After three days at SourceMedia’s Digital Banking Summit, one thing is clear: mobile technology ensures that consumers will compare the “banking experience” to every other experience available via the mobile channel.

That includes everything from retail shopping to interactive game-playing and messaging to watching streaming entertainment.

And that’s just how it begins, to borrow the metaphor from the conference’s Digital Banker of the Year, Niti Badarinath of U.S. Bancorp. In fact, the experience of interacting with your bank increasingly will be compared to the experience of interacting via the best of social media, the best of online shopping, the best brick and mortar retail, and so on. This is coming whether or not banks are ready for it or not.

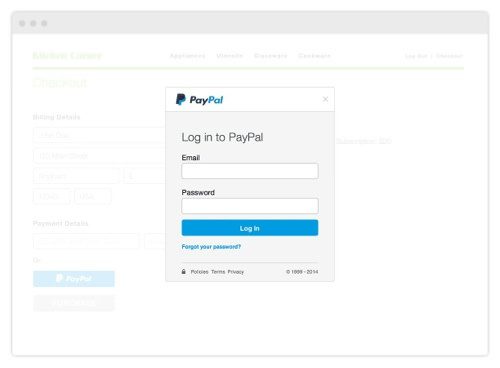

In other words, buying products and services from a bank will need to be as easy as catching a ride from Uber. Payments as efficient as PayPal. Customer service like Amazon.com’s Mayday. Branches like Apple Stores …

Much of what I heard that seemed most worth hearing echoed these ideas. I heard it in a poolside briefing with Marc Winitz of Monitise, who talked about the expanding opportunities for banks in e-commerce (stay tuned for more on that conversation). I heard it from Niti, who spoke from the stage about how non-banks like Apple and Google are driving consumer expectations higher.

Seen this way, the “channel” debate takes on an even bigger, meta-context. In the same way that consumers choose and switch between mobile, desktop, and tablet channels (and typically in that order over the course of the day, I learned at the conference), so to are banks likely to become just another channel for payments, e-commerce, authentication, and more. And therein lies the challenge and opportunity.

Will financial institutions leverage the fact that they remain, years after the financial crisis, highly trusted? And, at least from a financial data perspective, nobody knows us better. After all, who is more capable of providing a personalized purchasing, saving, shopping, budgeting, investing, insuring experience than your bank?

It’s clear that fintech innovators are on the case. One presentation, “My Digital Banking Nirvana” by Jim Marous, listed some 30 different ways that companies getting it right when it comes to providing a “simpler, engaging, and contextual” experience.

And we’re not just talking about payments – which one speaker called the “lowest value-add” in a digital wallet . Will banks begin to see at least a part of what they could do best as a form of “digital marketing”? One speaker used the phrase “a buyer’s club” on the consumer’s behalf when thinking about a potential direction for banks. A role that put banks at the center of a whole life of financial activity from retail shopping and family budgeting to saving for college and preparing for retirement.

About Those Banks

U.S. Bancorp was among the better represented financial institutions at the conference. And that was not just because one of the company’s executives walked away with the Digital Banker of the Year award (though it helps). From their work with the e-commerce Peri app to their innovations in “photobanking,” U.S. Bancorp is providing both a strategic template (“place small bets / fail fast / learn quickly”) as well as a suite of products and services geared toward consumers emerging mobile preferences.

Wells Fargo provided interesting contributions in a number of different areas, ranging from a conversation on omni-channel integration to a panel discussion on the relationship between fintech and wearable technology. Wells Fargo’s Brett Pitts highlighted the importance of combining channel use with transaction type in order to better understand what he called “customer intensity.” This concept, he said, was the “lever for growth” for banks. But it means that banks must commit to the providing as wide a range of channel options as possible. Brett noted that customers that took advantage of three channels, for example, the branch, the phone and digital, were almost twice as likely as digital only customers to make a purchase decision, and almost 50% more likely than branch only customers.

Also noteworthy was the panel discussion on “Fueling the Financial Revolution” by representatives of BBVA Ventures, Q2, Lending Club, and GreenDot. Here the focus was on cost containment, a willingness to start “from scratch”, and a focus on doing what banks were not or could not do (the “$14,000 unsecured consumer loan” in the words of Lending Club’s Jeff Bogan.)

That’s not to say the world of alternative lending is all nimbleness and brand new technology – two factors cited by Q2’s Matt Flake as helping provide an edge for new upstarts. The challenge of finding top notch talent outside of a few regional hotbeds like the Bay Area can be especially acute for startups. And there is the ever-present issue of incumbent players, incumbent technology, and incumbent ways of thinking. Said Jeff, “The value of banks in a community is about more than just lending. But can banks partner with technology providers who can give (them) what (they) need? Will banks take the risk?”

Finovate Alums in Attendance

In addition to some of those mentioned above, there were more than a handful of Finovate alums exihibiting at the conference, holding court at busy booths in the networking area. Present and accounted for were:

- FIS

- Fiserv

- GMC Software Technology

- Kofax

- MicroStrategy

- LeadFusion

- Monitise

- Waspit

PayPal

PayPal