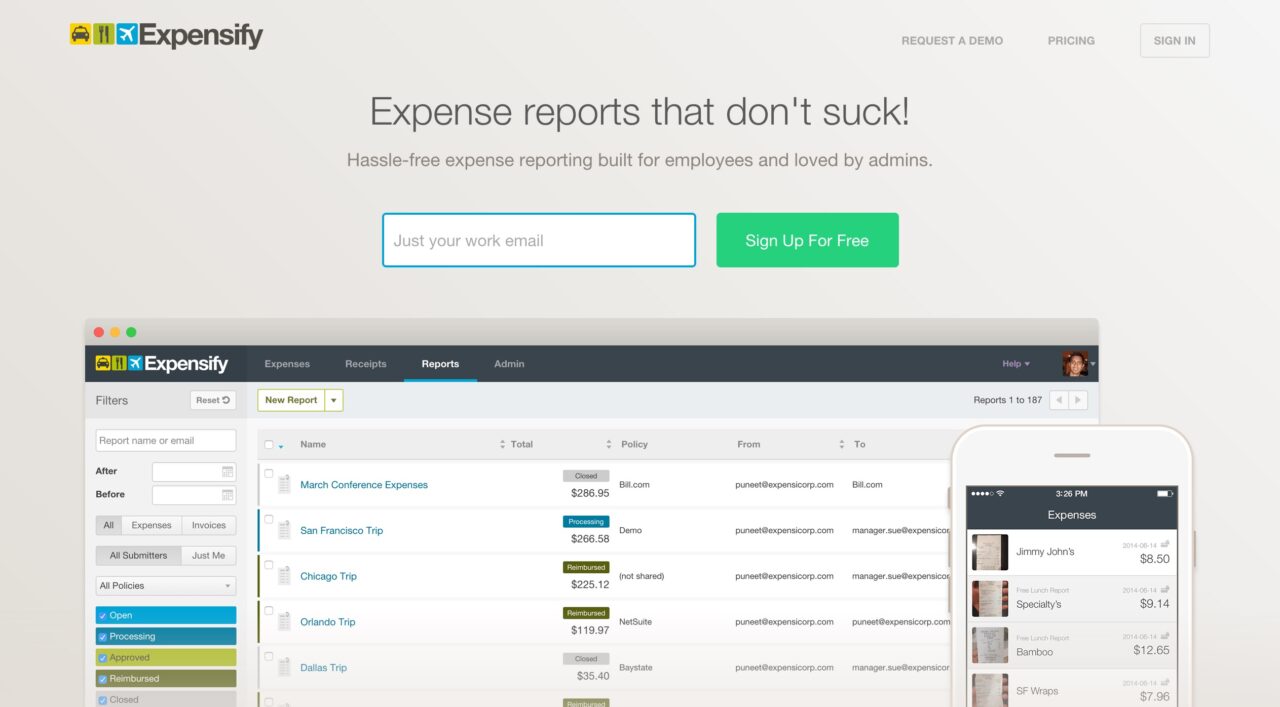

Automated expense-report-management platform Expensify closed a $17.5 million round of funding earlier this week from OpenView Venture Partners. The new installment brings the company’s total funding to $27.2 million.

The San Francisco-based startup, which has 16,000 customers, will use the funding to support its newly launched endeavor, Expensify Ventures, a strategic investment fund for early stage fintech startups. According to David Barrett, Expensify CEO:

Every day we meet with entrepreneurs and companies that have awesome ideas when it comes to solving some of the corporate world’s biggest pain-points, and making life easier for both employees and employers … . From receipt-capture to expense management and even booking travel, a ton of companies are out there trying to make these processes easier, and Expensify wants to be involved.

Expensify is positioning itself as a unique type of investor with an empathetic point of view. “Fundraising is pretty much the worst part of a CEO’s job,” the company states on its web page. “We know—we’ve been there. But we’ve made it through the ring of fire (many times) and are now in a position where we’re ready to give back. Let us help.”

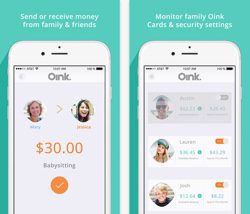

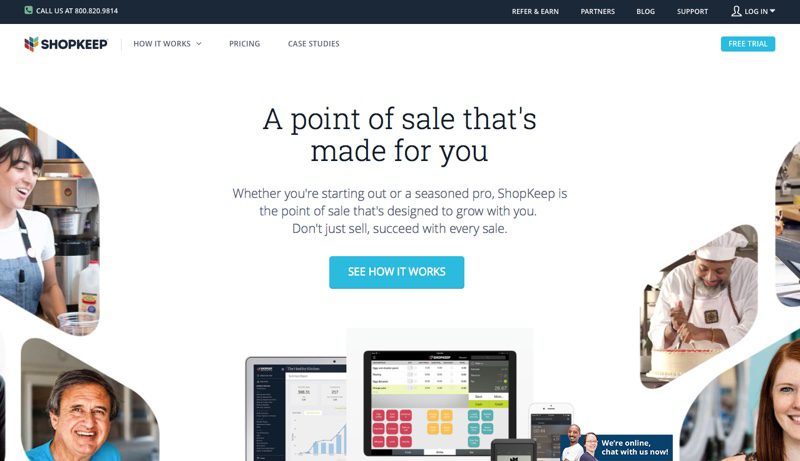

As a VC, the company is looking to invest in startups focused on financial technology, mobile OCR, travel services, payments, and anything relevant to business travelers and accountants. One of the first companies to partner with Expensify through Expensify Ventures is Piper, an alternative receipt solution.

Expensify’s most recent Finovate appearance was on stage at FinovateSpring 2013 where it debuted its invoice solution.