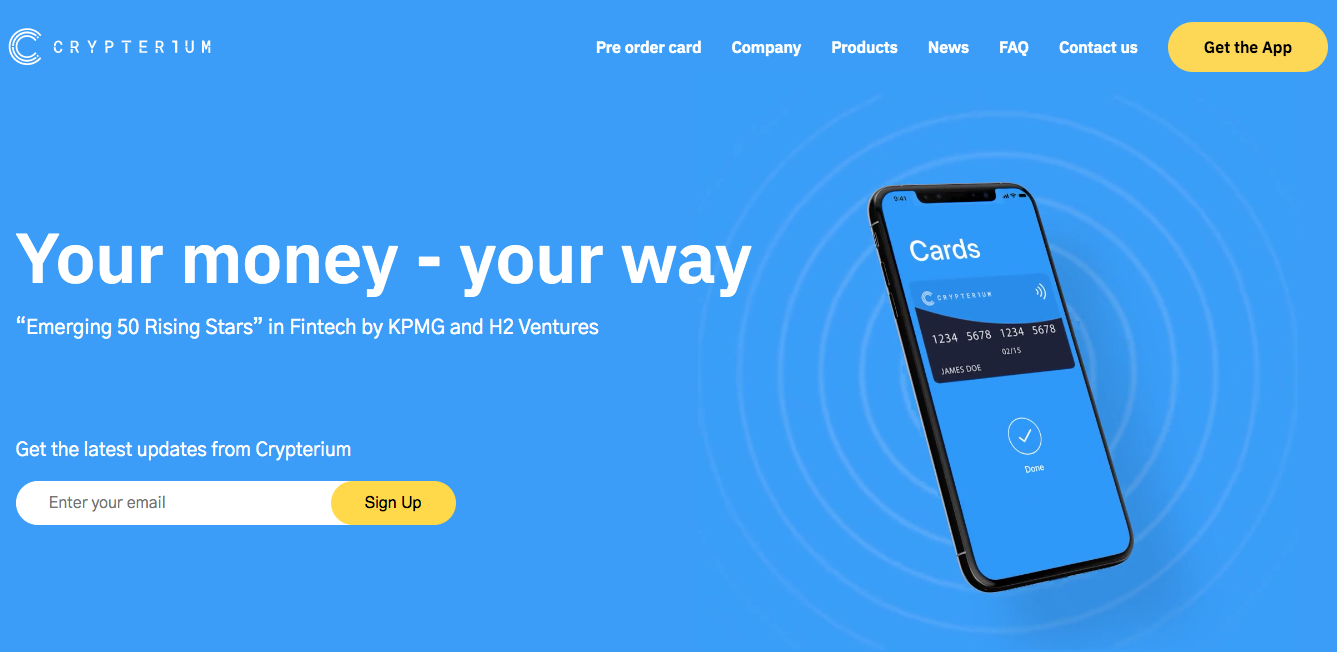

Crypterium, a company that turns cryptocurrencies into fiat money, launched its long-promised prepaid card today.

