It was a blockbuster week in fintech with more than $6 billion in new funds flowing to the sector. The vast majority, $5.9 billion, was raised in the IPOs of two mega payment processors: FinDEVr alum Worldpay ($3.3 billion) and First Data ($2.6 billion), which went public for the second time in its 44-year history.

It was a blockbuster week in fintech with more than $6 billion in new funds flowing to the sector. The vast majority, $5.9 billion, was raised in the IPOs of two mega payment processors: FinDEVr alum Worldpay ($3.3 billion) and First Data ($2.6 billion), which went public for the second time in its 44-year history.

The 23 private companies raised well over $372 million given that six of the rounds were not disclosed (so are not included in the total).

In addition to WorldPay, 7 other Finovate alums raised money, including Kabbage ($135 million); Stockpile ($15 million); Moven ($12 million); Xpenditure ($5.7 million); Blooom ($4 million); Payfone (undisclosed); and Roostify (undisclosed).

The YTD total raised is now more than $21 billion, or about $15.3 billion, excluding the two blockbuster IPOs.

Here are the deals by size from 10 Oct through 16 Oct 2015:

WorldPay

Payment processer

HQ: London, England, United Kingdom

Latest round: $3.3 billion IPO

Total raised: Unknown (carved out of Royal Bank of Scotland in 2010)

Tags: B2B, payment processing, FinDEVR alum

Source: NY Times, Finovate

First Data Corporation

Payment processing

HQ: Atlanta, Georgia

Latest round: $2.56 billion IPO

Total raised: Unknown

Tags: Enterprise, payments

Source: TechCrunch

Kabbage

Alt-lender to small businesses

HQ: Atlanta, Georgia

Latest round: $135 million at $1 billion valuation

Total raised: $600 million

Tags: SMB, lending, underwriting, Finovate alum

Source: Finovate

Symphony

Secure messaging for financial services

HQ: Palo Alto, California

Latest round: $100 million

Total raised: $165 million

Tags: Enterprise, messaging, investing, advisers, wealth management

Source: Re/Code

Opendoor

Residential real estate trading

HQ: San Francisco, California

Latest round: $80 million at $580 million valuation (per WSJ)

Total raised: $110 million

Tags: Consumer, real estate, home buying, home selling, investing

Source: Crunchbase, Wall Street Journal

Stockpile

Gift cards backed with public company equity

HQ: San Jose, California

Latest round: $15 million

Total raised: $15 million

Tags: Consumer, savings, investing, gift card, Finovate alum

Source: Finovate

Moven

Mobile-optimized neo-bank

HQ: New York City, New York

Latest round: $12 million

Total raised: $23 million

Tags: Consumer, retail banking, prepaid, mobile, neo-bank, debit card, white label, B2C, B2B2C, Finovate alum

Source: Finovate

Wynd

Electronic payment solutions

HQ: Paris, France

Latest round: $7.9 million

Total raised: $7.9 million

Tags: SMB, payments, processing, merchants, loyalty, ecommerce

Source: FT Partners

Xpenditure

Expense-management solutions for small businesses

HQ: New York City, New York

Latest round: $5.7 million

Total raised: $5.7 million

Tags: SMB, PFM, accounts payables, employees, accounting, Finovate alum

Source: FT Partners

Zwipe

Fingerprint-authenticated payment card

HQ: Oslo, Norway

Latest round: $5 million

Total raised: $7.5 million

Tags: Consumer, credit/debit cards, biometrics, security

Source: Finovate

Blooom

401(k) management

HQ: Leawood, Kansas

Latest round: $4 million Series A

Total raised: $4.1 million

Tags: Consumer, 401(k), retirement savings, tax-advantaged, wealth management, Finovate alum

Source: Finovate

Concord

Real-time investment strategies

HQ: Boston, Massecheusetts

Latest round: $2.7 million

Total raised: $2.7 million

Tags: Enterprise, investing, wealth management, data analytics

Source: FT Partners

WeGoLook

Asset verification

HQ: Oklahoma City, Oklahoma

Latest round: $1.5 million

Total raised: $3.25 million

Tags: Enterprise, lending, insurance, risk management, underwriting

Source: Crunchbase

Faira

Real estate technology

HQ: Seattle, Washington

Latest round: $1.37 million Seed

Total raised: $1.53 million

Tags: Consumer, real estate, home buying, mortgage

Source: FT Partners

Funderbeam

Tracking investments in startups

HQ: Tallinn, Estonia

Latest round: $750,000

Total raised: $2.2 million

Tags: Enterprise, SMB, investing, wealth management, data

Source: Crunchbase

Scorechain

Bitcoin compliance solutions

HQ: Luxembourg

Latest round: $600,000

Total raised: $600,000

Tags: Enterprise, SMB, cryptocurrency, blockchain

Source: FT Partners

Factom

Using the blockchain for managing records

HQ: Austin, Texas

Latest round: $400,000 Seed

Total raised: $1.54 million

Tags: Bitcoin, blockchain, cryptocurrency

Source: Coinbase

RewardStock

Card rewards management

HQ: Raleigh, North Carolina

Latest round: $350,000 Seed

Total raised: $350,000

Tags: Consumer, credit cards, rewards, travel

Source: Crunchbase

Hyperledger (division of Digital Asset Holdings)

