This week’s edition of Finovate Global showcases news from the fintech industry in New Zealand.

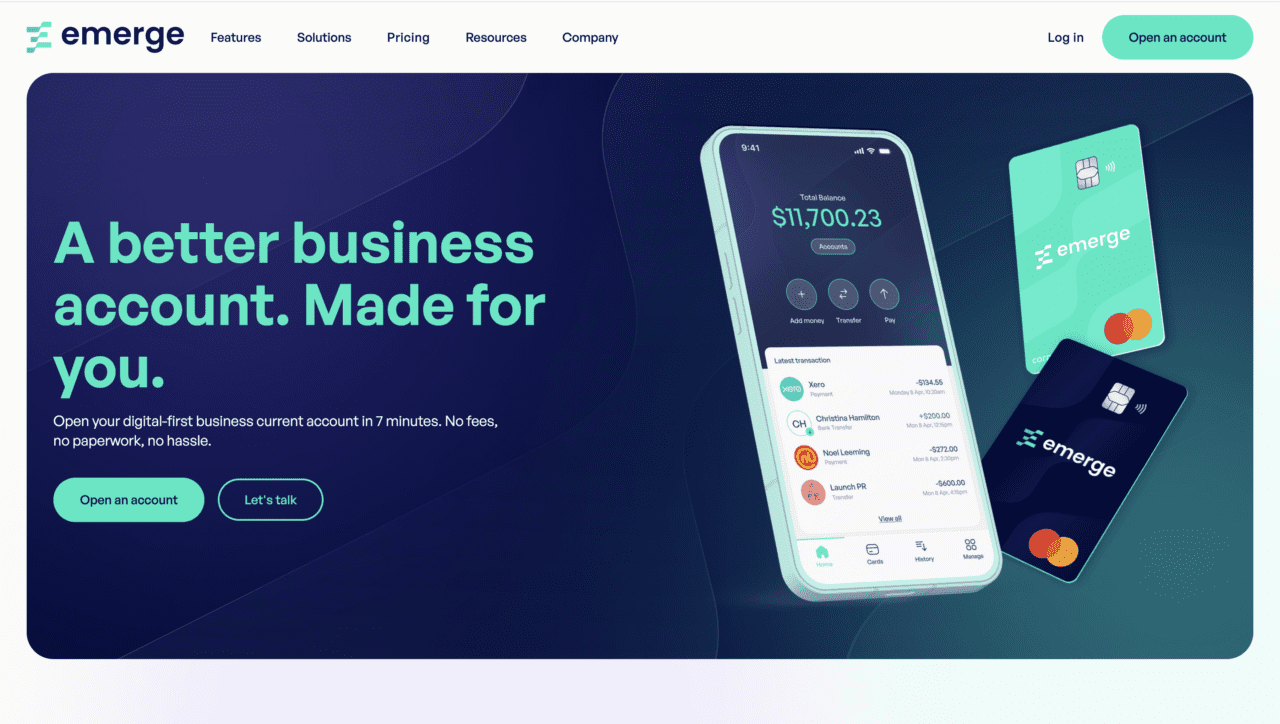

Business banking account Emerge secures investment

In a round led by Altered Capital, New Zealand-based fintech Emerge has raised approximately $7.3 million in Series A funding in its bid to build the country’s first challenger bank.

The round also featured participation from Icehouse Ventures, K1W1, NZ Fintech Fund, and Hard Yaka, a venture capital firm based in the U.S. Emerge will use the capital to support adding talent in marketing, sales, and product development. The company will also use the funds to accelerate its go-to-market strategy, including offering banking services to startups.

“Emerge was built to help Kiwi businesses do more, faster, better,” Emerge Co-founder Jovan Pavlicevic said. “In just a few minutes, you’ve opened as many Emerge accounts as you need, with features better than the banks, and team cards ready to go.”

A digital-first banking alternative, Emerge offers companies a single platform to manage their business finances. Emerge’s technology simplifies expense tracking, enables the creation of debit cards — including an unlimited number of virtual cards — and allows users to make and receive payments with a New Zealand business banking account backed by ANZ. Emerge provides bookkeeping and reporting tools and makes it easier for companies to track and manage their finances with a centralized view of their data. The company has also launched a service called EmergePay that converts a smartphone into a payment terminal.

Emerge evolved from a children’s financial literacy app called SquareOne that Pavlicevic and co-founder Jamie Jermain founded in 2020. Emerge was developed in January 2024, as the company shifted its focus toward providing banking services for SMEs, with the ultimate goal of becoming a neobank.

Headquartered in Auckland, Emerge was named to the Forbes Asia “Top 100 to Watch” in August.

FirstCape deploys wealthtech from InvestCloud

New Zealand’s largest wealth advice and asset management company, FirstCape, has partnered with InvestCloud to enhance the wealth management experience for advisors and clients alike. The deployment will help FirstCape increase the efficiency of its advisors, as well as provide a single platform for client engagement, experience, and advice at scale.

