For weeks we’ve been sifting through applications from companies vying to present their latest at FinovateEurope on 9/10 February 2016. Today, we’re excited to announce 59 of the 72 companies that will take the stage in London.

To watch all 70+ companies demo live, be sure to register soon. This is the final week to save £200 on FinovateEurope tickets.

We’ll announce the remaining stealth companies over the next two months.

additiv’s Descartes Finance Digital Asset Management Platform uses an array of sophisticated digital asset-management functions to provide demanding, self-directed investors with solutions to implement individualized portfolio solutions.

AdviceRobo’s Finius virtual money assistant uses machine learning-driven gamification to help borrowers and lenders manage risk by understanding the impact of future financial changes and teaching them how to respond.

Alpha Payments Cloud’s AlphaHub offers banks, merchants and payment-and-risk product vendors unlimited vendor access and orchestration, using a single integration.

Asseco Poland offers customers a tailored and satisfying banking experience for both internet and mobile banking systems.

Avoka’s digital commerce platform helps banks, insurance and wealth-management institutions overcome the challenge of “selling” financial products by offering a frictionless, omnichannel customer experience.

Backbase DBP for Wealth Management uses a beautiful customer experience that runs on any device. It uses algorithms to provide robo-advisory for traditional banks who are losing affluent customers to dedicated money managers.

BankersLab’s PortfolioQuest is an addictive simulation game for fintech investors, regulators, and bank executives to predict which managers and lending institutions will make good decisions.

Capital Preferences is an enterprise consumer-risk-profiling system that employs a series of simple investment games—based on advances in game theory, econometrics and experimental economics—to help banks, insurers and wealth managers solve growing regulatory scrutiny and unscientific profiling methods used to document client-risk preferences today.

Capitali.se’s platform for automation of trading uses a simple human language interface to help traders worldwide solve the technological barrier problem.

Capitalise.com is a one-stop-shop search and comparison site to help SMBs easily access financing.

CREALOGIX’s Digital Banking Hub uses best-of-breed functionalities and state-of-the-art technologies to flexibly deploy established banking functionalities and integrate various third-party products.

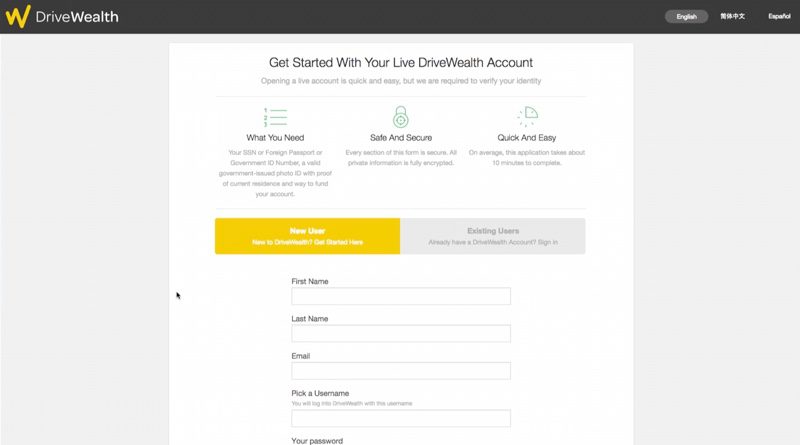

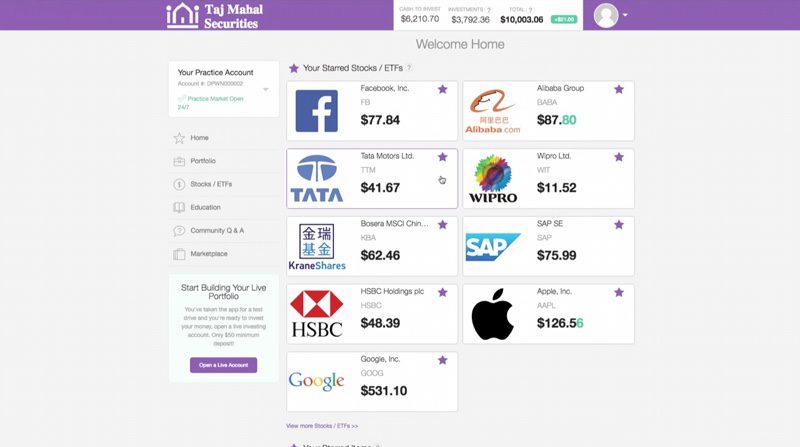

DriveWealth’s real-time fraction trading for global retail investors uses its full-stack investing platform to build diversified portfolios.

ebankIT’s platform uses innovative, omnichannel solutions to create customer traction and engagement through different channels.

Ethoca’s Alerts helps card issuers and merchants with a global collaboration network to prevent unnecessary and costly reliance on the chargeback process to resolve disputes and recover associated losses.

Envestnet’s platform helps financial professionals and investors scale goals-based wealth management using a unique mix of service and technology.

ETRONIKA’s BANKTRON uses visual attractiveness, robust tools, and an omnichannel banking approach to create products that facilitate a fintech partnership ecosystem for established banks, new fintech startups, and aggregators.

