Now that the U.S. personal credit crisis of 2008 to 2010 is in the rear-view mirror (but still visible), banks and credit unions are getting more aggressive with credit. And guess what new marketing vehicle is available in 2013 that didn’t exist five years ago? Yep, mobile this and mobile that.

So far, the sales component in mobile banking has been minimal. Generally, users must already be a customer of the bank and even pre-registered with online banking. And cross-selling? About the only thing you can buy remotely is an ATM withdrawal.

But that will change as more customers only deal with their bank and cards through mobile apps, a number that is already pushing 30% of the online banking base of Bank of America (see previous post).

Eventually, most financial products will be sold through the mobile app. Not convinced? Look internationally where mobile was a thing even before the iPhone. I still remember Bankinter’s 2007 BAI Retail Delivery presentation where they said 20% of their retail interest-rate swaps were done via mobile phone.

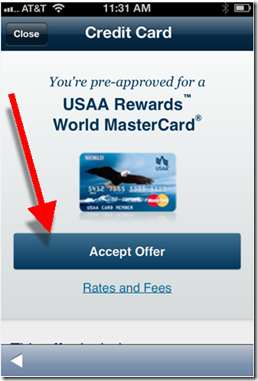

In the United States, we are starting to see banks pushing the envelope. USAA has been the leader in most areas. So no surprise that they are the first (that I know of) to place preapproved credit offers within their mobile app (see screenshots below).

In the bank’s Dec. 2012 update (see inset), it added the ability to:

- Accept pre-approvals in the app

- Apply for checking and savings accounts in the app

- Apply for life insurance after getting a quote in the app

Bottom line: The power of the pre-approved credit offer is well known. Traditionally, snail mail has been the medium of choice. But that’s expensive, time-consuming, and oftentimes not delivered at the optimal moment. Delivering offers via mobile phone can solve all those problems.

And as an added bonus: The sales results will create a better business case for your entire mobile initiative.

——————–

USAA delivers preapproved credit card offer within its mobile app (Dec 2013)

Note: Screenshots shown are from a customer with an existing USAA life insurance relationship.

Price disclosures (right screenshot) displayed after clicking “Rates and Fees” under “Accept Offer” (left screenshot)

Source: comScore Q4 2012, Mobile Financial Services Advisor

————————–

Note: We cover online mobile delivery and marketing in depth in our subscription-based Online Banking Report.

Forbes.com

Forbes.com