Another monster week in fintech. Depending on how much Stripe received in its round (at a $5 billion valuation), something north of $600 million flowed to 17 fintech companies worldwide. That closes out the month at just under $2 billion raised ($1.65 billion equity; $250 million debt), more than double the $900 million raised a year ago ($675 million equity; $225 million debt).

Another monster week in fintech. Depending on how much Stripe received in its round (at a $5 billion valuation), something north of $600 million flowed to 17 fintech companies worldwide. That closes out the month at just under $2 billion raised ($1.65 billion equity; $250 million debt), more than double the $900 million raised a year ago ($675 million equity; $225 million debt).

About 80% of the money this week ($479 million) flowed to Finovate and FinDEVr alums, our biggest week ever (not including the Lending Club IPO which raised $865 million). To put that in perspective, during all of 2014 our alums raised just over $1 billion (excludes IPOs (Yodlee, OnDeck, and Lending Club). An even more startling number: In July 2014, we had one alum funded to the tune of $27 million. During July 2015, 17 alums raised more than $750 million.

Will fintech funding go higher? It’s hard to look at the year-over-year trend and think that it will get much higher. The bigger question for startups, and their backers, is what happens after “peak fintech?” Is there a gradual decline to a sustainable level of investment, or are we witnessing a bubble, which by definition is the precursor to a bath. Given the enormous size of the financial services industry and the pent-up demand for digital services, as well as infrastructure modernization, we firmly believe in fintech’s sustainability.

Finovate and FinDEVr alums raising money this week:

- Kabbage $120 million (of rumored $150 million at $875 million valuation)*

- Twilio $130 million (at a rumored $1.1 billion valuation)*

- Behalf $119 million

- Shopkeep $60 million

- Radius $50 million

- Expensify $17.5 million

——

* Presenting at our upcoming developer event, FinDEVr 2015

Here are the 17 companies by deal size from 25 July to 31 July:

Kabbage

Alt-lender to small businesses

HQ: Atlanta, Georgia

Latest round: $120 million Series E (of rumored $150 million at $875 million valuation)

Total raised: $585 million ($357 million debt, $228 million equity)

Tags: Lending, credit, underwriting, SMB

Source: Finovate

Twilio

Cloud communications

HQ: San Francisco, California

Latest round: $130 million ($1.1 billion valuation)

Total raised: $234 million

Tags: Messaging, SMS, text messaging, marketing, VoIP, API, developers, FinDEVr presenter 2015

Source: Crunchbase

Behalf

Small-business short-term alt-lender

HQ: New York City, New York

Latest round: $119 million Series B

Total raised: $129 million

Tags: Credit, lending, underwriting, SMB, financing, factoring, receivables financing, Finovate alum

Source: Finovate

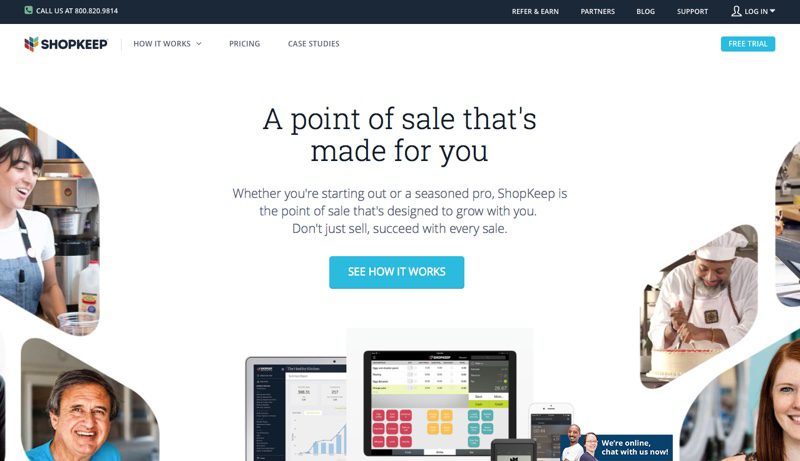

Shopkeep

iPad point of sale system

HQ: San Francisco, California

Latest round: $60 million Series D

Total raised: $97.2 million

Tags: Credit, debit cards, merchants, SMB, online, acquiring, POS

Source: Finovate

Radius

Predictive marketing technology

HQ: San Francisco, California

Latest round: $50 million Series D

Total raised: $129 million

Tags: Finovate alum

Source: Finovate

China Rapid Finance

Consumer credit marketplace in China

HQ: Shanghai, China

Latest round: $35 million Series C (at $1 billion valuation)