“We formed FirstCape with a stated intention of enhancing our client offering,” FirstCape CEO Malcolm Jackson said. “Integrating InvestCloud’s tools that streamline portfolio management and order execution is part of delivering on that promise. We continue to be focused on providing a complete suite of services tailored to every client’s unique needs at whatever stage of their investment life cycle.”

With more than 120 advisors and more than $30.3 billion (NZ $50 billion) in assets under management, FirstCape was forged earlier this year through the combination of four entities: JBWere NZ, Jarden Wealth, Harbour Asset Management, and BNZ Investment Services. The company has already deployed two InvestCloud solutions: Portfolio Manager and Order Capture. Portfolio Manager enables advisors to manage client portfolios with deeper insights that lead to tailored investment proposals. Order Capture provides a seamless interface for trading across asset classes, boosting operational efficiency by enabling advisors to act faster in response to client needs.

“We are thrilled to see the tangible success of our partnership with FirstCape as they embark on this modular digital transformation,” InvestCloud President of Digital Wealth International Christine Mar Ciriani said. “By leveraging our full suite of innovative front-office solutions, we are helping FirstCape create a robust digital backbone that will drive their growth, streamline advisor efficiency, and elevate client experiences.”

A global wealthtech company, InvestCloud serves wealth and asset managers, wirehouses, banks, RIAs, and insurers. InvestCloud’s clients represent more than 40% of the $132 trillion in total assets globally. A provider of digital wealth management and financial planning solutions since 2010, InvestCloud was named a CNBC “World’s Top Fintech Company” earlier this year. The firm is headquartered in West Hollywood, California.

International payments specialist Ebury arrives in New Zealand

Ebury, a specialist in international payments and collections, opened new offices in New Zealand this week. The move is designed to help the company provide a range of services to SMEs in the country, including cash management strategy and foreign exchange risk management.

“At Ebury, we embrace the complexity and risk of daily cross-border payments that enable business growth, in a way that traditional banks do not, or cannot,” Ebury Managing Director for APAC, Rick Roache said. “We make the sophisticated products and services that banks typically reserve for their biggest clients accessible to SMEs.”

The New Zealand office represents Ebury’s 40th office worldwide, and comes six years after Ebury expanded to neighboring Australia. The move to New Zealand also supports the company’s presence in nearby Shanghai and Shenzhen in China.

“Right now there are few options for SMEs looking for cross-border payment solutions and local advice in New Zealand,” Roache added, “so we’re really excited to bring our innovative technology platform into the market supported by a ‘boots on the ground’ team that differentiates us from other providers.”

Headquartered in London and founded in 2009 by a pair of Spanish engineers, Ebury serves primarily SMEs and mid-cap companies with payments, collections, and foreign exchange services in more than 130 currencies. Santander acquired a minority stake in the company for $459 million (£350 million) in 2020, and added to its stake two years later. With more than 1,700 employees across 25 countries, Ebury is reportedly preparing for an IPO in 2025 that would value the company at as much as $2.2 billion (£2 billion).

Here is our look at fintech innovation around the world.

Latin America and the Caribbean

- Warburg Pincus acquired a minority stake in Brazilian accounting-based fintech Contabilizei for $125 million.

- PXP Financial teamed up with Latin American payments platform Kushki.

- Brazilian paytech Barte raised $8 million in Series A funding in a round led by AlleyCorp.

Asia-Pacific

- Singapore-based finance platform for businesses, Aspire, secured in-principal approval for the Major Payment Institution license from the Monetary Authority of Singapore (MAS).

- Bank of Hangzhou teamed up with Malaysia’s Maybank to support Chinese businesses as they expand operations in Southeast Asia.

- Vietnamese private bank VPBank partnered with customer engagement platform CleverTap.

Sub-Saharan Africa

- Somalia’s Premier Bank has teamed up with Mastercard and Tappy Technologies to launch Tap2Pay, a tokenized-passive payment wearable.

- Fintech provider Flutterwave partnered with 9jahotel.com to launch a point-of-sale system to enhance hotel management in Nigeria.

- Nigerian cryptocurrency exchange Yellow Card secured $33 million in Series C funding.

Central and Eastern Europe

- Romanian payment service Pago secured $2.5 million (€2.3 million) to fuel expansion.

- Budapest, Hungary-based B2B payment solutions provider, PastPay, raised $13 million (€12 million) in Series A funding.

- Romania’s national mobile payment system, RoPay, went live this week.

Middle East and Northern Africa

- UAE’s National Bank of Fujairah to deploy banking technology from Intellect Global Transaction Banking (iGTB).

- Cross-border payments company Thunes expanded its Direct Global Network to Egypt.

- Morocco-based CIH Bank turned to Backbase for its Engagement Banking platform.

Central and Southern Asia

- Mastercard opened a new tech hub in Pune, India.

- Fingular, a neobank based in Singapore, launched a new digital lending business in Bangladesh.

- TBC Bank Uzbekistan secured a $10 million line of credit from Switzerland’s responsAbility Investments AG. Read our Finovate Global interview with TBC Bank Uzbekistan’s Head of International Business Oliver Hughes.