Innovators from Avoka to Yodlee are taking the stage to practice their presentations here on rehearsal day at FinDEVr San Francisco 2014.

FinDEVr San Francisco 2014: Helping Developers Do What Developers Do Best

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Innovators from Avoka to Yodlee are taking the stage to practice their presentations here on rehearsal day at FinDEVr San Francisco 2014.

We’ll be kicking off the first FinDEVr conference on Tuesday, September 30. There you’ll meet the developers and builders behind fintech companies such as Yodlee and Visa, and have the opportunity to code with them and others during several workshop sessions.

UCSF Mission Bay Conference Center1675 Owens Street Suite 251San Francisco, CA 94143-3008

Day OneOn Tuesday, September 30, registration begins at 8AM and we’ll serve a light breakfast until 9AM, at which point the presentations will begin. We’ll have a single-track schedule featuring presentations and intermittent networking sessions.

Day TwoOn Wednesday, October 1, registration and a light breakfast will run from 8AM to 8:30 AM, and the first workshop will begin at 8:30AM. We’ll have workshops throughout the day, running alongside separate presentation sessions in the afternoon.

Ahead of the FinDEVr conference next Tuesday and Wednesday, 50 companies will make their way to the UCSF Mission Bay Conference Center in San Francisco.

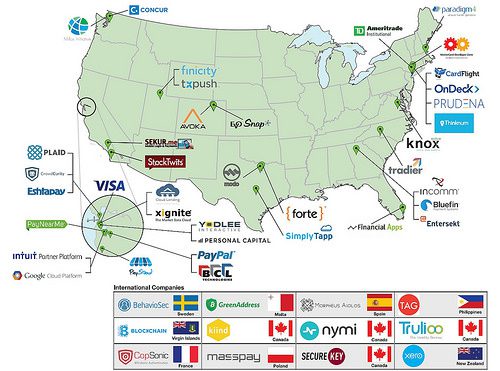

While 14 of the companies are local to the bay area, others will travel from all over the U.S. and even the globe to present their APIs, SDKs, and other tools at the first ever FinDEVr conference.

Here’s what the spread looks like (click to enlarge):

If you’re already registered, be sure to join the community of other developers on the Bizzabo app. Just download Bizzabo from the app store and search “FinDEVr”.

See you in San Francisco!

There will be a lot going on over the course of the two day FinDEVr conference in San Francisco next Tuesday and Wednesday. You can still pick up your ticket here.

Each of the companies below will have 6 minutes on stage to show off what their tools are all about:

PayStand, an online payment solution that offers zero transaction fees

Plaid, an API that powers fintech applications

Plaid is an API for financial infrastructure – we give developers the tools they need to build applications that interface with banks.

Prudena is a subscription-based online community that provides value analysis to developers.

SecureKey Technologies delivers authentication solutions for online consumer services

Sekur.me eliminates passwords by turning your phone into your digital identity.

SimplyTapp provides host card emulation

Tagcash, a digital payments and rewards company

The TxPUSH Initiative makes real time account events available to third party apps.

Thinknum provides technology for financial analysts to host their financial data in the cloud.

Trulioo a cyber identification company.

FinDEVr, the first event for fintech developers, is right around the corner. For the past few weeks we’ve introduced you to some of the innovators who will be presenting, demoing, and holding workshops on Day One.

Today, we’re happy to help you get to know some of the companies that will be showcasing and sharing their APIs, SDKs and more on Day Two.

BCL Technologies develops APIs for Financial Text Extraction that unlock Big Data in unstructured documents and websites, enabling FinTechDevelopers to easily extract structured Financial Triplets from any source.

Toronto-based Bionym is a team of experts in cryptography, biometrics, and security. Our first product is the Nymi, a wearable device that enables the user to authenticate once via unique cardiac rhythm and securely and seamlessly assert Persistent Identity to any system.

Blockchain is the world’s most popular, web-based Bitcoin wallet and the most highly trafficked Bitcoin website. Blockchain is the defacto search engine for the Bitcoin community. Blockchain has over 2 million wallets and our footprint continues to grow quickly.

CrowdCurity is a web security marketplace. We connect businesses with security testers. We do bug bounty programs-as-a-service. Bitcoin First.

Entersekt is an innovator in transaction authentication and mobile app security. Our one-of-akind approach to harness the power of electronic certificate technology with the convenience of mobile phones providing financial institutions and their customers with full protection from online and mobile banking fraud.

Google Cloud Platform enables

developers to build, test, and deploy applications on Google’s highly scalable and reliable infrastructure. This suite of services allows developers to choose from computing, storage, and application services for web, mobile, and backend solutions.

GreenAddress IT is a leader in securing bit coins and providing instant clearing confirmations. It supports desktop, mobile, and web apps, and offers a very featureful and secure wallet as well as APIs to enable third party developers.