Total raised: $56 million

Tags: Lending, credit, underwriting, consumer loans

Source: Crunchbase

iwoca

Short-term small-biz financing

HQ: London, United Kingdom

Latest round: $20 million

Total raised: $31.5 million

Tags: Credit, alt-lending, SMB, financing, loans

Source: Crunchbase

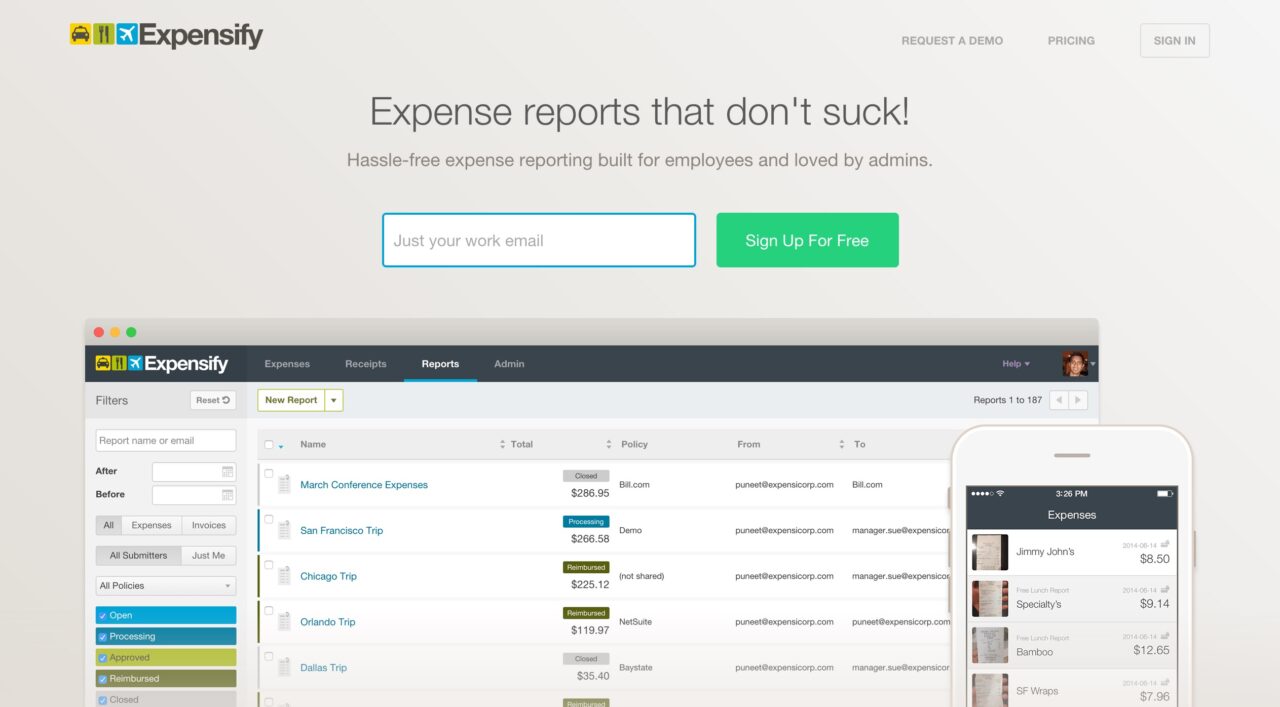

Expensify

Expense report management

HQ: San Francisco, California

Latest round: $17.5 million

Total raised: $27.8 million

Tags: Expense reports, SMB, accounting, enterprise, strategic investor

Source: Finovate

Seedrs

Equity crowdfunding marketplace

HQ: London, United Kingdom

Latest round: $15.6 million Series A

Total raised: $22.8 million

Tags: Investing, P2P, SMB, peer-to-peer

Source: Crunchbase

Crowdcube

Debt and equity crowdfunding marketplace

HQ: Exeter, England, United Kingdom

Latest round: $9.4 million

Total raised: $13.1 million

Tags: Lending, investing, SMB, equity, loans

Source: Crunchbase

OneVest

Platform for investing in startups

HQ: New York City, New York

Latest round: $3 million Series A

Total raised: $5.3 million

Tags: Investing, SMB, wealth management

Source: Crunchbase

Cryptocurrency Research Group

Card processing

HQ: San Francisco, California

Latest round: $3 million grant

Total raised: $3 million

Tags: Bitcoin, crypto, blockchain, R&D

Source: Crunchbase

Stockal

Automated stock-trading adviser

HQ: Bangalore, India

Latest round: $160,000

Total raised: $160,000

Tags: Investing, mobile, trading

Source: Crunchbase

Buyatab

Digital giftcard solutions

HQ: Vancouver, British Columbia, Canada

Latest round: Undisclosed

Total raised: Unknown

Tags: eGift cards, SMB, prepaid card, gifting, fee income

Source: FT Partners

realbest

Online real estate platform

HQ: Berlin, Germany

Latest round: Undisclosed

Total raised: Unknown

Tags: Homeowners, mortgage, house buying

Source: FT Partners

Stripe

Online payment processing and management

HQ: San Francisco, California

Latest round: Undisclosed (less than $100 million at $5 billion valuation)

Total raised: $190+ million

Tags: Payments, credit, debit cards, API, merchants, SMB, online, acquiring, Visa (investor), American Express (investor)

Source: Crunchbase

Cognia

Payment processing for telephone-based transactions

HQ: London, England, United Kingdom

Latest round: Undisclosed

Total raised: $4.6+ million

Tags: Payments

Source: FT Partners