Here’s a funding from one of our more interesting alums that slipped below the radar last month: mobile payment innovator Passport has raised $8 million in new funding. The Series B round was led by MK Capital, and featured participation from Grotech Ventures and Relevance Capital. The new investment takes Passport’s total funding to $17 million.

Passport CEO Bob Youakim said that the capital infusion would help speed the company’s growth and expansion both in the United States and around the world, as well as enable Passport to add talent to the team. “Our enterprise platform is striking a chord with the market as they look to bring technology into their operations and drive efficiency.” Youakim said. Bret Maxwell, MK Capital managing general partner, called Passport “the clear market leader on many fronts” and praised the company’s “cutting edge platform, expanding revenue growth, and … strong industry partnerships.”

Passport CEO Bob Youakim and CBDO Khristian Gutierrez demonstrated their mobile payment for transit solution at FinovateEurope 2016 in London.

Passport specializes in providing mobile payment solutions for transportation-related businesses, including parking and transit management. The company’s products include mobile parking-payment and public transportation ticketing technology, digital permits, gateway services for merchants, and integrations to help parking companies more efficiently monitor operations and collect revenue. Passport’s technology is being used in major metropolitan areas in North America such as Chicago, Toronto, Portland, and Salt Lake City.

Founded in 2010 and headquartered in Charlotte, North Carolina, Passport demonstrated its mobile payment for transit solution at FinovateEurope 2016. The company announced earlier this month that the Village of Orland Park had launched its new Passport-powered mobile parking-payment system. And in May, Passport partnered with the Southwest Ohio Regional Transit Authority to develop a mobile ticketing app for buses and streetcars. Also in May, Passport hired former Core Consulting Group CTO Mike Hulthen as its new VP of Engineering.

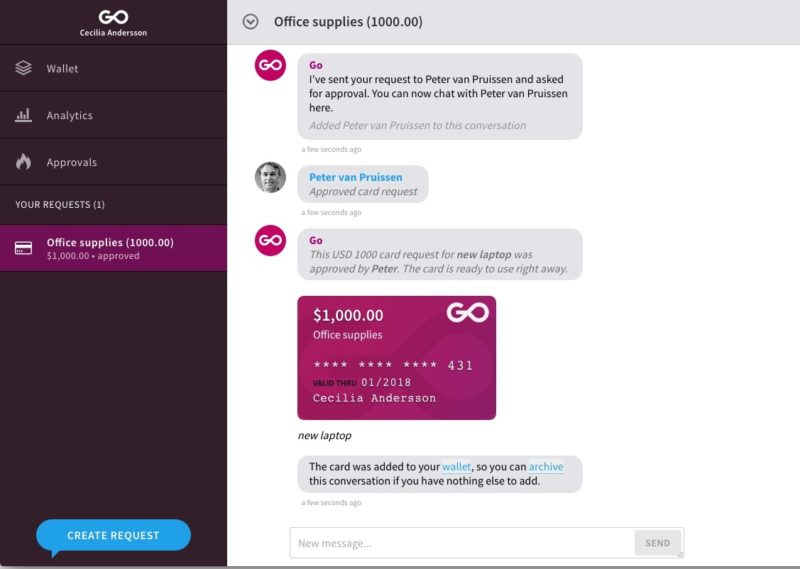

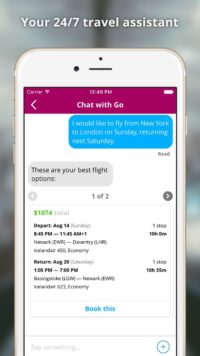

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.

At FinovateFall 2015, Socure’s co-founders Sunil Madhu, CEO, and SVP Johnny Ayers, business development, demoed Perceive (a facial biomentrics solution).

At FinovateFall 2015, Socure’s co-founders Sunil Madhu, CEO, and SVP Johnny Ayers, business development, demoed Perceive (a facial biomentrics solution).

Our

Our