This post is part of our live coverage of FinovateFall 2015.

AcceptEmail demonstrated how it’s making it easier for customers to pay bills:

AcceptEmail demonstrated how it’s making it easier for customers to pay bills:

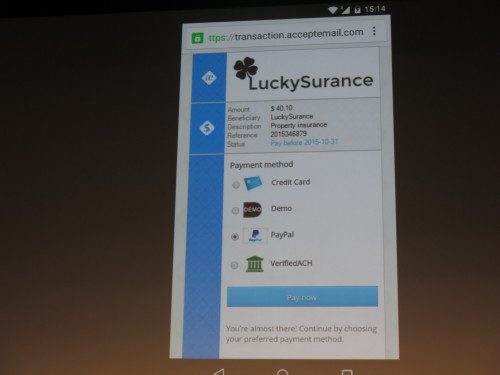

AcceptEmail delivers payment requests directly to the customer’s mobile device or desktop via various messaging solutions including email, IM, QR code, and social media. The customer may make a payment any time and from anywhere, directly from the inbox, with just a few clicks. There are no apps to download, no registering, no logging in.

Payment may come from the customer’s bank account via Verified ACH, by credit or debit card, or via a third-party method. Once the payment goes through, the status bar changes from blue (due) to green (paid) in real time. Customers love AcceptEmail’s simplicity and convenience.

AcceptEmail presenters: CTO Geerten Oelering and CEO Peter Kwakernaak

Product Launch: April 2014

Metrics: 20 employees; offices in Amsterdam, Brussels, London, and New York

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

HQ: Amsterdam, The Netherlands

Founded: September 2006

Website: acceptemail.com

Twitter: @AcceptEmail