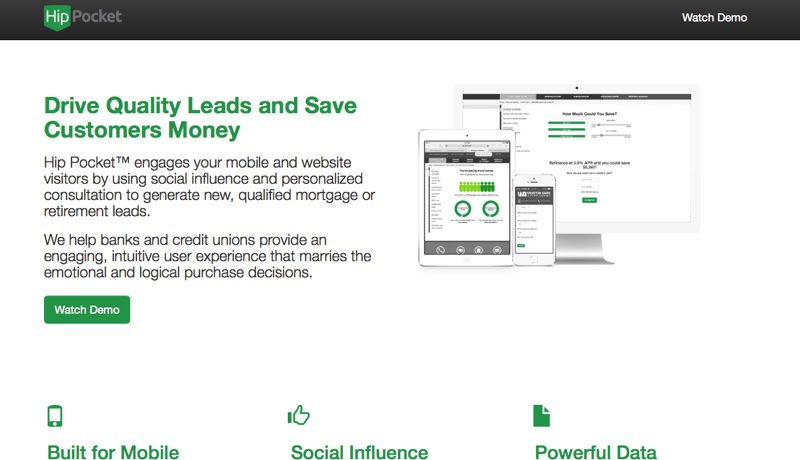

Hip Pocket is a web-based app that helps consumers compare their mortgage rate with that of their peers and the bank’s current rate. The white-label solution leverages the popularity of financial calculators and other interactive financial tools to give potential borrowers the best chance at securing a mortgage that is right for them.

For Mark Zmarzly, CEO and founder, the average person’s spirit of competition and sense of fairness are powerful tools to encourage people to look for better financial opportunities. And Zmarzly believes that banks and credit unions that provide these tools will build trust with new and existing customers alike over the long run.

From left: Todd Cramer, Hip Pocket’s head of design, and Mark Zmarzly, CEO, founder, demonstrated their Mortgage Comparison Software at FinovateSpring 2015 in San Jose.

“Of the hundreds of banks we talked to,” Zmarzly said, “all said they want more online engagement, they want lead gen, and that their online calculators were one of their most powerful and most-visited tools on their website.” The problem? All of the calculators were self-service.

Hip Pocket eliminates that pain-point, he explained, automating the self-service calculators and providing the user with personalized, custom savings “without making them work for it.” And with version 1.0 launched in July 2014, Hip Pocket came to San Jose this spring to debut Version 2.o of this mortgage-comparison solution.

Company facts:

Company facts:

- Founded in June 2013

- Headquartered in Lincoln, Nebraska

- Raised $110,000

- Has three employees

How Hip Pocket works

Zmarzly says his experience years ago in auto financing helped tip him off to the idea that educating borrowers on their rate options is not only a good service, but also can be part of an effective customer-engagement strategy. “I used to look for people who were overpaying,” he explained. “But there was no practical way to provide rate-comparisons for thousands of borrowers via direct mail.” It was something, however, that could be done digitally, and that was where the idea of Hip Pocket was born.

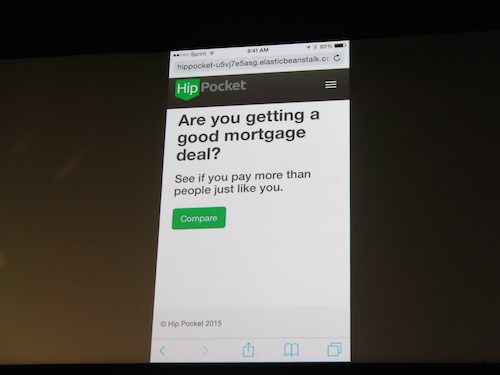

Hip Pocket lets users compare their current mortgage with both the mortgage products offered by the hosting bank or credit union, as well as with “a unique, unbiased, peer group” based on age, location, marital status, and credit rating.

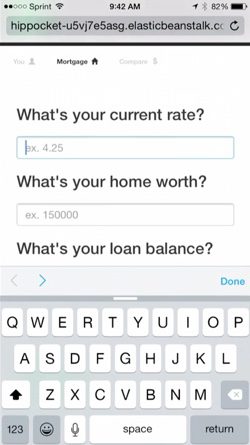

After entering that demographic information, users add their current rate, value of their home, loan balance, and number of years left on the mortgage. Zmarzly says that with these eight data points, Hip Pocket is able to provide peer and

After entering that demographic information, users add their current rate, value of their home, loan balance, and number of years left on the mortgage. Zmarzly says that with these eight data points, Hip Pocket is able to provide peer and product comparisons, as well as overall market intelligence when the anonymous data is aggregated.