Kiind helps businesses reward their employees and customers with gift cards., With Kiind, you can easily send personalized offers to multiple contacts, and Kiind’s technology allows you to defer when you pay for rewards and gifts, thereby saving you money.

Knox Payments allows people to make ACH payments using only their online banking login information, providing the cheapest, safest, and easiest way to accept digital payments.

MASSPAY is m-payments for every(f)one. If you know how to dial, you know how to pay. It’s simple and convenient. You don’t even need a smartphone with a data plan – you can use it with an NFC QR code. MASSPAY is the first solution dedicated to emerging and developed markets with minimum investment.

Morpheus Aiolos is a company based in Spain that has developed financial software since 2012. We have two featured products: an API to extract bank transactions and a clone of Mint, which uses the API.

If you’re one of the lucky ones who will be able to tell the grandkids that you were at the very first FinDEVr, then congratulations! We couldn’t be happier to have you onboard for what promises to be a historic opportunity for developers looking to make connections or add key final pieces to their own fintech projects.

We are expecting a diverse crowd on September 30 and October 1. Not only will decision-making CEOs and app-building developers be on hand for this inaugural, two-day event, but just about everybody in between, as well (see below).

Here’s Part Three of our final preview of the companies that will be demoing their technologies on Tuesday, September 30, Day One of FinDEVr. In this installment, we look at:

Paradigm4 develops and supports SciDB: the open source, analytic DBMS; programmable from R & Python. SciDB is designed from the ground up to support more facile data management for Big and Diverse data and to do faster and bigger math. Hard questions. Fast answers. Open source.

PayNearMe enables consumers to pay rent, repay loans, buy tickets, make online purchases, and do much more with cash. Consumers can make cash payments in their own neighborhood in less than 60 seconds through PayNearMe’s network of 17,000 authorized payment locations including 7-Eleven, Family Dollar, and ACE Cash Express stores.

Personal Capital helps people live better financial lives with technology-enabled advisory services as well as free financial software and educational content. Their award-winning apps enable you to effortlessly view your entire financial life in one place. Personal Capital brings to everyone wealth management that previously only the wealthiest could afford.

StockTwits is a social network and publishing platform for investors and traders. We created the $ prefix of stocks (e.g. $MSFT). Follow @StockTwits and go to stock twits.com of real-time ideas and stock conversations.

Tradier is a financial services cloud provider that offers a groundbreaking solution to serve platform providers, developers, and investors. The Tradier solution features an innovative set of fully hosted APIs, modules, and “out of the box” tools that are leveraged by a growing list of providers.

FinDEVr begins in just over a week. To be a part of the first fintech event for developers, click here to get your tickets today.

Here is Part Two of our last look at the companies that will demo on Tuesday, September 30. In this installment, we meet:

CopSonic is a French company founded in 2013 specialized in the development and marketing of its sonic and ultrasonic authentication technology. The company is composed out of a strong team of researchers and engineers specialized in security, payment, sonic and ultrasonic authentication protocols. Recently, CopSonic joined the Microsoft Partner Network and became a member of the FIDO Alliance organization.

Founded in 1999, Finicity is a privately held fintech industry pioneer. Leading the charge to the Evented Financial Web, Finicity enables fintech developers to build real-time apps through its RESTful Aggregation API and the Finicity API Platform.

The Mifos Initiative is a 501(c)3 non-profit that guides the development of the Mifos X solution for financial inclusion, an API-driven open source platform with a suite of configurable cloud apps. Our community speeds the elimination of poverty by scaling financial services to the 2.5 billion unbanked.

ModoPayments powers better buying experiences with better economics, created by YOU! Using our handcrafted API, any developer can build their own mobile app with the ability to perform in-store purchases at tens of thousands of store locations. Modo powers the payments and tech and you design the experience.

Launched in 2007, OnDeck uses data aggregation and electronic payment technology to evaluate the financial health of small and medium sized businesses to efficiently deliver capital to a market underserved by banks. Its proprietary technology – the OnDeck Score – enables small businesses to obtain affordable loans with a fraction of the time and effort that it takes through traditional channels. OnDeck’s credit models look deeper into the health of businesses, focusing on overall business performance, rather than the owner’s personal credit history.

One of the great things about FinDEVr is the way it gives us the opportunity to get to know both new companies and innovators as well as see familiar companies and innovators in new and exciting ways.

To this end, here is the first of three looks at another fifteen innovators who will be taking the stage on September 30, Day One of FinDEVr.

BehavioSec is a leader in frictionless behavioral user verification & authentication. BehavioSec examines how you interact with a website or mobile device to provide a frictionless layer in web fraud prevention.

Bluefin Payment Systems is a leading FinTech company focused on processing, integrating, and securing payments. Bluefin offers P2PE, tokenization, mobile payment SDK’s, payment gateways, merchant accounts, PCI Compliance, transparent redirect, recurring billing, and branded online merchant account enrollment.

