If there is one theme that unites all of our FinovateEurope Best of Show winners this year, that theme may be summed up in one word: data. As Finovate senior research analyst Julie Muhn pointed out during a recent conversation, the ability to leverage data to create more meaningful, more personalized, more secure experiences for consumers of financial services underlies much of the innovation that we see not just on the Finovate stage, but across fintech writ large, as well.

In this way, financial technology is turning the old adage – it’s not what you know, it’s who you know – on its head. The connections between us and the things we do, the places we go, the transactions we make, are in many ways the Holy Grail for companies that are constantly seeking out better ways to serve us. And for those companies that do win our trust and gain access to what we know and do, the rewards could not be greater.

With this in mind, we present to you a small sample of those companies that may be best positioned to take advantage of this Golden Age of Data: the Best of Show winners of FinovateEurope 2018.

![]() Backbase for its Customer OS, the next generation of the Backbase Digital Banking Platform, which is laser-focused on providing customer-first journeys. Video.

Backbase for its Customer OS, the next generation of the Backbase Digital Banking Platform, which is laser-focused on providing customer-first journeys. Video.

![]() Be-IQ for its holistic and gamified approach to risk profiling and financial well-being that accounts for the very contradictions that make us human: our behaviors. Video.

Be-IQ for its holistic and gamified approach to risk profiling and financial well-being that accounts for the very contradictions that make us human: our behaviors. Video.

![]() CREALOGIX for its customer banking platform, Gravity, which is breaking new ground with its intuitive and user-friendly, self-service insights application. Video.

CREALOGIX for its customer banking platform, Gravity, which is breaking new ground with its intuitive and user-friendly, self-service insights application. Video.

iProov for its liveness-protected, facial biometric authentication technology which is fully-automated for fast, easy and ultra-secure mobile and PC on-boarding. Video.

iProov for its liveness-protected, facial biometric authentication technology which is fully-automated for fast, easy and ultra-secure mobile and PC on-boarding. Video.

![]() Meniga for its digital banking solution that helps banks around the world use data to personalize digital channels and drive customer engagement. Video.

Meniga for its digital banking solution that helps banks around the world use data to personalize digital channels and drive customer engagement. Video.

Microblink for BlinkReceipt, its SDK for real-time extraction of all purchase data from retail receipts and OCR technology which eliminates typing from mobile apps. Video.

Microblink for BlinkReceipt, its SDK for real-time extraction of all purchase data from retail receipts and OCR technology which eliminates typing from mobile apps. Video.

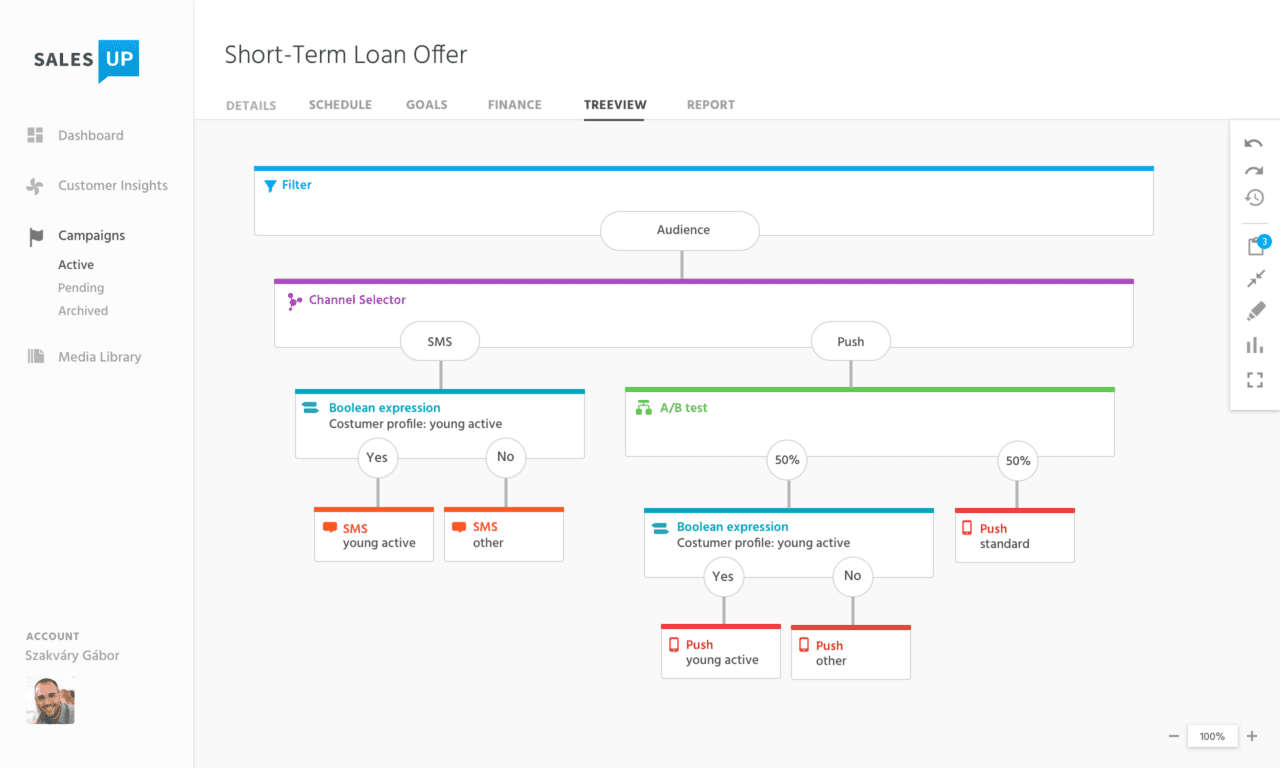

![]() W.UP for its digital banking sales and engagement solution that uses pre-built customer insights to build relevant, personalized, and timely interactions with clients. Video.