Hip Pocket also achieves low abandonment rates. “Keeping the process simple at just eight data points, yields a nice 84% completion ratio once someone starts the engagement,” Zmarzly said.

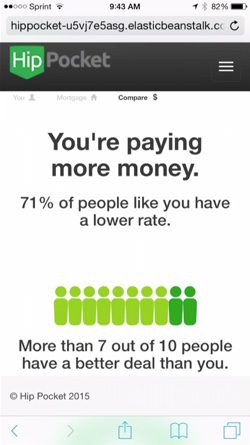

Hip Pocket uses natural conversational language and social comparisons to encourage users to action. Messages such as “More than 7 out of 10 people have a better deal than you” and “You pay $10,629 more interest than your peers” are designed to appeal to the user’s sense of both competition and fairness. Zmarzly says this combination allows people to “apply an emotional reason (to) back up a logical reason.”

“Fairness is a big emotion,” he said. “It’s a reason why people make decisions, especially financial decisions.”

“Fairness is a big emotion,” he said. “It’s a reason why people make decisions, especially financial decisions.”

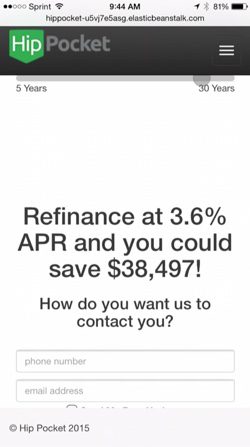

Hip Pocket then lets the user see how much he or she could save per month, per year, and over the life of the loan if they refinance with the hosting bank or credit union. This is followed by a specific offer with the rate, a call to action, and preferred contact method.

Users who learn that their rates are better than their peers, are encouraged to share their good fortune with their peers via social media. Zmarzly said that even if this does not result in a new refinancing, it helps build the kind of trust he fears banks and other FI’s have lost in recent years.

The technology is relatively straightforward. The calculator, Zmarzly said, is a “super-simple java script that goes right on the website.” He says the simplicity is all by design: “We wanted easy and fluid so they can make changes later.” The data is available instantly via API. “No uninstall process if they want out,” Zmarzly said.

The future

The future

As one FinovateSpring observer suggested, the challenge for Hip Pocket may be the willingness of lenders to actively compete on rates. To this end, Zmarzly intends to keep the app both diversified and FI-plentiful. “The more data we get, the more we’ll be able to maximize the flow of what goes through,” he said. “More institutions (means) more data.” Currently targeting community banks, especially at the $5 billion-and-above mark, Zmarzly is also keen to partner with credit unions and even PFM partners. “Distribution is our focus,” he said.

Looking forward, Zmarzly envisions companion products such as the retirement-comparison solution the company launched shortly after Hip Pocket’s Finovate debut. The key is a relationship in which both the consumer and the bank gain. “Consumers need context for (banks) to establish value and trust,” he said. He cited a recent survey in which 69% of respondents said that when banks asked for personal data, it was for the bank’s benefit, and never delivers value to the consumer.

Zmarzly said, “That is where Hip Pocket can help.”

Check out the FinovateSpring 2015 demo video for Hip Pocket below.

Adrian Nazari, CEO

Adrian Nazari, CEO Jesse Levey, Head of Product

Jesse Levey, Head of Product

Mark Zmarzly, CEO, Founder

Mark Zmarzly, CEO, Founder Todd Cramer, Head of Digital Experience & Design

Todd Cramer, Head of Digital Experience & Design itBit

itBit Charles Cascarilla, CEO, Co-founder

Charles Cascarilla, CEO, Co-founder Bobby Cho, Director of Institutional Client Group (ICG)

Bobby Cho, Director of Institutional Client Group (ICG) Drew Hyatt, Senior Vice President, Mobile Applications

Drew Hyatt, Senior Vice President, Mobile Applications Diane Morgan, Senior Business Development Manager

Diane Morgan, Senior Business Development Manager Mitek

Mitek Michael Nelson, Vice President for Business Development

Michael Nelson, Vice President for Business Development Sarah Clark, Vice President Product Owner

Sarah Clark, Vice President Product Owner

Thomas Ko, President, Co-founder

Thomas Ko, President, Co-founder Piotr Budzinski, CEO, Co-founder

Piotr Budzinski, CEO, Co-founder

Abhiram Modak, Principal Business Analyst & Industry Expert

Abhiram Modak, Principal Business Analyst & Industry Expert