Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

Previous Quarterly Comparisons

- Q4 2016: More than $700 million raised by 26 alums

- Q4 2015: More than $302 million raised by 28 alums

- Q4 2014: More than $1.4 billion raised by 26 alums

- Q4 2013: More than $294 million raised by 17 alums

The biggest equity deal of the final quarter of 2016 was $180 million raised by Payoneer in October. Also worthy of note was the $115 million raised by PaySimple, and the $80 million raised by NuBank. For the fourth quarter of 2016, the top 10 overall investments totaled $593 million or more than 84% of the total alum funding for the quarter.

Top 10 Overall Investments (equity only)

- Payoneer: $180 million

- PaySimple: $115 million

- NuBank: $80 million

- BlueVine: $49 million

- Finicity: $42 million

- Nutmeg: $37 million

- Quantopian: $25 million

- Personal Capital: $25 million

- Lendio: $20 million

- SecureKey: $20 million

These Q4 numbers for Finovate/FinDEVr alums suggests that the pace of investment in fintech innovation remains robust. With a $700 million Q4, the total investment in our alums for 2016 is more than $2.3 billion. This compares to a $3 billion 2015, a $2.2 billion 2014, and a $825 million 2013.

Here is our detailed alum funding report for Q4 2016.

October 2016: More than $371 million raised by eight alums

- Aire: $2 million – post

- DeMystData: $7 million – post

- FinanceIt: $17 million – post

- Lendio: $20 million – post

- Nanopay: $10 million – post

- Payoneer: $180 million – post

- PaySimple: $115 million – post

- SecureKey: $20 million – post

November 2016: More than $97 million raised by eight alums

- Finagraph: $5 million – post

- figo: $7 million – post

- Five Degrees: $10 million – post

- Nutmeg: $37 million – post

- P2Binvestor: $7. 7 million – post

- Sezzle: $1.85 million – post

- TrueLink Financial: $3.6 million – post

- Quantopian: $25 million – post

December 2016: More than $235 million raised by eleven alums

- BlueVine: $49 million – post

- Finicity: $42 million – post

- Hip Pocket: $150,000 – post

- Kreditech: $10.4 million – post

- NuBank: $80 million – post

- Nutmeg: $14.6 million – post

- Personal Capital: $25 million – post

- Socure: $13 million – post

- Tradeshift: undisclosed – post

- Walletron: undisclosed – post

- Zighra: $1 million – post

If you are a Finovate alum that raised money in the second quarter of 2016, and do not see your company listed, please drop us a note at [email protected]. We would love to share the good news! Funding received prior to becoming an alum not included.

