What’s in your wallet? Or rather, what’s in banks’ clients’ wallets? Some sexy competition appeared on the market yesterday, as Apple announced the pending launch of its own credit card in collaboration with Goldman Sachs and Mastercard.

The card is touted more for its mobile and digital qualities than its shiny titanium finish. Despite the shine, however, many of the card’s features and offerings aren’t new. And that’s good news for banks. While traditional financial institutions aren’t as sexy as tech companies such as Apple, they are generally viewed as more trustworthy. And with that kind of foundation, all banks need to do is piece together the features into their own credit card offering and market it properly.

Fortunately, there are plenty of fintech firms out there to help. Here are some of the features Apple is promoting and a list of corresponding fintechs that can help banks take the same approach.

Physical card security

Apple boasts a titanium card with the customer’s name etched on the front– no credit card number, no cvv code, no expiration date. All of that information is tucked away inside the app. Physical card innovator Dynamics takes a similar (though admittedly less visually appealing) approach. The Pennsylvania-based company offers a computer-in-a-card that hides part of the card number, the cvv code, and expiration date on the physical card until the consumer enters their PIN into the card. As an added bonus, Dynamics also offers in-card loyalty and rewards features, as well as a card that hosts multiple numbers, allowing customers to toggle between debit and credit cards.

Chat functionality

As a company that is known for simplifying technology, Apple is taking a similar approach with its customer service. “Have a question? Just text,” is the message the company features on its card website. Fortunately, there are plenty of fintechs that help banks simplify their customer experience. Two such companies are Finn.ai and Clinc, both of which leverage AI to save banks money on customer service representatives, while simplifying and expediting access to answers via a chat interface.

