Automatic saving tools have been around since the dawn of the new millennium. You’re probably familiar with how they work; the tools allow users to contribute to savings goals on a regular basis using microtransfers. Some take a randomized approach to the contributions, transfering under $10 a few times a week from a user’s checking account to their savings account. Other tools round up the amount of everyday purchases and contribute the “spare change” to a savings account.

Though Bank of America’s autosave tool has been available since 2005, it wasn’t until the launch of investing app Acorns in 2012 that the industry picked up on the possibility of success for autosave and payment round-up tools.

Banks were quick to notice not only the positive consumer response to such tools but also the potential for more consumer deposits and increased debit card usage. While many banks offer a straightforward version of autosave, a handful offer more robust features, such as purchase round-ups, to entice users to keep a few more bucks in the bank. Below are autosave programs from six banks.

USAA’s Tracker

Tracker from USAA tries to make saving a bit more approachable with the use of a German Shepherd. The tool does not implement purchase round-ups, however. Instead Tracker randomly withdraws small amounts ranging from $2 to $9 from a user’s checking account one to four times per week. To keep the user involved, Tracker texts the user every day to inform them of their checking account balance.

Bank of America’s Keep the Change

Bank of America was well ahead of its time when it launched Keep the Change in 2005. The savings program rounds up consumers’ purchases to the nearest dollar and deposits the extra change into a separate savings account.

The tool is still available and is relatively unchanged today.

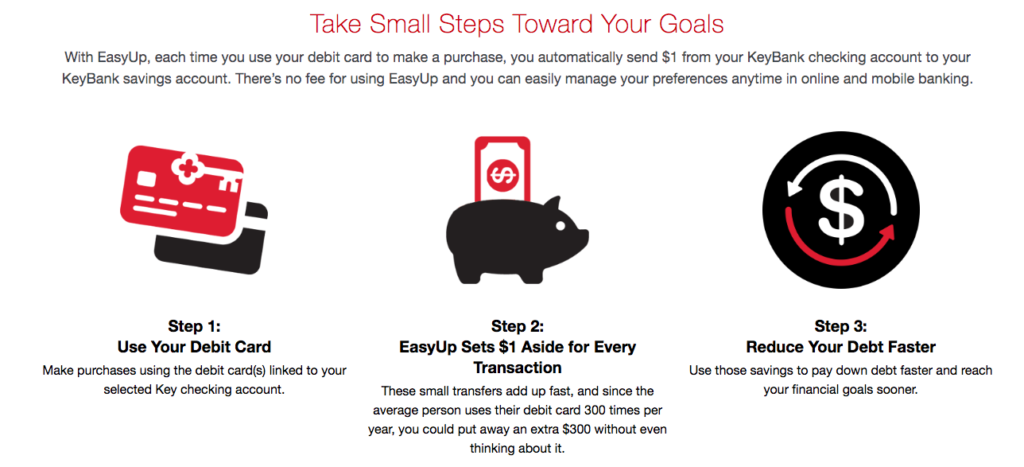

KeyBank’s EasyUp

KeyBank’s savings tool, EasyUp, is tied to a user’s debit card and works by automatically transfering $1 to a specified savings account every time a user makes a purchase. While customers can use the savings balance any way they choose, KeyBank specifically highlights using EasyUp to pay down debt faster.

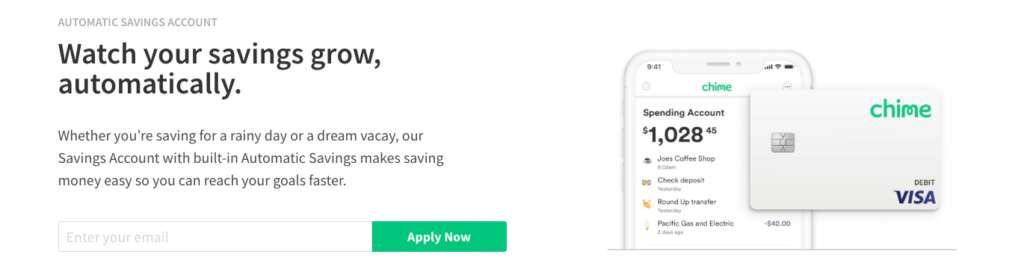

Chime’s Automatic Savings

Chime, a U.S. challenger bank that was founded in 2013, uses the round-up concept to help users save money every time they make a purchase. In conjunction with this way to save, the bank also allows users to automatically transfer a percentage of each paycheck into their savings account. While this isn’t a new concept, Chime has built a user experience around the transfer capability and sends push notifications regarding savings progress to make it more accessible for users.

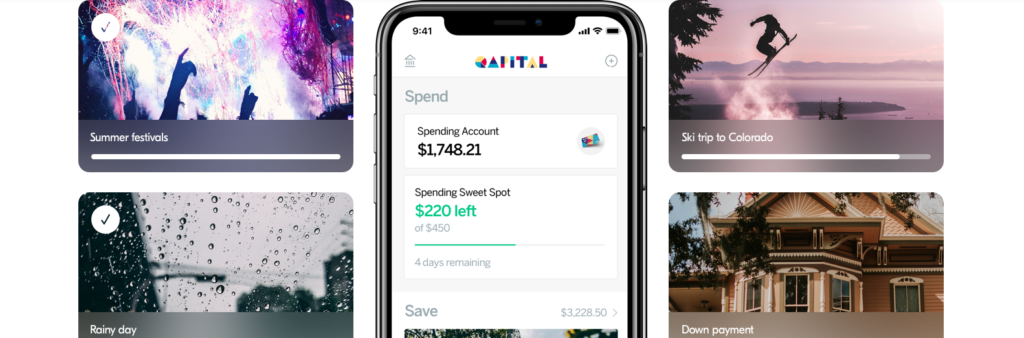

Qapital’s Rules

Qapital uses the concept of If This, Then That (IFTTT) to help users set up a structure around their savings transfers. The tool leverages behavioral economics to get users to save when certain actions are triggered. For example, accountholders can have Qapital set a small amount of money aside each time they visit the gym, every time it rains, or each time Donald Trump tweets.

Simple’s Round-Up Rules

Simple’s saving program, Round-up Rules, works similarly to Bank of America’s Keep the Change tool by depositing the “spare change” from each of a customer’s purchases into a separate savings account. The one difference with Simple’s savings tool, however, is that it waits until the spare change adds up to or exceeds $5 before transfering the cash into the savings account.