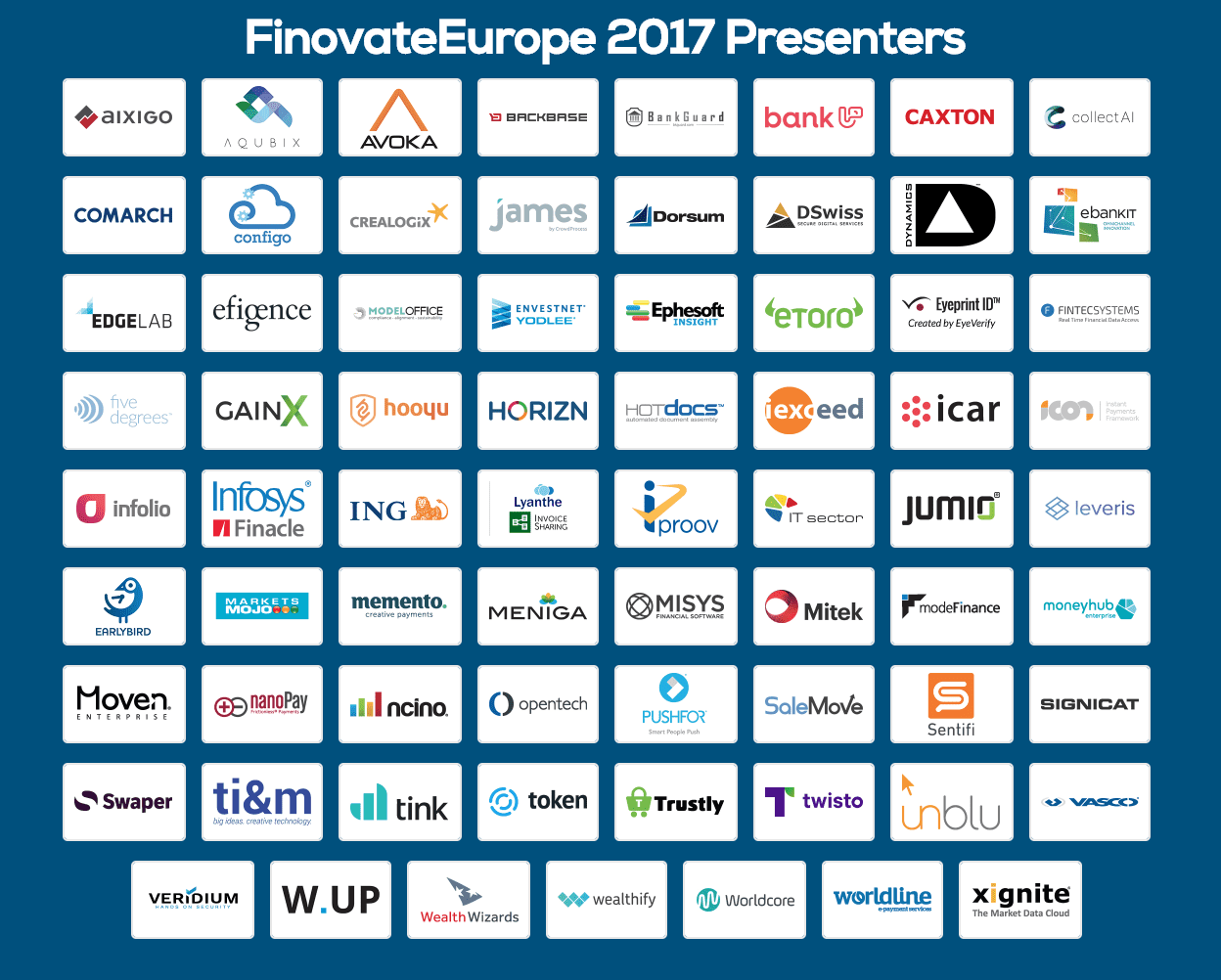

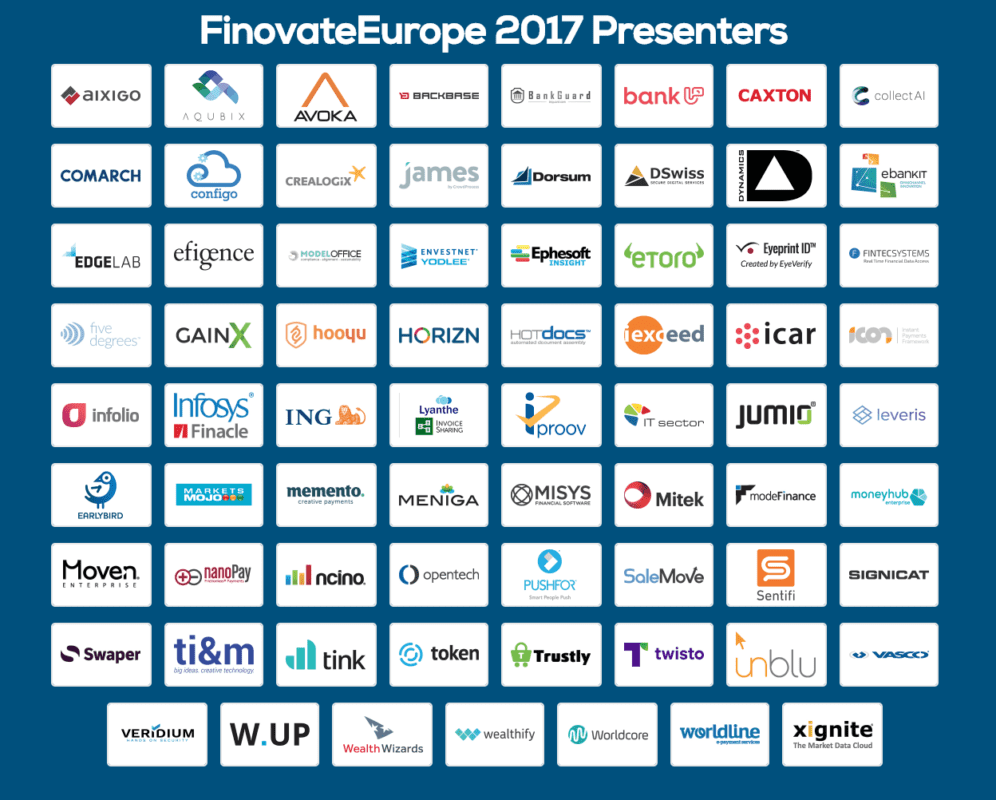

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

Matthew Pearch, Commercial Director

Matthew Pearch, Commercial Director

Balázs Zotter, Head of Product Line

Balázs Zotter, Head of Product Line

Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

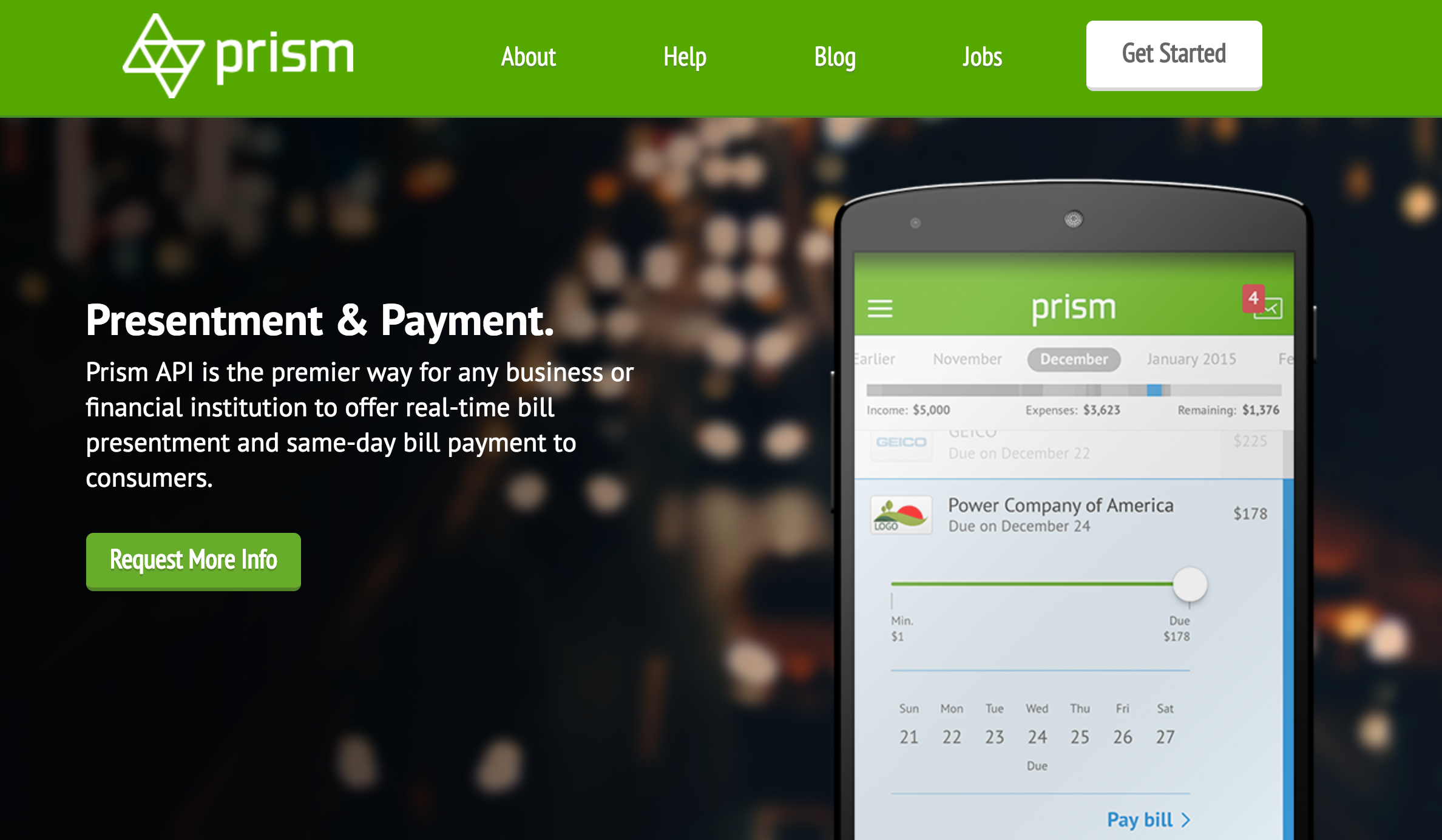

Prism’s bill presentment

Prism’s bill presentment

Laven called Addario a “perfect fit” for the task of helping create solutions that will enable companies to take advantage of “new and emerging business models” without being limited by legacy technology. “Ed will play a key role in developing the tools that we provide,” Laven said, “to allow our customers to build the best solution for their business needs.”

Laven called Addario a “perfect fit” for the task of helping create solutions that will enable companies to take advantage of “new and emerging business models” without being limited by legacy technology. “Ed will play a key role in developing the tools that we provide,” Laven said, “to allow our customers to build the best solution for their business needs.”