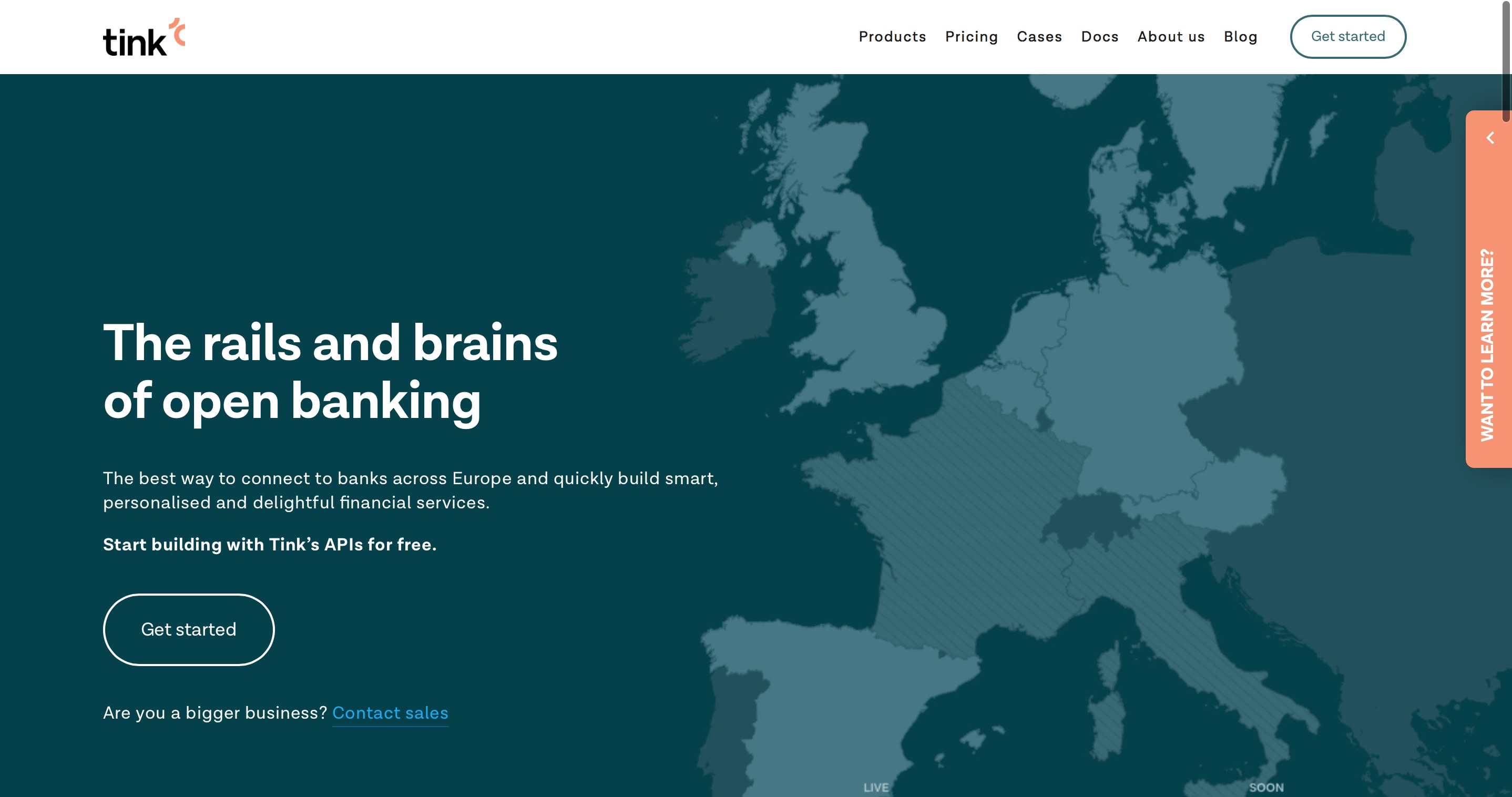

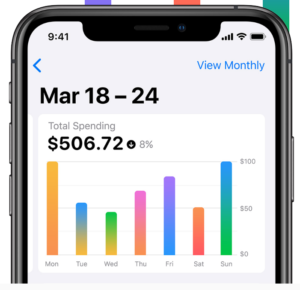

PFM

PFM

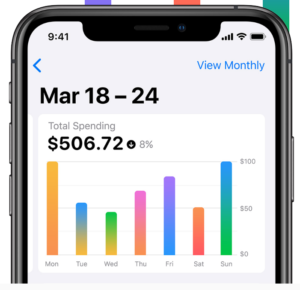

One way to win over customers is to convince them you’ll help them organize their finances and ultimately save them money. That’s why Apple is offering in-app PFM capabilities. And while the technology hasn’t changed much since it debuted before the fintech craze, the colorful user interface is beautiful enough to convince anyone to want to look at their spending behavior.

Banks have seemingly endless options to compete with this feature. And while most financial institutions currently offer some sort of PFM capabilities, it’s worth looking at it from a superficial point of view. Utah-based MX and Sweden-based Tink both offer visually-pleasing interfaces that are arguably more beautiful than Apple’s and are backed by powerful PFM engines.

Mobile app security

Apple’s iPhone holds the hardware for both fingerprint and facial recognition technology, and since the company is reinforcing its focus on security, it is leveraging biometrics for account access. With the right software, banks can leverage fingerprint and facial recognition technology as well. Jumio, IDology, and Mitek all offer technology banks can implement for fast account access, as well as account onboarding.

Fast onboarding

With access to consumer data, Apple has an advantage of being able to quickly onboard new consumers using existing consumer information. There are multiple fintechs that help banks onboard consumers quickly, as well, including Digital Onboarding, Q2’s Gro Solutions, and Fenergo. Digital Onboarding motivates customers to open new accounts using incentives and gamification. Gro Solutions touts the ability for customers to open and fund accounts in under four minutes. And Fenergo takes a holistic approach to onboarding, providing banks a lifetime view of the client to help perform data refreshes, ongoing due diligence, and upsell and cross-sell opportunities.

Rewards

Credit card rewards programs may seem like a feature of the past, but rewards are certainly still relevant. With its new card’s rewards program, Apple once again seeks to simplify things by offering consumers daily rewards. Two fintechs, Cardlytics and Cartera Commerce, offer tried and true loyalty and rewards programs. These offerings not only boost consumer loyalty, they also offer banks further insight and analysis into consumer spending.

Apple’s new credit card is shipping this summer. Fortunately for banks, fintechs are here to help them compete.

PFM

PFM