This post is part of our live coverage of FinovateFall 2015.

Then, Lexmark showed off upgrades to its Mobile Onboarding Platform:

Then, Lexmark showed off upgrades to its Mobile Onboarding Platform:

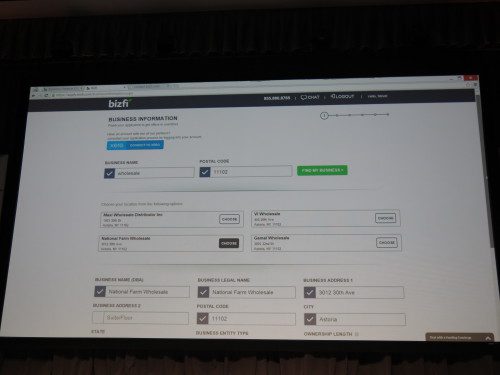

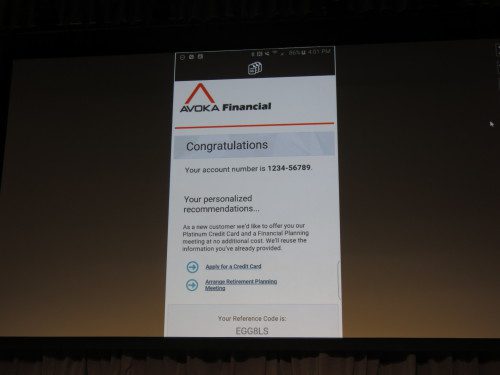

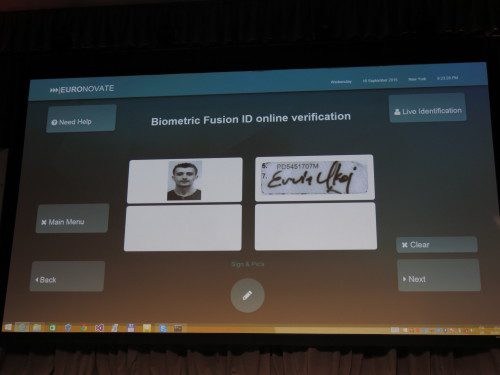

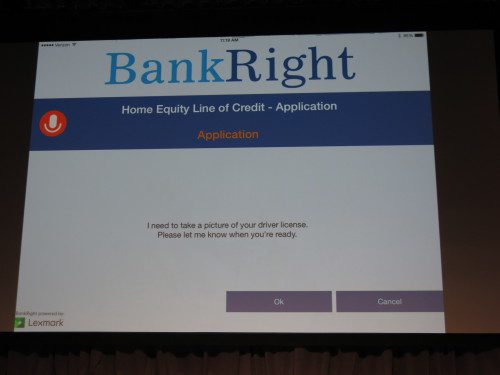

Lexmark is demonstrating a significant customer enhancement to its Mobile Onboarding Platform: a frictionless mobile onboarding process driven by interactive and instructive, natural voice recognition along with a virtual collaboration session to e-sign the application in real time.

The demonstration guides the customer along the new account-application process with instructions and guidance in natural language trained for this specific purpose. The applicant can interact with the platform in plain English to correct data extracted from their driver’s license, advance to the next step, initiate a same-session video-chat to collaboratively e-sign the new account application in real time, and finally to submit the completed application.

Presenters: Darren Collins, global director, financial services and insurance; Chris Edington, senior marketing manager, industry solutions

Metrics: Sells products in more than 170 countries; 12,700 employees; NYSE: LXK; $3.7 billion in revenue (2014)

Product distribution strategy: Direct to business (B2B)

HQ: Lexington, Kentucky

Founded: January 1991

Website: lexmark.com

Twitter: @lexmark