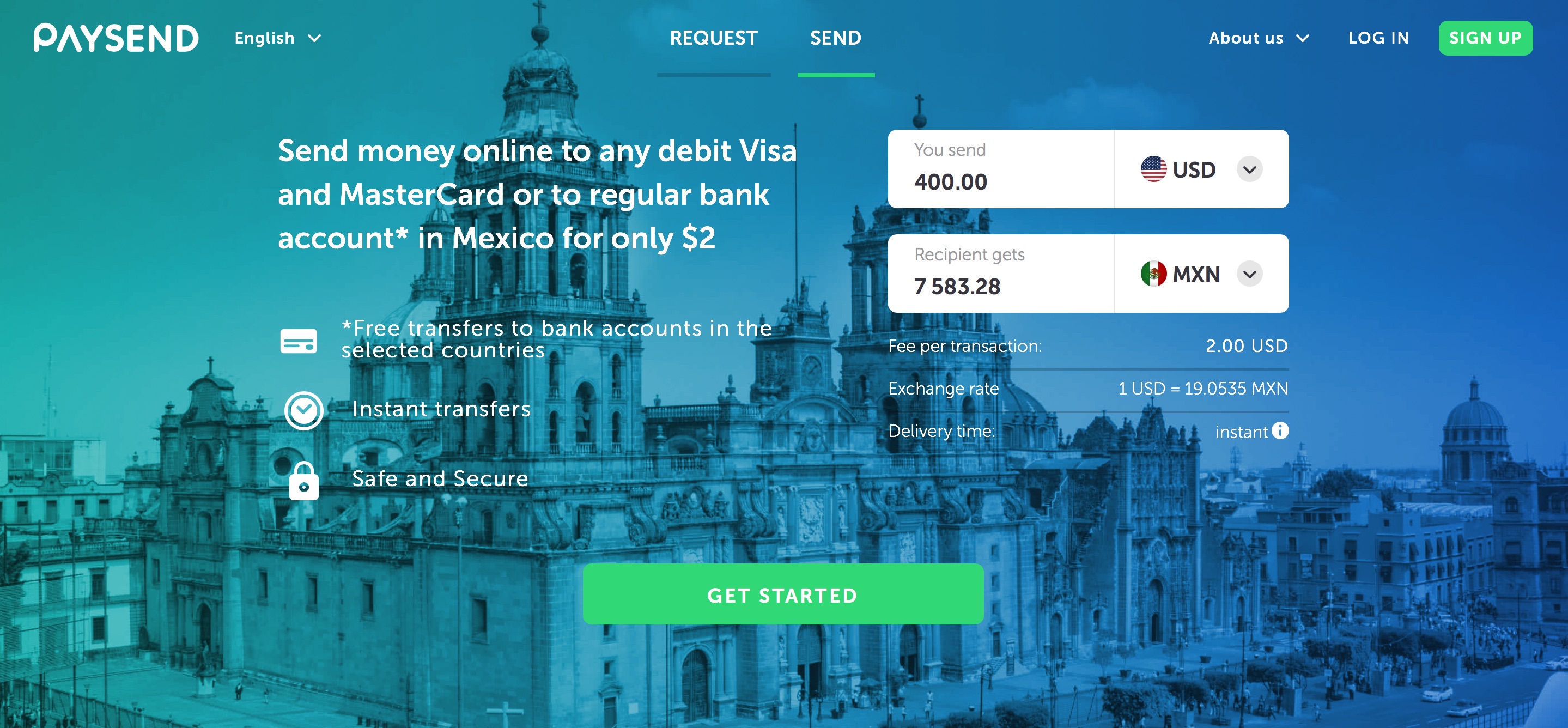

The Crypterium Card is loaded with cryptocurrencies and functions just like a traditional prepaid card in that it can be used with online and brick-and-mortar merchants. With this functionality, the card overcomes one of the biggest hurdles to cryptocurrency usage since the number of merchants who accept cryptocurrency is limited.

“One of the major barriers to general crypto acceptance has been the fact that it is very difficult to spend cryptocurrency in the real world, and any solutions offered so far have been confined to specific countries or retailers,” said Crypterium CEO Steven Parker. “But the beauty of cryptocurrencies is that they are designed to be borderless and global. The Crypterium Card lives up to this borderless, global ideal: anyone can apply for one and start using their cryptocurrencies to pay for things in everyday life. This has the potential to take off as quickly as NFC.”

The Crypterium Card is available in any country across the globe and has generous spending limits of up to $10,000 per day or $60,000 per month. The card is linked to the Crypterium Wallet, which the company debuted at FinovateFall 2018.

The Crypterium Wallet is available in the company’s app and allows users to manage, store, and purchase a range of cryptocurrencies– including Bitcoin, Ethereum, Litecoin, and Crypterium’s CRPT token. Similar to other prepaid wallet apps, the Crypterium Wallet offers bank-like functionality such as spending analysis and money (both fiat and crypto) transfers. And because Crypterium is integrated with the top 10 exchanges, consumers can also use the app to follow real-time exchange rates and get the best rate for each transaction.

Perhaps coincidentally, Crypterium competitor Coinbase announced today that its debit card, the Coinbase Card, has expanded its geographical reach. Once limited to U.K. users, the card is now available for users in Spain, Germany, France, Italy, Ireland, and the Netherlands.

Crypterium is headquartered in Estonia and first listed its CRPT tokens on the HitBTC exchange last March. Last May, the company appointed former CEO of Visa U.K., Marc O’Brien, as CEO.