Late summer has proven to be red-hot in the fintech sector. This week, 16 companies received new funds, with 15 equity investments totaling $67 million and one massive debt placement of $200 million to AvantCredit. Combined with the $102 million of equity raised in the

first half of August, the sector has attracted $170 million so far this month (not counting the $200 million in debt).

——————–

New equity rounds this week:

Listed by size of deal (Aug 16 through Aug 22, 2014)

Discount real estate agency in UK

Latest round: $11.7 million

Total raised: $11.7 million

Tags: Real estate, rent, mortgage, UK

Digital bill presentment and payments

Latest round: $11 million

Total funding: $36.7 million

Tags: Electronic bill presentment, billpay, payments, North Carolina

Latest round: $10 million

Total funding: $12 million

Tags: Compliance, legal, regulations, Finovate alum, Connecticut

Provides fast access to the block chain for bitcoin developers

Latest round: $9.5 million

Total funding: $13.7 million

Tags: Bitcoin, cryptocurrency, California

Helps identify and reduce hidden financial fees in investment accounts

Latest round: $6.5 million

Total funding: $9.5 million

Tags: Investing, fees, disclosures, 401(k), IRA, New York

Mobile biometric security

Latest round: $6 million

Total raised: $10.4 million

Tags: Security, biometrics, Wells Fargo accelerator, Finovate alum, Kansas

Mobile security

Latest round: $6 million

Total funding: $9.4 million

Tags: Security, Wells Fargo accelerator, Finovate alum, California

Source:

Finovate

Virtual agent technology

Latest round: $2.3 million

Total funding: $2.3 million

Tags: Customer service, mobile, BBVA (investor), SRI (spin-out), California

Source:

Crunchbase

Crowdfunded real estate projects

Latest round: $1 million

Total funding: $1 million

Tags: P2P, investing, debt crowdfunding, rehab, mortgage, lending, North Carolina

Cryptocurrency distribution platform

Latest round: $800,000

Total funding: $800,000

Tags: Bitcoin, cryptocurrency, India

Two-factor authentication

Latest round: $791,000

Total funding: $2.8 million

Tags: Security, Finovate alum, Texas

Platform for bitcoin/cryptocurrency intelligence & research

Latest round: $500,000

Total funding: $500,000

Tags: Cryptocurrency, payments, Amsterdam

Social lending for technical talent development

Latest round: $400,000

Total funding: $400,000

Tags: P2P, crowdfunding, student lending, California

Payments gateway in Bangkok

Latest round: $300,000

Total raised: $300,000

Tags: Payments, mobile, Thailand

Weeleo Crowdsourced cash currency exchangeLatest round: $20,000

Total funding: Unknown

Tags: Fx, P2P, currency, transfers, Paris

——————–

Debt Funding:

Latest debt funding: $200 million

Total debt raised: $425 million

Total equity raised: $104 million

Tags: Subprime, credit, lending, Chicago

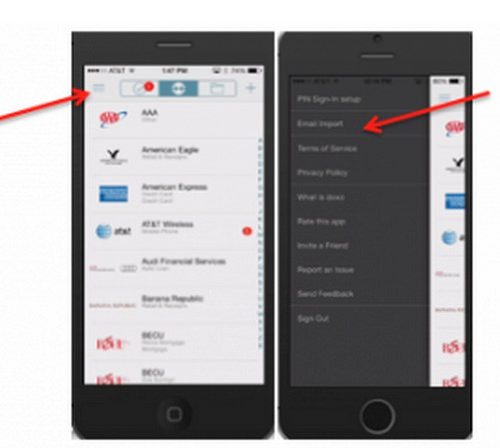

Pymnts features PayPal’s OneTouch mobile payments app.

Pymnts features PayPal’s OneTouch mobile payments app.

Monitise

Monitise