Our FinDEVr New York developer showcase last week was a success! FinDEVr Silicon Valley will be held October 18 & 19 in Santa Clara. Register today and save.

Our FinDEVr New York developer showcase last week was a success! FinDEVr Silicon Valley will be held October 18 & 19 in Santa Clara. Register today and save.

On FinDEVr.com

- FinDEVr New York Presentation Videos Live on FinDEVr.com.

- “Envestnet | Yodlee Unveils its Risk Insight API”

- “Google’s Guide: New Book Explains How Google Manages its Cloud Infrastructure”

- “With Shopify Integration, Thinking Capital Helps Diversify Alt Lending in Canada”

The latest from FinDEVr New York 2015 presenters

- OutsideIQ joins fintech accelerator, Bank Innovation INV, as an API partner. See OutsideIQ at FinovateSpring in San Jose next month.

- Vix Verify opens new offices in Atlanta, Georgia’s Transaction Alley as part of American expansion.

- Chase launches OnDeck-powered SMB loan platform.

- Praesidio ranks top 10 most-promising cloud-banking-solution providers of 2015.

- API report covers Streamdata.io.

- CryptoCoinNews takes a look at the recent funding for blockchain-development platform, Stratumn.

Alumni updates

- “CardFlight and Miura Systems Partner to Offer EMV and NFC Mobile POS Solution to the U.S Market”

- PayNearMe facilitates users to pay for their taxes in cash.

- “BehavioSec, Nationwide, Unisys Team Up on Biometrics”

- Crowdfund Insider interviews Snehal Fulzele, Cloud Lending CEO.

Stay current on daily news from the fintech developer community! Follow FinDEVr on Twitter.

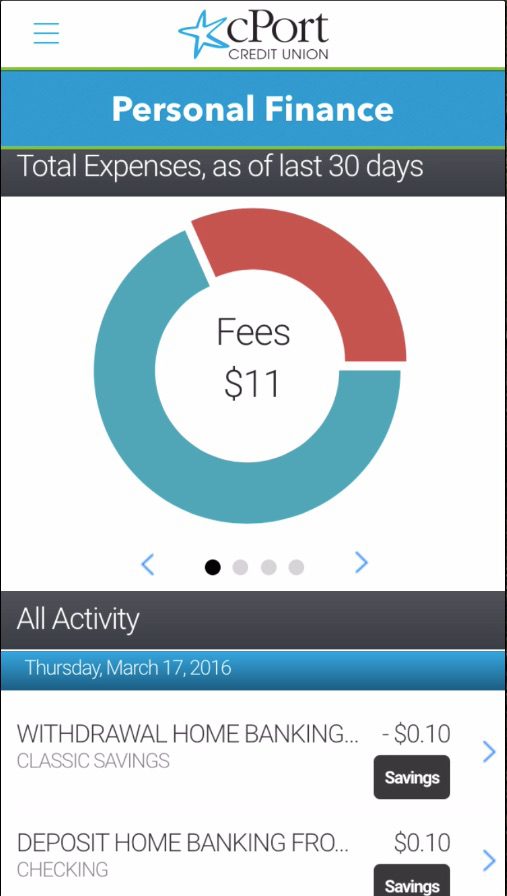

Jerry Filipiak, CEO and Chairman of the Board

Jerry Filipiak, CEO and Chairman of the Board Diana Chin, Human Resources and Operations, New York City

Diana Chin, Human Resources and Operations, New York City

Presenter: CEO Chris Hopen, founder

Presenter: CEO Chris Hopen, founder