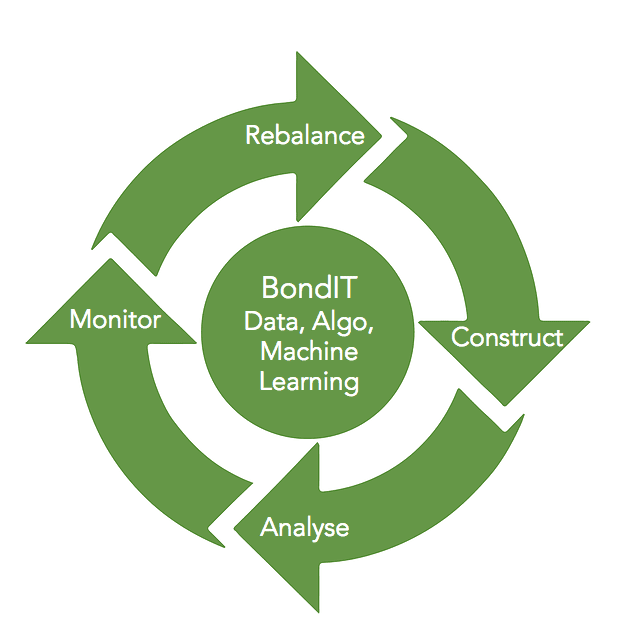

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”