EyeVerify’s Eyeprint ID seeks to solve the security and convenience issues inherent in passwords by using biometrics that image the blood vessels in the whites of the eye.

Featurespace’s ARIC Engine spots and prevents financial services fraud-attacks in real time with its world-leading adaptive behavioral analytics.

Fintura’s comparison platform for SME loans uses a risk-adjusted rate-comparison and a quick approval process to help SMEs find cheap loans in a transparent and quick way.

HotDocs’ automation software uses its document-assembly engine to help financial services companies with the challenges they face when producing high-volume, customized, repeat documentation.

IDscan Biometrics’ new algorithm helps financial institutions authenticate identities using game-changing neural network technologies.

ING Bank’s consistent, omnichannel ecosystem improves customer experience in corporate banking for B2B banking clients.

INNOFIS’ Real-Time Sales Transformation solution uses micro-targeting and smart analytics to bring sales efficiency to financial institutions.

InvestGlass’ engagement tool uses customizable artificial intelligence to enable easy compliance for financial professionals.

investUP offers sophisticated retail investors a crowdfunding brokerage in an increasingly fragmented marketplace.

InvoiceSharing’s Accounting Robot helps businesses automate their manual invoice processing using its free electronic invoicing network.

ITSector’s Digital Credit solution offers faster access to bank credit through alternative channels.

Kontomatik’s data-aggregation solution offers data accessibility to the financial services industry.

Ledger’s security tools help make Bitcoin secure.

Lendstar offers an app without the hassle of traditional P2P transactions.

Lexmark’s onboarding solution uses a real-time, voice-driven, collaborative mobile app to eliminate the antiquated mobile experience when onboarding new customers.

meetinvest’s automated, expert-driven, single-stock robo-adviser platform explains the what, when and how of stock investing for mass-affluent and retail investors worldwide by using successful investment recipes from the world’s best investment experts without using financial jargon.

Meniga’s communication platform offers timely, contextual and targeted events and notifications to promote engagement between banks and their customers

Nexmo’s Chat App API offers a single platform for financial and banking brands to stay connected with their users.

North Side’s VerbalAccess offers consumers and businesses an effective, self-service channel using leading-edge natural language-understanding technology.

Nostrum Group helps lenders reduce customer churn.

Outside IQ’s DDIQ-cob uses a cognitive computing engine with natural language processing to offer financial execs and investors advanced due diligence in compliance matters.

Passport is an enterprise software platform that uses mobile payments to bridge the technology gap in transportation.

payever’s platform solves the buying and selling problems that merchants and customers face every day.

PaySend’s global, card-based infrastructure not only helps users remember to send remittances on time, but also keeps them from paying too much to send and receive money across borders.

Qumram’s session recording and replay technology offers financial service companies transparency in digital channels.

Refund.me Group helps financial service providers capture cardholders’ full purchasing power and become top-of-wallet by offering features that enhance their customers’ travel experience.

Risk Ident’s EVE Evaluation Engine uses data science and machine learning to assess consumer risk for ecommerce companies and financial institutions.

Sandstone Technology’s BankFast 2.0 mobile app combines industry-leading self-service onboarding, mobile banking, card-management and customer-engagement modules to deliver a highly secure and seamless customer experience.

SBDA Group’s web solution offers bank-marketing specialists a client-behavior-prediction platform that uses machine learning to transform raw data into clear insights of customer behavior.

Scalable Capital is a digital investment manager that offers investment options to make intelligent investing accessible to everyone.

SizeUp offers banks a business intelligence SaaS platform to help their SMB customers make data-driven business decisions by generating analysis that is understandable and accessible.

Spiff’s simple investment service, with the female investor demographic in mind, offers tools and inspiration for new investors.

STRANDS Discovery uses machine-learning algorithms to offer banks simplified insights into complex customer behavior hidden within big data.

Stratumn is an open standard and API that offers enterprises transparency and traceability using the Bitcoin blockchain.

Suitebox’s virtual meeting room collaboration-solution removes time and cost constraints while ensuring full compliance for risk managers, wealth managers, and insurance advisers.

SwipeStox social trading app offers traders and investors a platform to make informed trades.

TaxFree4U is a mobile processing platform that uses a network of local agents in VAT-imposing countries to allow international travelers to claim VAT refunds quickly.

TWINO marketplace offers retail and institutional investors confidence in investing in unsecured consumer loans from non-Eurozone countries by combining the peer-lending model with traditional currency and default risk-management practices.

Valuto offers an open API for multi-currency wallets to facilitate cross-border payments and collections.

Vipera’s customer application uses a proprietary matching engine to help banks and retailers better engage their customers.

VoicePIN.com’s scalable and secure cloud-based Voice Biometrics System offers a multichannel customer experience for fintech and banking companies.

Xignite’s XigniteAlerts speed reactions to critical market fluctuations by using its market-data APIs.

Xpenditure’s efficient approval process and mobile technology reduces the hassle that SME and decentralized large companies face in managing and controlling expenses.

FinovateEurope is sponsored by KPMG

FinovateEurope is partnered with bobsguide, CoinTelegraph, Let’s Talk Payments, Mapa Research, The New Economy, PLUS Journal, and World Finance.

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”