CardFlight is a leading provider of mobile POS technology and tools that makes it easy for anyone to accept swiped (card present) payments in any mobile app with virtually any merchant account. They offer both iOS/Android mobile payment applications and software development kits (SDKs) that can be incorporated into custom applications. CardFlight’s platform also includes encrypted card readers and a payment gateway that supports over 20 different processors, to provide clients with complete mobile payments and mobile POS (mPOS) solutions. CardFlight won the Electronic Transactions Association’s 2014 Technology Innovation Award.

Cloud Lending Inc., is an enterprise cloud lending solution provider. Our agile solutions are designed to empower lending businesses to simplify business processes, stay compliant an deb future ready.

Concur is a leading provider of integrated travel and expense management solutions trusted by over 25,000 clients around the globe with over 25 million users. The Concur Platform allows developers to develop and market innovative solutions to the lucrative $1.23 trillion business travel market.

We’ve been helping you prepare for FinDEVr for a few weeks now. Between the presentations, networking, and workshops, there will be a lot to keep busy with during the show, so we wanted to make sure you’re ready.

Today we’re featuring:

Avoka is a leading customer experience management company specializing in multi-channel customer transactions. Avoka powers customer engagement applications for banking and insurance organizations worldwide, capturing and delivering business-critical customer transactions into back-office systems.

Financial Apps provides a suite of developer tools and API access for financial account and transactional data. Our solutions help to quickly build the next generation FinApp. The Financial Apps Relevancy Engine helps make data actionable, providing a comprehensive solution for Fintech development

InComm is the leading provider of prepaid and transaction technologies with 400,000 points of distribution, nearly $ 30 billion annual transaction volume and reaching over 1 billion customers weekly.

Xero is beautiful, easy-to-use online accounting software for small businesses and their advisors. The company has over 300,000 paying customers in more than 100 countries around the world. Xero ranks No. 1 by Forbes as the World’s Most Innovative Growth Company.

If you missed any of the previous FinDEVr Preview posts, check them out below:

In the weeks ahead of FinDEVr San Francisco, we’re taking a closer look at the companies that will share their technology through presentations and workshops on September 30 and October 1.

Today, we have two installments. In the first, we looked a Avoka, Financial App, Incomm, and Xero. In part two, we’re featuring:

Eshta develops and operates Eshtapay as a financial platform that can act as online payment system, e-wallet, escrow system, and self-service payment terminal back-end. Eshtapay (due to its very flexible architecture) is a Swiss-Army knife for the online banked and unbanked alike.

Your company + Eshtapay = fast access to billions of developing world consumers.

EVO Snap* is a one-stop shop for application integration, merchant underwriting and international payment processing. Our developer platform provides single-integration access to omni-channel payment processing and value-added services through one API – making it easy for developers to support merchants.

Keynote: DIY Offers and Rewards – Closing the Digital Loyalty Loop

Description: Activate and deepen relationships with customers by linking consumer data with payment and marketing services to create customized loyalty programs, card-linked offers and real-time rewards at point-of-sale.

Workshop: DIY Offers and Rewards API – A Look Under the Hood

Get up close and personal with the EVO Snap* Connect offers and rewards API and discover how to integrate offer publishing and card-linked redemption services into your loyalty app. Learn how to leverage pre-built service modules and explore options for making your bank/app portal more valuable to merchants by offering detailed retail analytics. We’ll crack open the API, review available data, and offer up sample code.

Why it’s great for developers:

Acquirer, Processor & Technology Partner – All-in-One. EVO Snap* is a one-stop shop for application integration, merchant underwriting and international payment processing.

Intuit Partner Platform (IPP) is an open platform that enables developers to integrate with rich financial and transactional data through REST-based APIs and offers unparalleled reach to millions of small businesses through Intuit Apps.com.

Xignite is the pioneer of cloud-based market data APIs & the provider for leading Fintech innovators Wealthfront, StockTwits, Robinhood & Yodlee. Our APIs cover every asset class, market & data type available & are ideal for integrating data into FinTech mobile apps, websites, and platforms.

• Get going now with our special startup pricing• Get to market first – thanks to our easy APIs• Huge catalog of market data to fuel your growth

If you missed any of the previous FinDEVr Preview posts, check them out below:

Think you’re fully prepared for FinDEVr? Aside from watching some of the top names in fintech present their latest tech and coding alongside others attending the multiple workshops, there will also be plenty of time for networking.

Get a head start by downloading Bizzabo and searching “FinDEVr”. From there, you can see key information about the conference, join the FinDEVr community, and even send in-app messages to other attendees.

This native app is available in the Apple App Store and Google Play Store. There’s also a web app for Windows phones and web interfaces.

After you’ve downloaded the app, search “FinDEVr” and join the community using LinkedIn or the email address you used to register for the conference.

If you haven’t picked up your ticket yet, there’s still time. Get yours here.