W.UP for its digital banking sales and engagement solution that uses pre-built customer insights to build relevant, personalized, and timely interactions with clients. Video.

Please join us in thanking our sponsors and partners who help us make FinovateEurope a huge success year in and year out. And be sure to stay tuned for coverage of our new extended format on Thursday and Friday as we take deep dives into some of the most pressing issues and fascinating trends in fintech today. For more information about the keynote addresses, panel discussions, and fireside chats coming up on Days Three and Four, our full agenda is available on our FinovateEurope 2018 page.

Presenters

Presenters Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP.

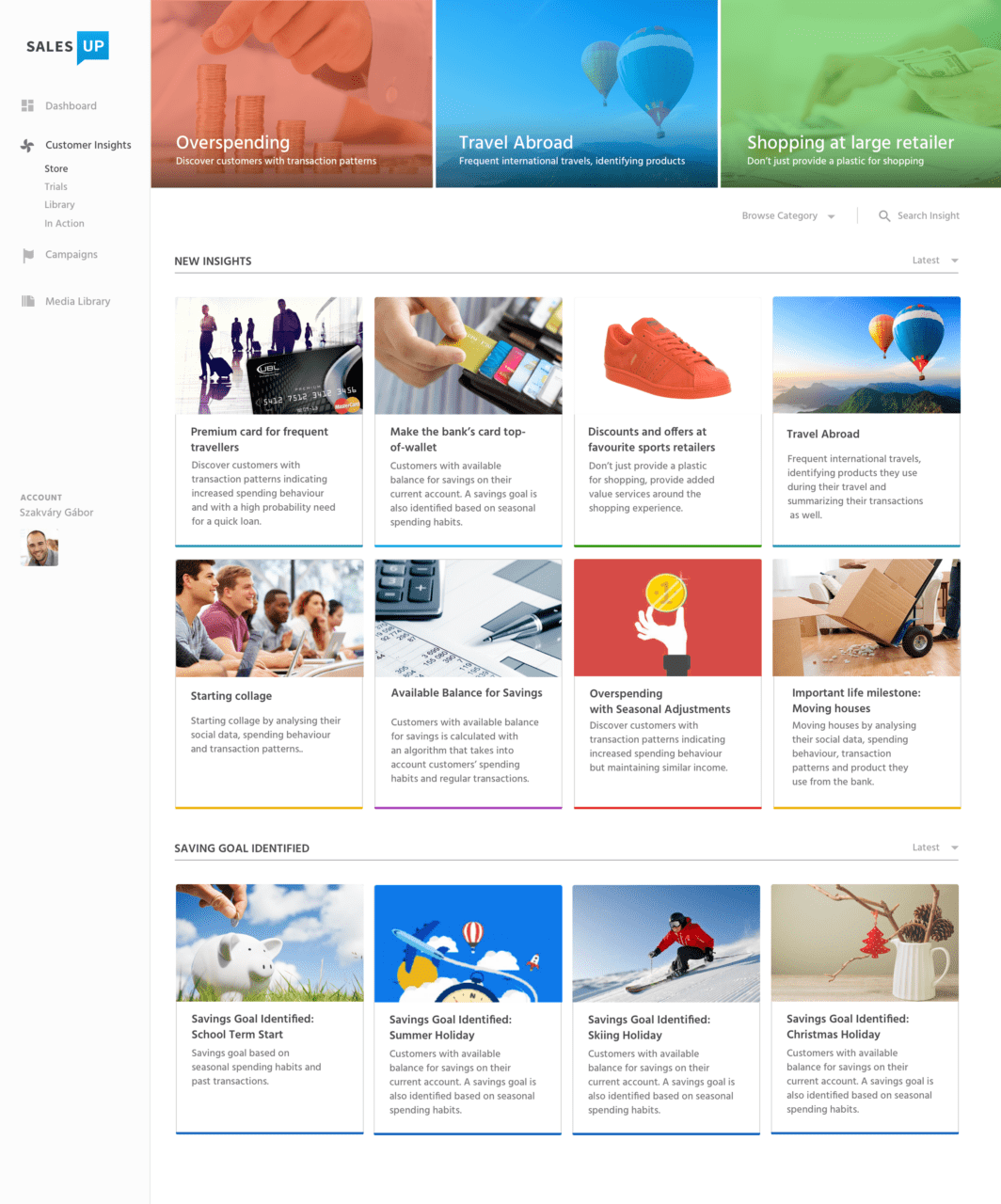

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP. Sales.UP’s Customer Insights Library

Sales.UP’s Customer Insights Library

Above: Marketers can build their own campaigns with W.UP’s automation tool

Above: Marketers can build their own campaigns with W.UP’s automation tool

Balázs Zotter, Head of Product Line

Balázs Zotter, Head of Product Line