Blockchain

Latest round: $50,000 Innotribe Prize

Total raised: Unknown

Tags: Consumer, blockchain, cryptocurrency, bitcoin

Source: Coinbase

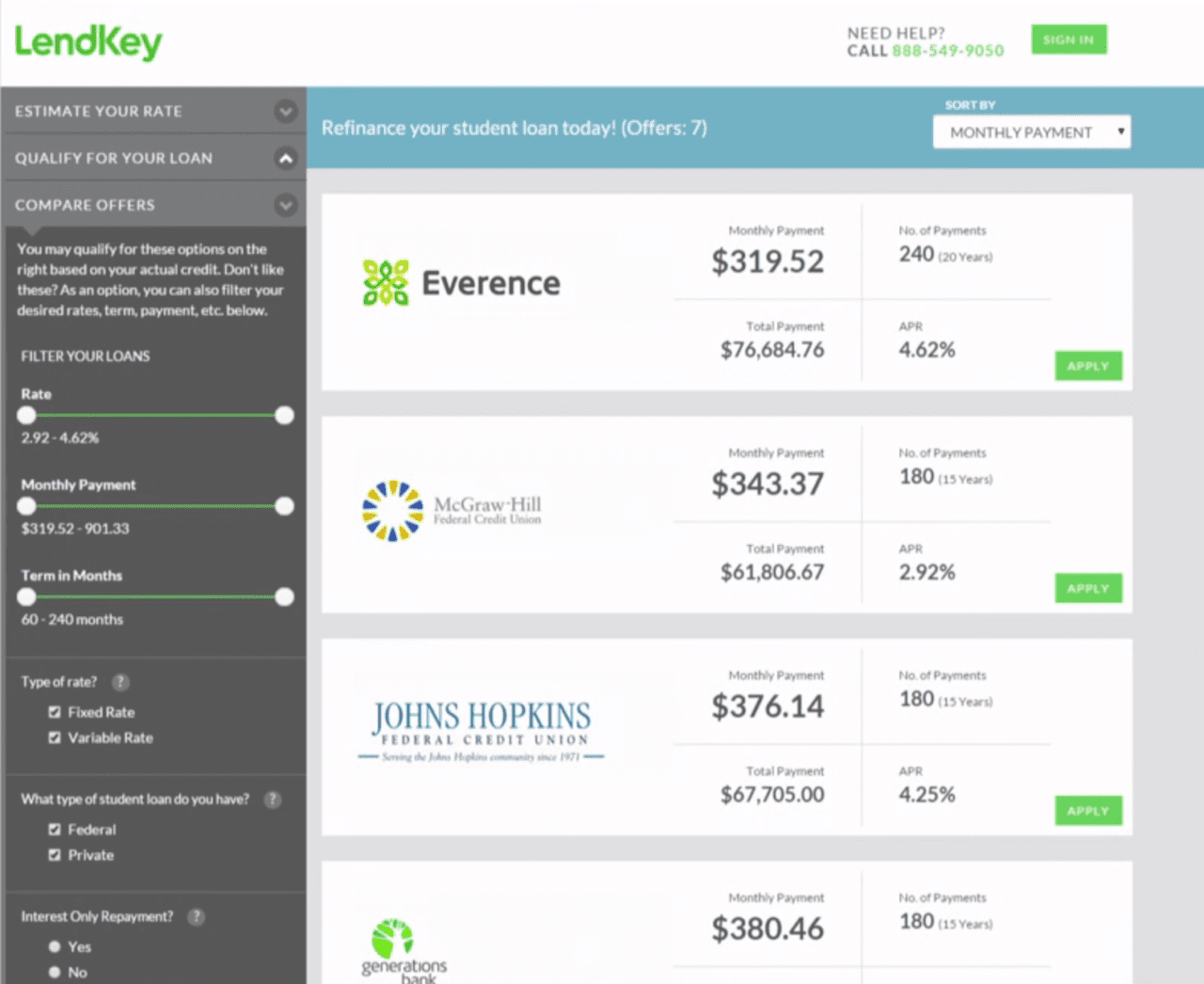

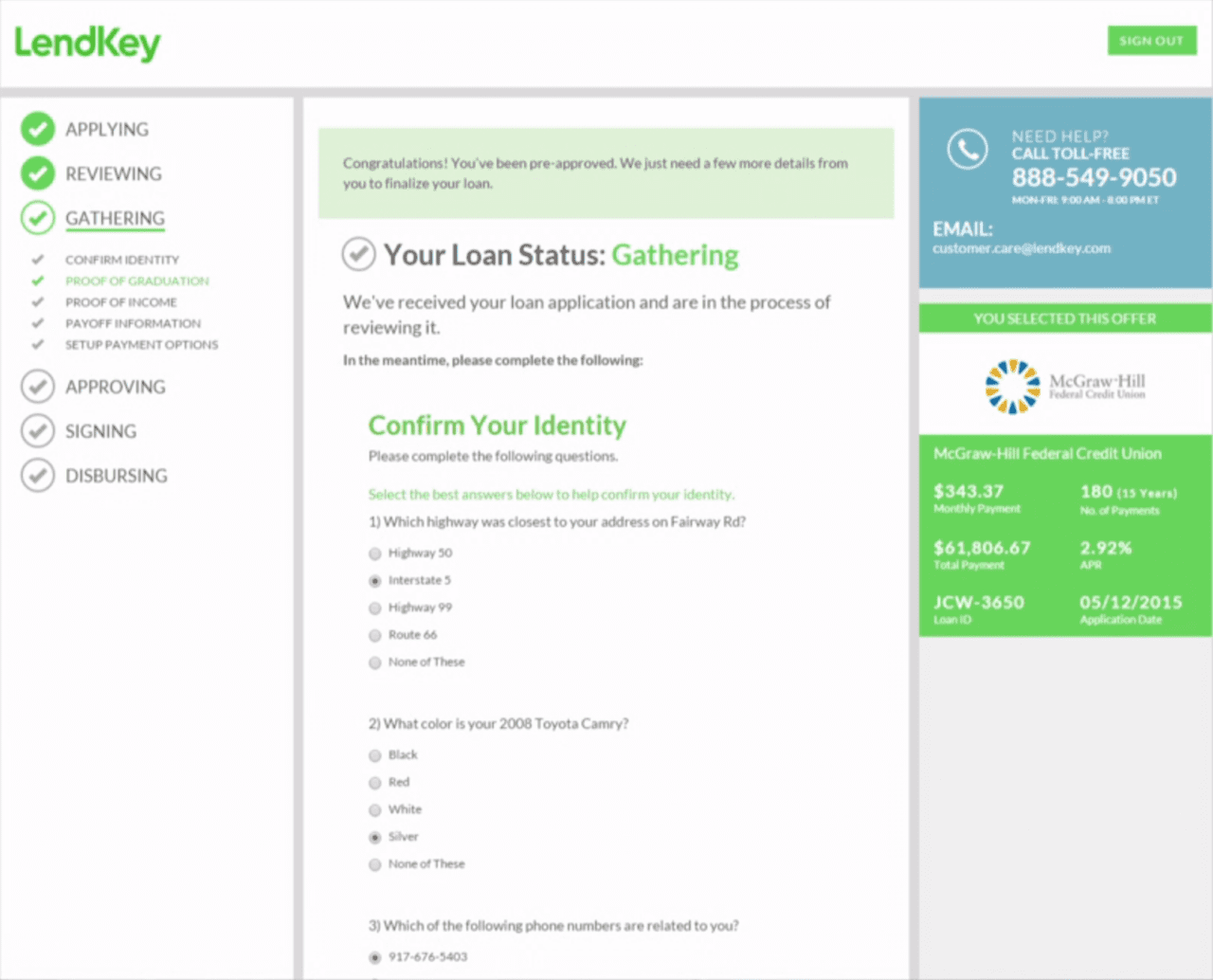

Payfone

Mobile identity to support payments

HQ: New York City, New York

Latest round: Undisclosed

Total raised: $46 million

Tags: Enterprise, IDology (investor), security, risk management, payments, Finovate alum

Source: Finovate

Roostify

Simplifies home buying

HQ: San Francisco, California

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, mortgage, home, real estate, PFM, Finovate alum

Source: Finovate

HealthiPASS

Medical payments processing and management

HQ: Lombard, Illinois

Latest round: Undisclosed Series A

Total raised: Unknown

Tags: Health care, insurance, payments, processing, medical, processing

Source: FT Partners

iZettle

Mobile point-of-sale services

HQ: Stockholm, Sweden

Latest round: Undisclosed Series D

Total raised: $176 million

Tags: SMB, small business, merchants, acquiring, payments, mPOS, cards

Source: FT Partners

Lenddo

Alternative loan underwriting models

HQ: New York City, Hong Kong

Latest round: Undisclosed Series B

Total raised: $14+ million

Tags: Enterprise, underwriting, credit, lending, analytics, API, Life.SREDA (investor)

Source: FT Partners

Rong360

Chinese financial services platform

HQ: Beijing, China

Latest round: Undisclosed Series D

Total raised: $60+ million

Tags: Consumer

Source: FT Partners