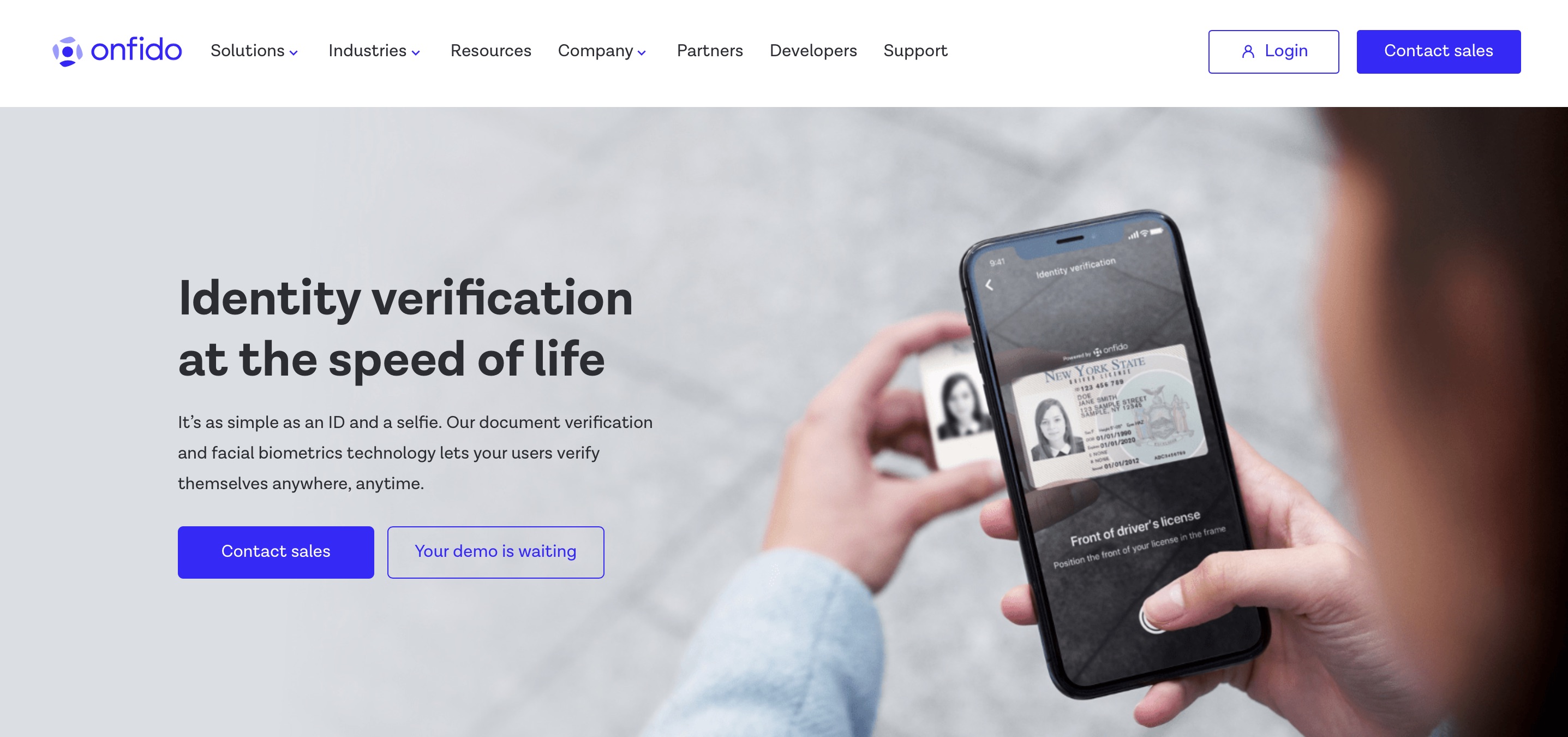

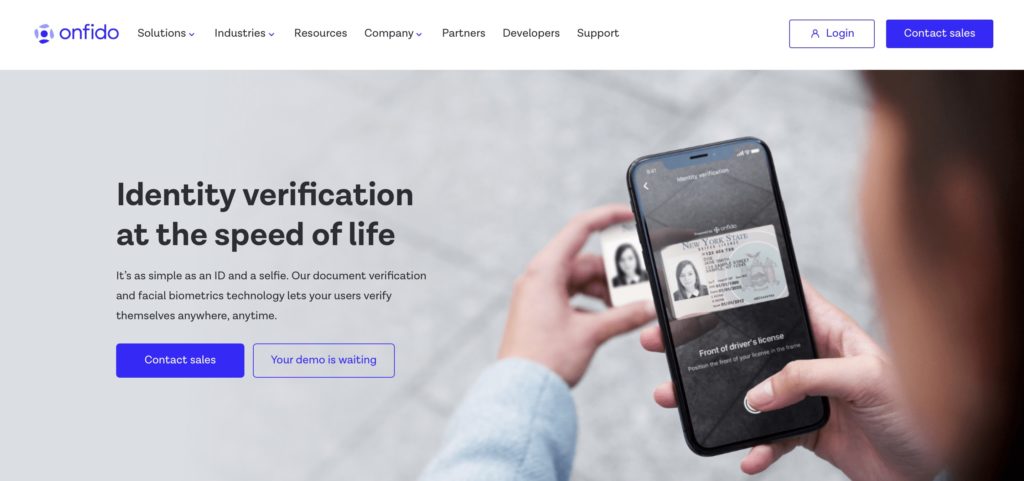

The new international partner program launched this week by Onfido will help expand the reach of the company’s identity verification solutions and explore new use cases. ForgeRock, IDEMIA, and iovation are among the cybersecurity and identity access management (IAM) specialists that have agreed to include Onfido’s AI-powered identity verification services in their own offerings.

“Empowering the channel is an important strategic move that will enable us to accelerate our expansion into the U.S.A., Southeast Asia, and Europe, while exploring new product innovation in areas such as account takeover and authentication,” Director of Alliances and Partnerships at Onfido Ed Ackerman said. “With some of the biggest enterprise names already signed up to our program, we’re now selecting additional applications from companies to join and share in exciting new revenue-generating opportunities.”

Onfido demonstrated its Facial Check with Video technology, available via the company’s SDK, at FinovateFall 2018. The solution leverages liveness detection by having users film themselves performing a variety of random movements and then comparing the image in the video to the facial image of the user extracted from their identity document.

Onfido’s technology can be integrated into existing cloud-based systems or co-sold by partners as a combined solution stack. The company boasts a number of fellow Finovate alums as current program members as well, including Mambu, Qwil Messenger, Signicat, InvestGlass, FiveDegrees, and Thought Machine.

Along with the program launch news, Onfido also reported that Visa was now offering Onfido’s end-to-end identity verification service on its marketplace. And that’s not the first of this type of partnership: Salesforce has offered Onfido’s technology on its AppExchange since in December 2017.

Recently selected to participate in the new data protection ICO Sandbox, Onfido has spent the summer partnering with firms like cross-border money transfer specialist MoneyNetint and international payments company Currencies Direct to enhance the verification component of their onboarding processes. Other partnerships for Onfido this year include a collaboration with Checkr to support the background check specialist’s Checkr Connect IDV solution, and an agreement with mobility-as-a-service company Drover to help the firm offer a more secure, seamless onboarding experience for customers.

Onfido raised $50 million in funding this spring in a round led by SBI Investment and Salesforce Ventures, which took the company’s total financing to more than $100 million. Founded in 2012, Onfido is headquartered in London, U.K. Co-founder Husayn Kassai is CEO.