Yesterday, financial settlement services platform Ripple announced a partnership that will boost its expansion into a region where it has seen lots of local interest and growth potential.

The San Francisco-based startup has teamed up with financial conglomerate SBI Holdings to form a new company called SBI Ripple Asia.

As a part of the joint venture, SBI Holdings will launch an engineering and business development team to sell and install Ripple’s cross-border payments solutions for banks across the Asia region:

- Japan

- China

- Taiwan

- Korea

- ASEAN countries

Australia-based Ripple APAC will continue to service Australia, New Zealand, Singapore, India and the Middle East.

Japan-based SBI, which has 5,000 employees and offices in 20 countries, is a good candidate for helping Ripple reach the new region. The company focuses on Asia’s developing countries and has established joint ventures with companies such as E-LOAN, E*TRADE, MorningStar, and Sumitomo Mitsui Trust Bank. SBI holds stakes in 10 financial institutions across ASEAN. Ripple plans to use this network to distribute Ripple Connect, the startup’s enterprise-grade settlement solution.

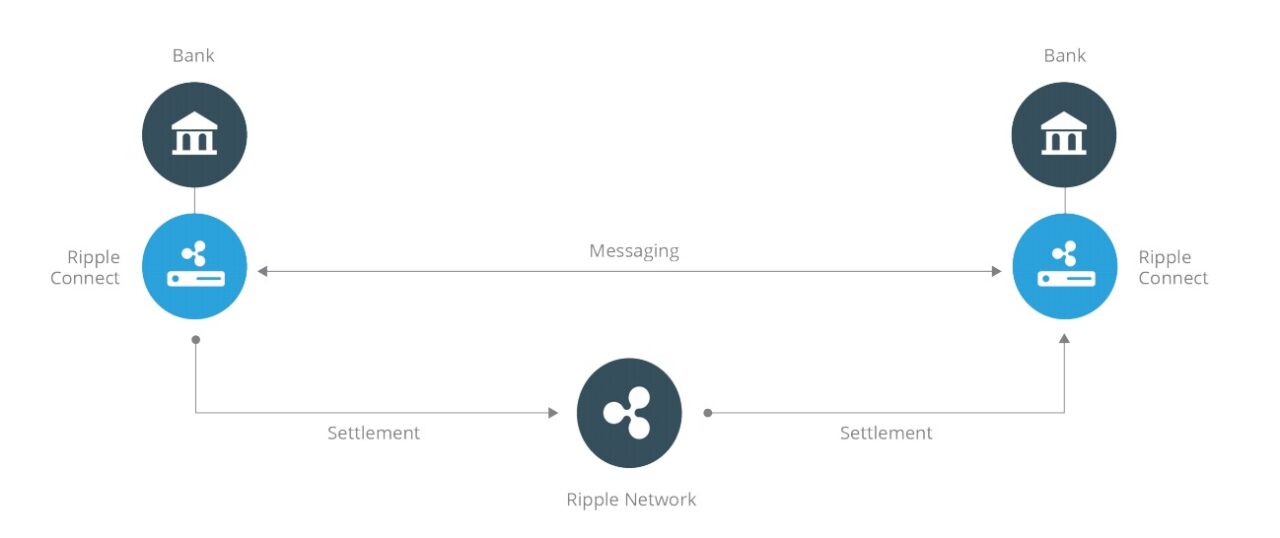

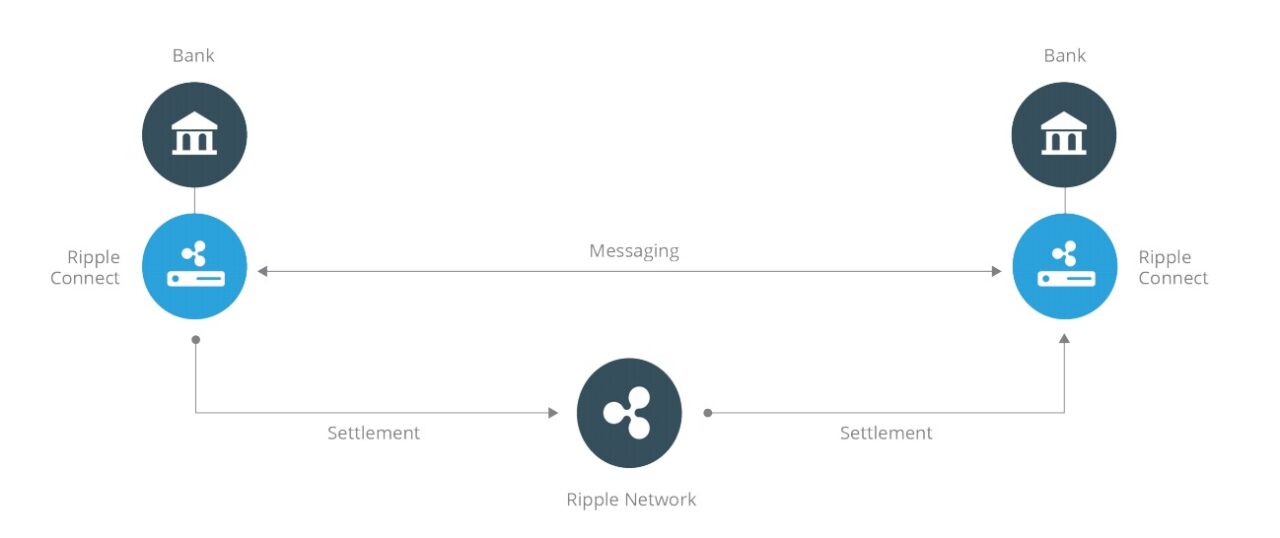

Ripple’s technology is a distributed global ledger that enables banks around the world to instantly transact with each other without the need for a central bank. The startup uses a distributed open-source payment network to create a distributed currency exchange.

Ripple Connect is a module that processes real-time international payments for banks. It connects the internal systems of financial institutions to the decentralized Ripple Consensus Ledger. It allows banks to exchange payment details before the payment is initiated and communicates with the network to get the lowest currency quote.

If you’ve ever chatted with Ripple CEO and co-founder Chris Larsen, or heard him speak, it likely wasn’t without hearing a mention of the internet of value (IOV), an internet for money that allows the free and instant exchange of anything of value. As Larsen once explained to me, it makes a P2P money-transfer as easy as emailing a link to an article.

Larsen calls up the concept in a comment on the SBI partnership: “Interbank payments establish the foundation of the internet of value. SBI is the perfect partner to help forge that foundation and then extend Ripple’s capabilities to new use-cases in the future.”

In what Larsen describes as the “kicker” of this deal, Ripple and SBI are exploring ways to list XRP through SBI’s various online brokerage properties.

Larsen launched the Ripple Network at FinovateSpring 2013 under the name OpenCoin. Since its debut, the company now claims:

Binns joined HP in 2007 and served as VP of Software Field Operations and VP of Investor Relations before being named Vice President and CFO, HP Software in 2014. Binns won the Tech IR award from Institutional Investors Magazine in 2014 and 2015, and is a fellow of the Chartered Association of Certified Accountants in the UK.

Binns joined HP in 2007 and served as VP of Software Field Operations and VP of Investor Relations before being named Vice President and CFO, HP Software in 2014. Binns won the Tech IR award from Institutional Investors Magazine in 2014 and 2015, and is a fellow of the Chartered Association of Certified Accountants in the UK.