With the announcement that its PFM app will be available on Motorola’s Moto 360 and Samsung Gear smartwatches, Moven is showing just how affectionate fintech’s relationship with wearable technology can be.

As quoted in American Banker, Moven founder and CEO Brett King sees wearable technology as delivering the key real-time financial feedback that is critical in making financially-savvy behavioral changes. Focusing on specific spending decisions rather than psychology, King calls his solution “day-to-day gamification of financial wellness.”

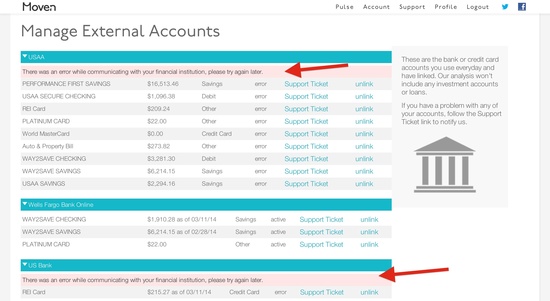

Moven’s app works differently from traditional PFM budgeting apps in some ways. Referred to as

“anti-budget” in a review by VentureBeat, Moven’s technology includes a debit card and an app that tracks spending in real-time. Notifications and alerts are sent when spending nears or reaches pre-set levels. Monthly spending is also tracked by category.

What’s interesting about redesigning mobile apps for smart watches is the way it will sharpen the focus. What information will a consumer want at a glance at the wrist? Because the smaller form factor, developers will need creative ways to communicate PFM data as quickly as consumers can tell time.

Here’s a look at how Moven plans to do it:

Moven’s emphasis on notifications (King calls them “key to engagement”) is in sync with comments King has made previously about wearables and financial technology. In a

roundtable discussion led by The Financial Brand’s Jim Marous, King pointed out that the device is just another channel. “I don’t think wearables per se is the key here,” he said.

“The more important issue is understanding context and what data the customer needs to make a decision. Banks need a feedback or personal data strategy for customers independent of the device.”

Founded in 2011 and based in New York, Moven says it has “tens of thousands” of cardholders, with “hundreds of thousands” having downloaded the app. The company expects to have a total of more than

10 million users by the end of 2015.

Accounts Receivable Management takes a look at Global Debt Registry.

Accounts Receivable Management takes a look at Global Debt Registry.

Silanis Technology

Silanis Technology

San Antonio Federal Credit Union to

San Antonio Federal Credit Union to